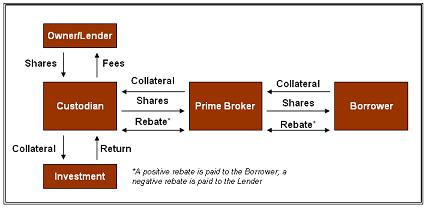

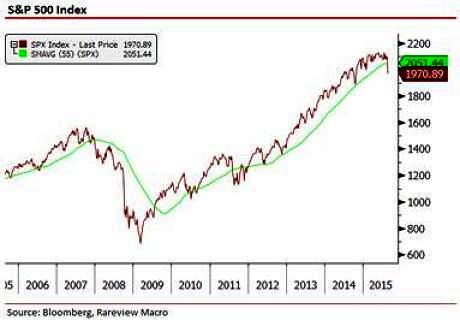

Sec Lending is a big business for Wall Street and through the big banks, institutional investors are lending out more bonds and accepting increasing amounts of non-cash securities — including exchange traded funds — as collateral, according to a recent report spotlighted by MarketsMuse editors courtesy of a.m. story from FT.com. But the practice is raising concerns among some investors some of whom are particularly concerned about the practice of ETFs accepting other ETFs as collateral.

The trends for more bond lending and less cash collateral were picked up in the latest report from the International Securities Lending Association (ISLA), published on August 27. It said the €1.8tn securities lending industry had continued to move towards sovereign debt, with 39 per cent of securities on loan being made up of government debt, up from 35 per cent a year earlier. Of the €718bn worth of government bonds on loan, 72 per cent is taken in return for non-cash collateral, up from 61 per cent 12 months before.

Among those institutions feeding the increased desire to borrow securities is iShares, the world’s largest ETF provider in terms of assets under management, which is owned by BlackRock. It recently scrapped the 50 per cent limit on securities lending for ETFs domiciled in Europe that it had imposed in 2012.

In a statement published in July, iShares said it had decided to scrap the limit to “ensure clients can benefit from additional securities lending returns in funds where there is more borrowing demand”.

But scrutiny of just one US Treasuries ETF reveals some decisions — over collateral — that investors might find surprising. In the 12 months to the end of June 2015, the $1.8bn iShares $ Treasury Bond 7-10yr Ucits ETF (IBTM), had lent out on average 47.48 per cent of its assets under management, generating a 12 month return of 0.09 per cent.

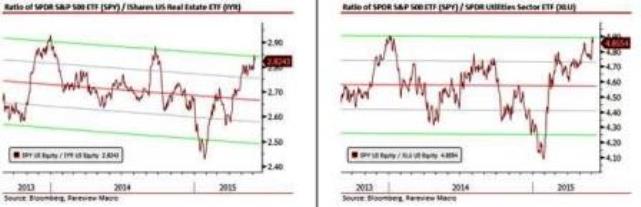

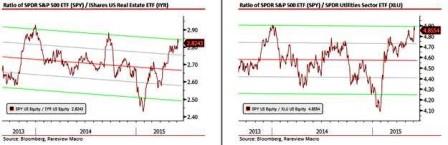

iShares’ online information about this fund states that acceptable collateral includes “selected ETF units”, which last week included 10 iShares ETFs, including ones tracking US property and Chinese and Australian equities.

Andrew Jamieson, global head of broker dealer relationships for iShares, insists the policy of using ETFs as collateral is “nothing new” and that ETFs “are a viable and liquid collateral type as part of a broad range of assets that you can use”.

Ben Seager-Scott, director, investment strategy at Tilney Bestinvest, says he is “deeply concerned” by the securities lending programme at iShares and accused the provider of poor communication.

There’s no conflict of interest and there’s no cannibalisation

And Peter Sleep, senior portfolio manager at Seven Investment Management, questions iShares’ use of a Chinese equity ETF as collateral in a government bond fund. “What happens if you have a China ETF? Maybe it’s liquid, maybe it isn’t. What happens if China suspends trading on its stock market again?”

For the full story from FT.com, please click here