The True Pain Trade in Yields and Euro…Not the Wall Street Pain Trade of Equities

Greece, Grexit and the notorious ‘pain trade’ commentary below is courtesy of MarketsMuse’s extracted rendition of today’s above-titled edition of “Sight Beyond Sight”, the global macro commentary and investment insight newsletter published by Rareview Macro LLC. Added bonus: a thesis for trading EEM.

Those like us who have been in this business for some time will be familiar with Futures Magazine, a cornerstone property of The Alpha Pages and its sister publication FINalternatives. Their new flagship publication, Modern Trader, has just been launched and hit the newsstands last week. The full publication can be viewed HERE (Password: prophets). Our article “Riding The Dollar Bull” begins on page 28. We were pleased to be a centerpiece of this inaugural issue and would like to use this moment to wish CEO Jeff Joseph and Editor-in-Chief Daniel Collins the best of success in this new endeavor.

The True Pain Trade in Yields and Euro…Not the Wall Street Pain Trade of Equities

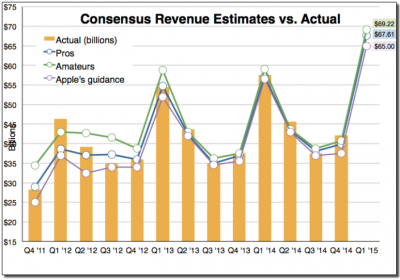

The professional community is fixated on a “pain trade” – that is, a durable European equity relief rally that lifts all other risk assets in sympathy.

The “Shenzhen-style” bid in European equities this morning argues in favor of that theory and clearly validates the view that risk reduction has been thematic the past two weeks and professionals are left without enough of a position should risk assets continue to appreciate.

This is where this theory stops working, however.

We think this is the wrong way to think about what a Greece resolution means for asset prices going into the third quarter of 2015 and it also tells you why this conversation is about much more than just a 5-10% rally in the German DAX.

Now those who have followed us for years appreciate that we actually have two definitions for the widely-touted phrase “pain trade” – one for the true meaning – that is, lower prices because that leads to investors actually losing money – and one for sales people on Wall Street – that is, some terminology that makes them sound like a “cool kid” who is “in-the-know” for their hedge fund clients who do nothing more than try to capture 60% of any market move up or down so they can justify their existence for a bit longer.

While we appreciate that the “cool kids” believe equity markets can go higher, we think real investors, ones that are not forced to be “close to the Street”, are much more concerned about a breakdown in the correlation of the European carry trade relative to the US dollar.

Let us explain what we mean…

The three drivers of global macro investing during 2012-2015 have been and still are: the US Carry Trade (SPX + UST 10-yr), the Japanese Yen, and the US dollar.

The additional driver of global macro investing during 2015 is: EU Carry Trade (DAX + German 10-yr BUND).

Now, let’s combine a key long-term driver with the additional driver…In today’s edition of Sight Beyond Sight, we provide our readers with an illustrative of the EU Carry Trade (DAX + German 10-yr BUND) versus the U.S. Dollar Index (DXY), and a detailed thesis as to our proposed trade idea.

Model Portfolio – New Position – Emerging Markets Book Hedge

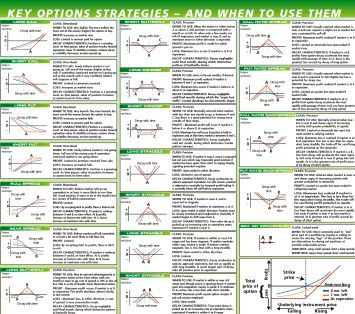

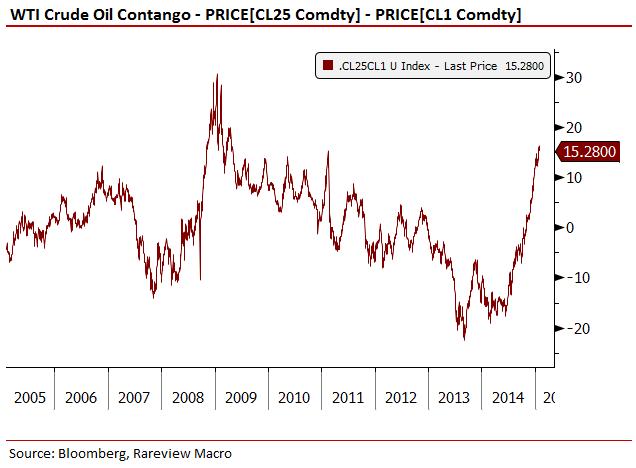

On Friday, in the model portfolio, we spent 10 bps of the NAV and added a long emerging market volatility position in the portfolio overlay return stream to protect the existing long risk positions in the Real-Yen (BRL/JPY) and crude oil (CLX5).

Specifically, we purchased 10,000 iShares MSCI Emerging Markets ETF (EEM) 06/26/15 C41– 39.5 option strangles for $0.31. For the purposes of this model portfolio being liquidity verified, not just time-stamped, we paid $0.02 through the asking price.

Given the binary risk around possible Greek capital controls, we were genuinely shocked to see that such a trade existed in the marketplace. Additionally, the hedge was cheaper than using S&P 500-related options, and has a higher correlation to the Greek stock market. This makes EEM one of the best kept secrets in the market.

The break-even for the trade at the time of execution was 2.23% by next Friday, or exactly the historical 1-sigma move by the end of this week. On a 2-sigma move, the expected profit return is 2.5:1.

On further analysis, we discovered that about 33% of the weekly occurrences during the last 12 months (i.e. last 52 weeks) exceeded the expected 1-sigma move, and that doesn’t even include the potential Greek risk next week!

Ultimately, this means that upon entering the trade there is statistically a 1 in 2 probability that we turn a profit on the position. We like those kind of odds.

Neil Azous is the founder and managing member of Rareview Macro LLC, a global macro advisory firm to some of the world’s most influential investors and the publisher of the daily newsletter Sight Beyond Sight.