MarketsMuse.com ETF update profiles a less than tasty example of how not to select certain offerings from the menu of China ETF products with a snapshot of a seemingly sour taste investors might be left with after consuming Blackrock’s iShares FTSE A50 China Index (HKG: 2823). Below extract is courtesy of reporting by Bloomberg LP’s Elena Popina and Boris Korby “The 80% BlackRock ETF Return That Shortchanged China Stock Bulls.”

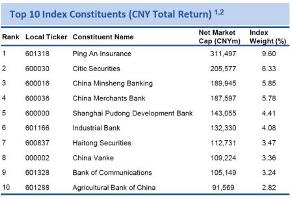

The $9.1 billion iShares FTSE A50 China Index ETF, an exchange-traded fund designed to track returns of the 50 largest companies traded in Shanghai and Shenzhen, has underperformed its benchmark by a whopping 29 percentage points on a total return basis over that span.

The cost to investors? More than $900 million in unrealized gains, according to data compiled by Bloomberg.

ETFs such as BlackRock’s, which popularized the use of complex derivatives as a way for foreigners to tap into China’s growth potential, are now becoming unintended casualties as the nation opens up its capital markets. As more foreigners gain direct access to yuan-denominated A shares on mainland bourses, demand for the derivatives has plunged. That’s unmoored the ETFs from their benchmarks and robbed investors of returns.

“It’s not providing what it advertised to do,” Ajay Mehra, the head of equities at Salient Partners LP, which oversees $27 billion, including FTSE A50 China Index ETF shares, said by phone from New York. “This tracking error has led to substantial underperformance over the past year, which makes it less attractive as an access vehicle.”

Discount Widens Continue reading