The founders of Singapore-based and now bankrupt crypto “investment firm” Three Arrows Capital (aka 3AC), Su Zhu and Kyle Davies seem to aspire to be profiled in “Ripley’s Believe It or Nuts” with their latest pitch to investors: “For a mere $25mil, we aim to build a ‘crypto bankruptcy claims platform’ that can enable [defrauded] investors to sell their claims against Three Arrows (which amount to $3.bil), as well as any of the several dozen other defunct crypto firms, via an online exchange, for what is likely to yield those investors pennies on the dollar.

As reported by StraightsTimes.com, “Mr Zhu and Mr Davies’ proposed venture “is akin to arsonists returning to the scene of the crime and offering to charge their victims for buckets of water”, Mr Nic Carter, a partner at crypto venture capital firm Castle Island Ventures, said in an e-mail.

(The full article from Jan 18 2023 StraightsTimes.com)

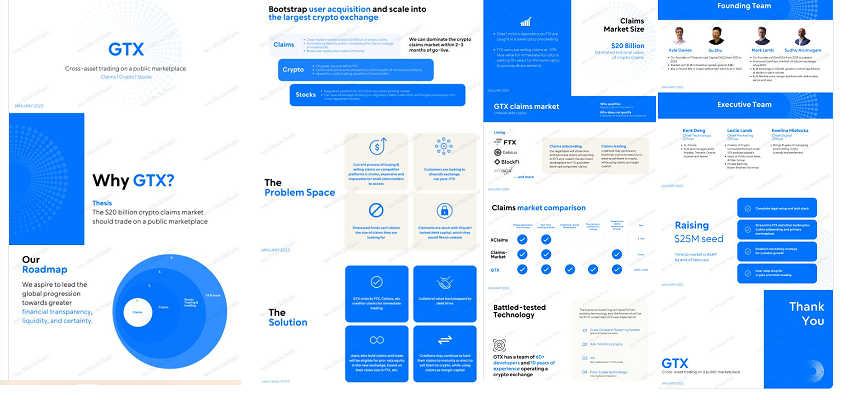

The pitch deck that is being passed around suggests that the new platform, which they had initially dubbed “GTX” will compete with already-established Xclaim by offering “lower listing fees and lower transaction commissions than existing bankruptcy claims platforms.” They are teaming up with the founders of CoinFlex, a digital asset exchange that filed for restructuring in Seychelles last August. For those not aware, CoinFlex was among a cohort of “digital exchanges” that offered “yield farming” schemes with ‘guaranteed 8%-15% interest on deposits!’

Editors Note: The entire notion of yield farming has, until recently, been the underpinning of the crapto industry. The fact that hundreds of thousands of individual investors were lured into believing they could earn ‘risk-free’ interest on their deposits, with the interest payments far exceeding the interest on money market accounts, government bonds and/or other legitimate securities held in regulated financial institutions, speaks to a much deeper issue: A Fool and His Money Are Soon Parted.

Three Arrows imploded in 2022 and left behind ashes for lenders and investors, but not before enriching themselves . They bought a $50mil yacht, mansions, and took ‘loans’ from their own firm to fuel extravagant lifestyles.

A December 4, 2022 update from the 3AC bankruptcy trustee states, “We have had to effectively recreate the company and the records of the company from scratch” because Mr Zhu and Mr Davies are not cooperating, said Mr Russell Crumpler, a liquidator for Three Arrows in the British Virgin Islands.

But, according to several crapto industry insiders, these boys shouldn’t be tarnished; after all, “that’s what the vast majority of Crytpo Cool Kids have been doing for years; plundering the assets entrusted to them”.

According to informed sources, a draft of a Three Arrows Capital investor solicitation memo for the “GTX” claims platform initiative, written in gobbledygook and translated by this outlet, reads as follows:

Dear Investor:

We know that the “crypto winter” has resulted in many people’s investments turning into worthless crap. Many have lost life savings, and many others have had their accounts frozen by bankruptcy liquidators. We ourselves have had our $50mil yacht, which we acquired with Three Arrows Capital investors’ funds, seized by liquidators.

All of this is a shame. This has been a difficult time for both myself and Kyle, and our investors in Three Arrows Capital, yet our respective academic and career pedigrees (we were both schooled at Phillips Academy, then Columbia University before we went to work as derivatives traders at esteemed banks Credit Suisse and Deutsche Bank), have emboldened us to overcome all obstacles!

[BTW- Re mugshot photo, WE ARE NOTHING LIKE THE CRYPTO CRETIN PROFILED HERE!

Now, we can help you recover some (or as SBF suggests, much of your assets) via a new, online crypto bankruptcy claims platform that we are building. And, if you invest in our new scheme, we believe the profits generated by our business model will deliver 10x returns on your investment.

We are seeking $25mil for the new platform, the minimum investment in the new limited partnership is only $100k. The link to our pitch deck is here.

It is true that similar online platforms exist, and the cost to build such platforms is typically no more than $500k-$1.5mil. But, this cost to build doesn’t include the extra security software applications that will protect the online document exchange system and private email messaging application built into the system. The security software component that protects against hacking will cost us another $2mil.

The remaining $20mil from our capital raise will necessarily be needed to fund the lifestyles of our founders, including the legal fees that we are now subjected to for our past indiscretions. We will also be hiring five or six software engineers to build and maintain the new platform at princely sums, and there will be software licensing fees for chatbots to interact with system users.

According to Reuters, The Total Addressable Market (TAM) for the crypto bankruptcy claims marketplace is already $20bil when considering the travails of Genesis, Core Scientific, BlockFi, FTX, Celsius, Babel Finance, Ourselves/Three Arrows Capital, Voyager Digital, Zipmex, Hodlnaut, Blockchain Global, FCoin. among others.

We believe that we can capture 50% market share within 12 months of launch, and generate as much as $1 billion in revenue via listing fees and transaction fees within 2-5 years.

(It is true that our internal analysis shared via private txt messages [which Gary Gensler could never discover], predicts we might more likely generate as little as $5mil in top line revenue within 5 years. And, with a budgeted operating overhead of $5mil per month towards paying us (the GPs), along with the costs of sponsoring boondoggles, industry conferences, putting our firm’s name on sports venues, and compensating celebrity endorsers such as Mr. Wonderful, Anthony Scaramucci, the Winklevoss bros, Brock Pierce and others, it will require us to raise additional tranches of capital in the months ahead. But, instead of diluting your investment via multiple rounds, the good news for first-in investors is that we already plan on merging with an existing SPAC, whose share value should skyrocket, much like NYSE: DWAC surged after announcing it would merge with Donald Trump’s “Truth Social” enterprise.

If you would like a copy of the offering prospectus, please remit your indication of interest via Twitter to either myself ( @zhusu ) or Kyle .

Warm regards, Su Zhu and Kyle Davies.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com