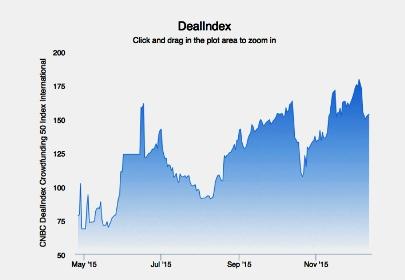

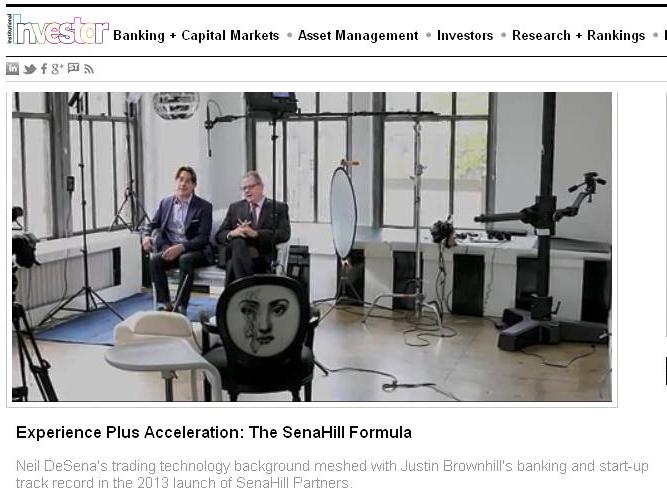

MarketsMuse Global Macro curators, like many across the hedge fund complex, have attempted to decipher an investment thesis that can prove itself without being hijacked by short-term volatility. Deflation, Inflation, Oil, the Dollar and bets being made in advance of the Fed’s widely-expected interest rate adjustment are talking point ingredients that are potentially leading to […]

Read More