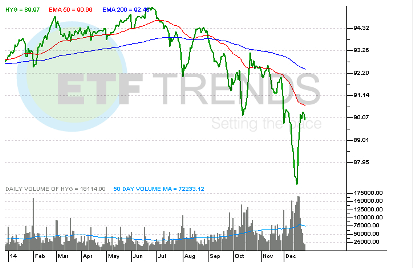

(SubstantiveResearch.com). Trading oil or simply just talking about where, when and why this commodity will assert a more predictable pricing direction has proven to be a slippery slope for professionals and pundits alike. Expressing views via the actual barrel (WTI) or via an ETF (e.g. USO, BNO etc) has been challenging for the best of traders who have spent the last number of months trying to catch a falling knife, or at least pinpoint a trend that doesn’t slip through their fingers. Neil Azous, from global macro think tank Rareview Macro has spent some time this week discussing switching out of his bearish views on oil and its correlated asset classes should the right signals appear.

The idea being that should oil take out last week’s highs (i.e. step 1), and that move is then confirmed by breaking the upside of the downward channel (i.e. step 2), he would start buying the correlated exposure (MSCI EM, high-yield, RUB, TIPS etc). Well, step 2 was breached yesterday, but only on an intraday basis, not on a closing basis. So technically it’s not confirmed, but it is moving in the right direction.

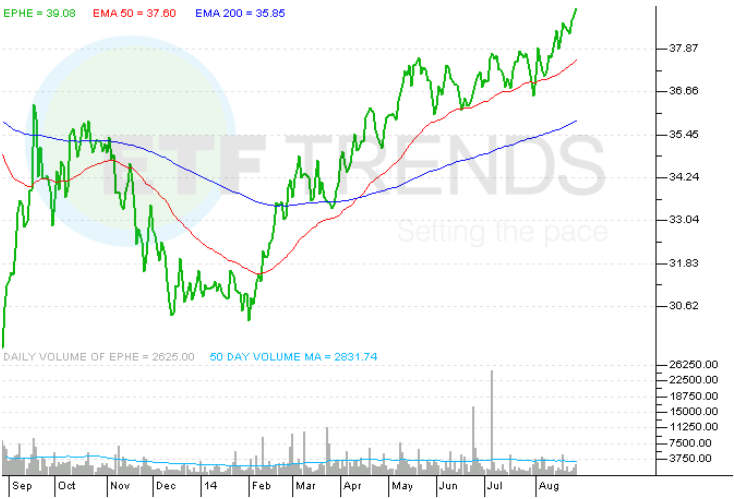

While Rareview still holds the view that oil may go back and retest, or take out recent low prices before bottoming, Azous has some interesting observations about oil positioning that makes going long enticing. He reckons there is a very clear agenda from the professional community to label the reversal in prices as the long awaited bottom in crude oil and that there is now a genuine exercise underway to engineer higher prices by joining the long crude oil position. Of course the idea that OPEC and non-OPEC may co-opt in production cuts takes this a step further, but it’s just wishful thinking at this stage. Azous goes on to discuss CTA positioning, expectations for IMMs later today, oil’s correlation with the MSCI, which will be of interest to those looking to put on an actionable proxy trade/hedge related to the above narrative.

Click the below link to access Rareview’s archive, or to receive this report.