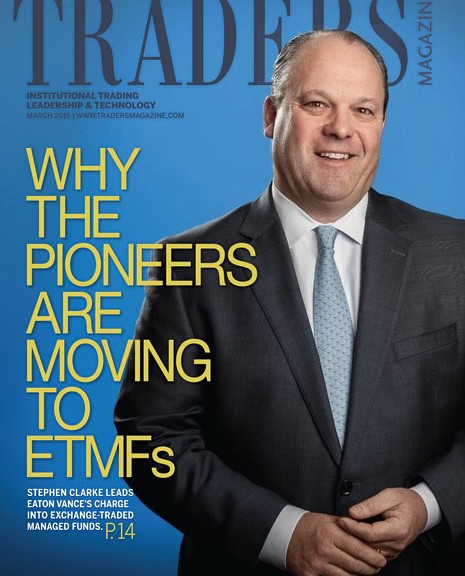

Eaton Vance Corp. today launched the first-ever non-transparent, actively-managed ETFs. Their new creation is called an exchange-traded managed fund (ETMF) and goes under the brand name NextShares.

Quite a coup considering last week’s MarketsMuse story “SEC Chair White Says I’ve Got a Dream” [for the SEC to actually read offering prospectus of complex ETFs before rubber-stamping their flotation in the market]. For those confused about what the heck a non-transparent, actively-managed exchange-traded fund is (and whether it is an appropriate investment vehicle for you/your clients), keeping reading..

(Boston Globe)-Eaton Vance Corp.’s new experiment in exchange-traded funds — blending active stock-picking with the popular ETF structure of trading on a stock exchange — launched Friday morning.

(Boston Globe)-Eaton Vance Corp.’s new experiment in exchange-traded funds — blending active stock-picking with the popular ETF structure of trading on a stock exchange — launched Friday morning.

The Boston-based investment firm’s new fund, called Eaton Vance Stock NextShares, a diversified stock portfolio, listed and begin trading on the Nasdaq Stock Market. Individuals, financial advisers and institutions can start trading in the shares Monday.

It’s been a long road for Eaton Vance to get regulatory approvals and bring this product to market in the crowded, $2 trillion ETF arena dominated by inexpensive, passive portfolios that mimic indexes like the Standard & Poor’s 500.

What is a non-transparent ETF??? Click Here To Find Out

And instead of launching a planned roster of new active ETFs, Eaton Vance is testing this one first, and aims to follow with others.

“The company was hoping to have more of a suite to offer on the first day or in the early innings,’’ said Stephen Tu, a senior analyst with Moody’s Analytics in New York.

The market may want to see how this ETF trades. It’s different from passive funds in that its holdings won’t be as transparent; investors won’t get to know what the fund owns every day.

And in order to get the full benefits of lower costs generally associated with ETFs, there have to be significant assets in the fund to make it easy and inexpensive to buy and sell.

For some, the NextShares concept is a kind of hail-Mary pass for the traditional, actively managed fund industry. The question is whether investors will embrace active management in this new package.

“The appetite in the marketplace right now is going towards vanilla ice cream,’’ Tu said, meaning passive ETFs. Likening traditional, active mutual funds to strawberry ice cream, he said, “whether it’s in a cone or a cup, you may not buy that strawberry ice cream.”