MarketMuse update courtesy of extract from Bloomberg’s Jim Polson

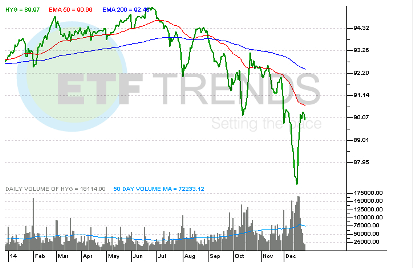

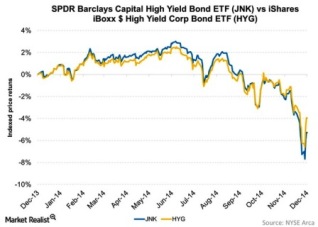

Bargain-seeking investors have turned bullish on embattled energy stocks, plowing record amounts into the industry.

More than $3.13 billion went into exchange-traded funds holding stakes in Exxon Mobil Corp. (XOM), Schlumberger Ltd. (SLB)and other energy stocks this month, even as the price of oil fell 22 percent, according to data compiled by Bloomberg. That’s four times the average for the year and more than the prior record in December 2007, when oil was trading near $91 a barrel.

“There definitely seems to be evidence of investors seeking to bottom-fish this market and pre-position for 2015,” David Mazza, head of ETF research at State Street Corp., said in a phone interview. “Some investors we’ve spoken with don’t believe the negative picture on energy that’s become consensus.”

Investors are betting on a higher long-term price for crude oil. Brent, the global benchmark, has traded around $60 a barrel since mid-month, after dropping by half from its June high. A stabilization in futures prices since Dec. 15 has helped energy stocks rebound for the past two weeks.

Oil slipped to a five-year low of $56.74 in London. Brent futures have plunged 51 percent from their June high.

“Longer-term investors, two to three years from now, will look back on this and say, ‘God, that was a good buying opportunity,’” said Fadel Gheit, a New York-based energy analyst for Oppenheimer & Co. For short-term investors, “it’s not going to be very pretty for the next few months.”

ETFs are increasingly seen as a bellwether of investor sentiment because they allow broad bets across a sector with lower transaction costs than buying individual stocks. Year-to-date, energy ETFs have attracted $9.25 billion of new money, the most of any sector behind real estate funds and more than triple the same period in 2013.

For Jim Polson’s entire article from Bloomberg, click here