Stocks Benefit From Surge Pricing A review of February equities market performance The Drivers : AI + Economic Improvement + Corporate & Consumer Confidence What’s Next? Looking Back to Look Forward : Month End Equities Market Comment 2024 Episode 3 This being the 3rd edition of the year for our…Read More

Knowing that nearly every reader has already consumed as many financial market predictions for the new year as they can stand, we decided to wait for the official first day of 2024 to publish our financial market predictions and outlook, if only because Santa Claus rallies that find Santa slipping…Read More

Sam Bankman-Fried (aka "SBF") Fries Clients and Customers FTX Crypto Exchange Bankruptcy Explained; Investors Loss Estimated at $2bil; Exchange Customers Loss Estimated at $4bil-$5bil (so far..) Comparisons Made to Lehman Brothers Scandal; Sam Bankman-Fried Scheme More Similar to Jon Corzine Shenanigans when he ran MF Global into the ground. FTX…Read More

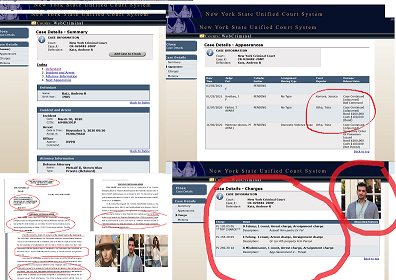

Andrew Katz aka Ross Katz aka Stark Katz, the co-founder of so-called digital asset infrastructure and crypto-currency trading firm Seaquake.io, who along with his partner Matthew J. Krueger of San Francisco and UK citizen Dylan Knight are facing investor fraud charges, is now slated to appear in New York Criminal…Read More

GameStop Corp (NYSE:GME) $GME share trading during the past days has, if you’ve somehow not heard, proven that an un-coordinated assembly of day traders, enabled and empowered by social media platforms Reddit and WallStreetBets can accomplish what the mob that attempted to take over the capitol in Washington DC could…Read More

Jane Street Capital, the quant-centric proprietary trading firm best known for its dominant role in the ETF marketplace--including its role as a liquidity provider for stocks and options as well as exchange-traded funds to buy-side accounts-- has a new arrow in its quiver; making markets in corporate bonds. The firm…Read More

Bonds and Billions 3.0...Tradeweb Markets, one of the original electronic bond trading pioneers, which first introduced its dealer consortium platform in 1996, proved that patience is a virtue when it comes to monetizing enterprise value. The company raised $1.1billion via its Nasdaq-listed IPO yesterday (NASDAQ:NW). Illustrating investor attraction to owning…Read More

The never ending battle to electronify the secondary market for corporate bonds has yet another new entrant that aims to disintermediate corporate debt dealers that 'control' the trading in what has morphed from a $2trillion market to a $9 trillion marketplace during the last decade alone. As profiled by CNBC…Read More

Trifecta Month for GTS; NYSE DMM, Quant-Trading Powerhouse and Fin-Tech Think-Tank Now Aligned With Investment Bank Specializing in Primary Debt & Equity Capital Markets GTS, the NYSE's Top DMM, and one of the global trading market's leading multi-asset electronic market-makers, is on a strategic deal-making binge. On the heels of…Read More

Morgan Stanley Raises Its Hand and Appoints e-Trading Veteran to lead investment bank's scheme for the Electronification of Fixed Income Markets. Electronic bond trading has long been a holy grail for certain folks in and around Wall Street. On the one hand, reducing head count and mitigating dependence on high-paid sales…Read More

Corporate Bond Market Transparency 4.0 MarketsMuse fixed income fintech curators, who have been on the beat for better than 8 years, were keen to cover this week's inaugrual meeting of FIMSAC. e-Bond trading system founders, fixed income fund managers and fintech aficionados who have long lamented the limited degree of US…Read More

Taking a Unequivocal Stand is Easier for Fortune CEOs than for POTUS--so it seems. Fortune 500 CEOs who have taken exception to erratic and equivocal statements made by the current sitting president of the United States have been systematically subjected to 'assault by Twitter' by the country's CEO-in-Chief. In turn,…Read More

Well Matilda, as if the universe of corporate bond electronic trading platforms isn't crowded enough, despite clear signs of consolidation taking place for this still nascent stage industry (e.g. upstart Trumid's recent acquisition of infant-stage Electronifie) , one more corporate bond e-trading platform has its cr0ss-hairs on the US market.…Read More

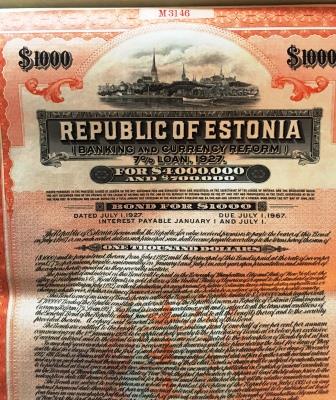

MarketsMuse Exclusive: The Trump-Russia-Estonia Government Bond connection, first disclosed three weeks ago by a MarketsMuse investigative report that linked US Treasury Secretary Mnuchin to a cache of rare, $1000 USD denominated 1927 Estonian Govt bond certificates, has a new layer of intrigue. According to Trump White House sources, last week…Read More

The notoriously fragmented universe of upstart electronic bond trading platforms that aim to address "the lack of liquidity" concerns voiced by institutional fund managers and deliver e-bond trading tools that enhance transparency and make trading fixed income products easier for buysiders is starting to consolidate. This week Trumid, founded in 2014 and…Read More

Credit Markets Are More Than Just Selling Credit; Includes Giving Credit When Due: to The Women on Wall Street! MarketsMuse Fixed Income Curator Sara Abel spotlighted a superb salute to one of the top Women on Wall Street in connection with a bond issuance brought yesterday by Citigroup which was…Read More

So-called President Trump's Secretary of Treasury Steve Mnuchin is hoping to cash in on a cache of US $1000 dollar-denominated 1927 Republic of Estonia Bonds, according to credible sources who were privy to wire-tapped discussions between Mike Flynn, the one-time National Security Advisor to Donald Trump and Sergey Kislyak, the…Read More

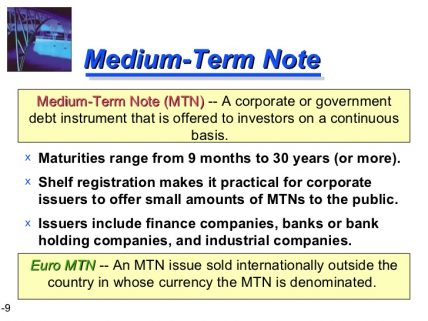

Fintech Fixed Income Trading & Fragmentation-What's Next? A Venue for Private Placement Bonds & MTNs Despite the seeming oversupply of electronic bond trading initiatives, the convergence of fintech and fixed income trading continues to spawn new electronic trading start-ups, bringing the total industry count to 128 venues. The latest player,…Read More