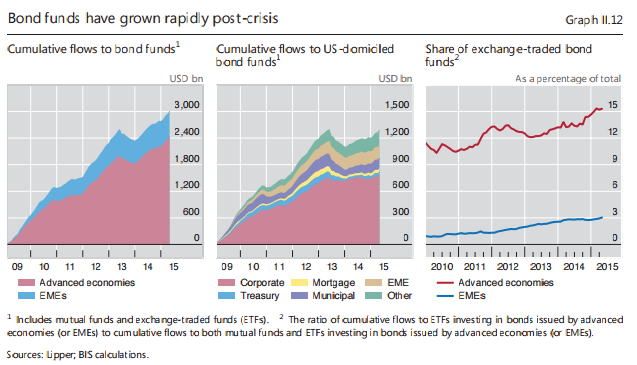

Last week, Canadian upstart exchange Aequitas NEO announced its first ETF listing, and in response to that PR promotion, Toronto Stock Exchange (TSX), a subsidiary of TMX Group fired back with a slapshot, thanks to TD Asset Management (TDAM) listing and launching six new ETFs. (TradersMagazine) Executives from TD Asset Management opened trading of its […]

Read More