Stocks Benefit From Surge Pricing A review of February equities market performance The Drivers : AI + Economic Improvement + Corporate & Consumer Confidence What’s Next? Looking Back to Look Forward : Month End Equities Market Comment 2024 Episode 3 This being the 3rd edition of the year for our…Read More

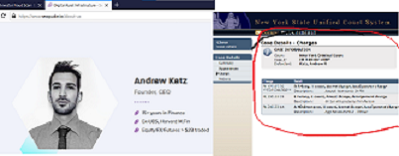

Andrew Katz, aka Ross Katz aka Drew Katz aka Stark Katz, a serial criminal who, at various times over the past seven years has claimed to be a "crypto entrepreneur" (operating through an entity known as "Seaquake"), and more recently, profiles himself on LinkedIn * as a "Fintech and "AI…Read More

Andrew Ross Katz aka Drew Katz aka Ross Katz aka Stark Katz, the former co-founder of a crypto criminal enterprise known to have used a labyrinth of shell companies under the name "Seaquake" to defraud investors such as crypto pioneer Brock Pierce, and an individual who claims to be a…Read More

"Stay Calm and Don't Panic" SVB President and CEO Greg Becker When a CEO of a publicly-traded company says that, you know it's time to put your head between your knees and grab your ankles. Especially after SVB CEO Gregory Becker, sold nearly 20% of his holdings in the company…Read More

The founders of Singapore-based and now bankrupt crypto "investment firm" Three Arrows Capital (aka 3AC), Su Zhu and Kyle Davies seem to aspire to be profiled in "Ripley's Believe It or Nuts" with their latest pitch to investors: "For a mere $25mil, we aim to build a 'crypto bankruptcy claims…Read More

Matthew J. Krueger, who until October 2022 had displayed himself on both LinkedIn and the Seaquake.io website as the Chief Financial Officer for "digital asset infrastructure firm", Seaquake.io, an enterprise that specialized in bilking investors out of their money, has apparently made efforts to re-invent himself and ‘erase’ his role…Read More

Sam Bankman-Fried (aka "SBF") Fries Clients and Customers FTX Crypto Exchange Bankruptcy Explained; Investors Loss Estimated at $2bil; Exchange Customers Loss Estimated at $4bil-$5bil (so far..) Comparisons Made to Lehman Brothers Scandal; Sam Bankman-Fried Scheme More Similar to Jon Corzine Shenanigans when he ran MF Global into the ground. FTX…Read More

Andrew Katz, the self-described CEO of "crypto trading firm" Seaquake.io, an individual whose escapades for defrauding investors and threatening those who have filed complaints against him have been profiled via this platform and other platforms for several years. In addition to his ongoing efforts to dupe investors (with the latest…Read More

For those not aware, Michael Novogratz, the famed crypto industry 'pioneer' and crypto evangelist is a former Goldman Sachs ‘global macro wunderkind’ who then did a stint at asset management firm Fortress Investments, which cratered during his watch, turned into a bitcoin evangelist and became the “bitcoin billionaire” brains behind…Read More

Andrew Ross Katz (aka Ross Katz), founder and CEO of Seaquake.io, a self-labeled “crypto trading firm” and “B2B service for cryptocurrency exchanges”, along with his partner, the firm’s Chief Financial Officer, Matthew Krueger of San Francisco, were first profiled by this outlet in September 2019 for their roles in defrauding…Read More

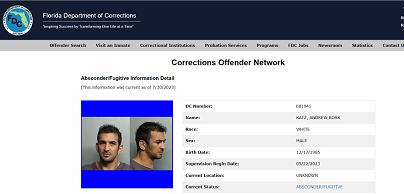

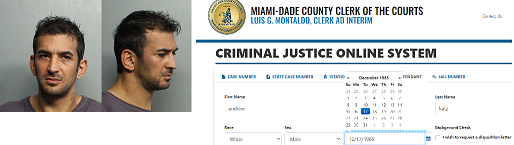

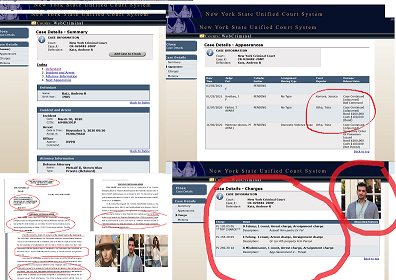

FEBRUARY 15 2022: ANDREW ROSS KATZ AKA ROSS KATZ WAS CONVICTED OF ASSAULT CHARGE IN NYC on Feb 7; FLEES AND FOREGOES $200K BAIL BOND; FUGITIVE WARRANT FOR ARREST ISSUED IN NEW YORK; KATZ NOW BELIEVED TO BE SENDING DEATH THREATS TO WITNESSES; CONSIDERED TO BE ARMED AND DANGEROUS In…Read More

Digital World Acquisition Corp (NASDAQ:DWAC) Blank Check Company aka SPAC Proposes to Merge With Trump Blank-Deck Company. Will SEC Investigate? When “E.F. Hutton Talks", Will SEC Chairman Gensler Read the SEC and FINRA Rules Prohibiting SPAC Sponsors from engaging with acquisition targets prior to listing?? Just when we thought that…Read More

Crypto Firm Co-Founder Andrew Ross Katz aka Ross Katz aka Stark Katz Andrew Katz aka Ross Katz aka Stark Katz, the co-founder of so-called digital asset infrastructure and crypto-currency trading firm Seaquake.io, who along with his partner Matthew J. Krueger of San Francisco are facing investor fraud charges, is now…Read More

From the Believe It or Nuts Department: Elon Musk, aka Technoking of Tesla and SpaceX boss, has tweeted that he will create an NFT Digital Video Artwork that showcases his self-immolation. Tesla CFO Zack Kirhorn, who just changed his corporate title to Master of Coin, will wrap the video with…Read More

Social Capital SPAC factory run by SPACmeister, notorious Tweeter and promoter of RedditArmy favorite stocks Chamath Palihapitiya is rumored to have filed a confidential S-1 for his latest Special Purpose Acquisition Company, (aka SPAC). The entity is to be called SIDS Acquisition Corp. According to sources, @chamath aims to focus…Read More

Andrew Katz aka Ross Katz aka Stark Katz, the co-founder of so-called digital asset infrastructure and crypto-currency trading firm Seaquake.io, who along with his partner Matthew J. Krueger of San Francisco and UK citizen Dylan Knight are facing investor fraud charges, is now slated to appear in New York Criminal…Read More

"Amateur Day Traders" by the tens of thousands who are taking tips from #reddit and #daytrading rebels, and particularly, the financial market anarchists who believe you are inflicting pain on fat cat wall street hedge fund traders by squeezing their shorts and bidding up share prices of distressed or challenged…Read More

GameStop Corp (NYSE:GME) $GME share trading during the past days has, if you’ve somehow not heard, proven that an un-coordinated assembly of day traders, enabled and empowered by social media platforms Reddit and WallStreetBets can accomplish what the mob that attempted to take over the capitol in Washington DC could…Read More