Stocks Benefit From Surge Pricing A review of February equities market performance The Drivers : AI + Economic Improvement + Corporate & Consumer Confidence What’s Next? Looking Back to Look Forward : Month End Equities Market Comment 2024 Episode 3 This being the 3rd edition of the year for our…Read More

Knowing that nearly every reader has already consumed as many financial market predictions for the new year as they can stand, we decided to wait for the official first day of 2024 to publish our financial market predictions and outlook, if only because Santa Claus rallies that find Santa slipping…Read More

"Stay Calm and Don't Panic" SVB President and CEO Greg Becker When a CEO of a publicly-traded company says that, you know it's time to put your head between your knees and grab your ankles. Especially after SVB CEO Gregory Becker, sold nearly 20% of his holdings in the company…Read More

The founders of Singapore-based and now bankrupt crypto "investment firm" Three Arrows Capital (aka 3AC), Su Zhu and Kyle Davies seem to aspire to be profiled in "Ripley's Believe It or Nuts" with their latest pitch to investors: "For a mere $25mil, we aim to build a 'crypto bankruptcy claims…Read More

Sam Bankman-Fried (aka "SBF") Fries Clients and Customers FTX Crypto Exchange Bankruptcy Explained; Investors Loss Estimated at $2bil; Exchange Customers Loss Estimated at $4bil-$5bil (so far..) Comparisons Made to Lehman Brothers Scandal; Sam Bankman-Fried Scheme More Similar to Jon Corzine Shenanigans when he ran MF Global into the ground. FTX…Read More

September (and October) are typically the most negative time periods for stock market investors, and to illustrate this seasonal pattern, this year is no different. And, stock market pundits are once again in the limelight. First, if you are a CNBC enthusiast, stop reading here. Our MarketsMuse team has voted…Read More

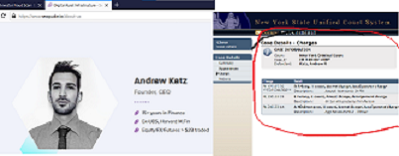

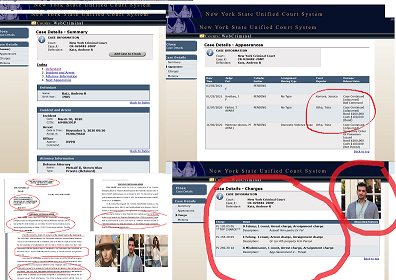

FEBRUARY 15 2022: ANDREW ROSS KATZ AKA ROSS KATZ WAS CONVICTED OF ASSAULT CHARGE IN NYC on Feb 7; FLEES AND FOREGOES $200K BAIL BOND; FUGITIVE WARRANT FOR ARREST ISSUED IN NEW YORK; KATZ NOW BELIEVED TO BE SENDING DEATH THREATS TO WITNESSES; CONSIDERED TO BE ARMED AND DANGEROUS In…Read More

Digital World Acquisition Corp (NASDAQ:DWAC) Blank Check Company aka SPAC Proposes to Merge With Trump Blank-Deck Company. Will SEC Investigate? When “E.F. Hutton Talks", Will SEC Chairman Gensler Read the SEC and FINRA Rules Prohibiting SPAC Sponsors from engaging with acquisition targets prior to listing?? Just when we thought that…Read More

Crypto Firm Co-Founder Andrew Ross Katz aka Ross Katz aka Stark Katz Andrew Katz aka Ross Katz aka Stark Katz, the co-founder of so-called digital asset infrastructure and crypto-currency trading firm Seaquake.io, who along with his partner Matthew J. Krueger of San Francisco are facing investor fraud charges, is now…Read More

From the Believe It or Nuts Department: Elon Musk, aka Technoking of Tesla and SpaceX boss, has tweeted that he will create an NFT Digital Video Artwork that showcases his self-immolation. Tesla CFO Zack Kirhorn, who just changed his corporate title to Master of Coin, will wrap the video with…Read More

Social Capital SPAC factory run by SPACmeister, notorious Tweeter and promoter of RedditArmy favorite stocks Chamath Palihapitiya is rumored to have filed a confidential S-1 for his latest Special Purpose Acquisition Company, (aka SPAC). The entity is to be called SIDS Acquisition Corp. According to sources, @chamath aims to focus…Read More

Andrew Katz aka Ross Katz aka Stark Katz, the co-founder of so-called digital asset infrastructure and crypto-currency trading firm Seaquake.io, who along with his partner Matthew J. Krueger of San Francisco and UK citizen Dylan Knight are facing investor fraud charges, is now slated to appear in New York Criminal…Read More

GameStop Corp (NYSE:GME) $GME share trading during the past days has, if you’ve somehow not heard, proven that an un-coordinated assembly of day traders, enabled and empowered by social media platforms Reddit and WallStreetBets can accomplish what the mob that attempted to take over the capitol in Washington DC could…Read More

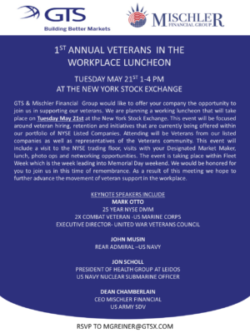

Working Luncheon will celebrate veterans in the workplace with attendees from notable publicly traded companies May 16, 2019 10:00 AM Eastern Daylight Time NEW YORK--(BUSINESS WIRE)--GTS, a leading electronic market maker across global financial instruments and the largest designated market maker at the New York Stock Exchange (“NYSE”), in partnership…Read More

Jane Street Capital, the quant-centric proprietary trading firm best known for its dominant role in the ETF marketplace--including its role as a liquidity provider for stocks and options as well as exchange-traded funds to buy-side accounts-- has a new arrow in its quiver; making markets in corporate bonds. The firm…Read More

ETFs $HONR and $VETS advance an intriguing investment thesis: companies that stand up for military veterans outperform their peers. Much like the view that women-led VC firms tend to outperform their male-dominated competitors, the thesis for investing in a culture-centric portfolio of companies is an approach now used by a broad…Read More

MarketsMuse coverage of the exchange-traded fund (ETF) industry began nearly ten years ago, and our senior curators have since been scratching their heads as to why CNBC, the retail investors' most-watched business news network had never created dedicated programming to educate their viewers about ETFs, an asset class that has consistently…Read More

Stock Price Implosion Leads Some to Challenge Current Market Structure; HFT Firms Are Under Attack, Again… Heads Up to High-Frequency Firms: Time to Hire a PR Crisis Manager Again, Call Your Lobbyists, Book Your Plane Tickets to Washington DC. Before “bidding on” to the anti-HFT and anti-ETF remarks circulated by…Read More