MarketsMuse update courtesy of extract from 19 December edition of FT.com, with reporting by Tracy Alloway

Extreme movements in the prices of bonds, commodities and other assets have prompted regulators at the Federal Reserve Bank of New York to take a closer look at the inner workings of exchange traded funds.

Wall Street’s top regulator has been talking to the firms responsible for ensuring the smooth functioning of such ETFs as it seeks to gauge the resilience of the structures to sharp fluctuations

Two “authorized participants” aka “APs” [investment banks and other trading firms whose role includes administering the ETF creation and redemption processes] that were contacted by the New York Fed said the regulator was concerned that prices of ETF units might significantly diverge from the value of their underlying holdings, particularly if the funds tracked less liquid assets or if they experienced heavy redemption requests.

A spokesperson for the New York Fed declined to comment.

Authorized participants said ETFs had performed well even in the face of oscillations in the price of assets such as currencies, commodities and corporate bonds.

“ETFs have been a good tool for price discovery,” a senior trader at one of the largest authorized participants said. So many investors were using the structures to dart in and out of hard-to-trade assets that the ETFs had become a better representation of pricing than the underlying cash market, he said.

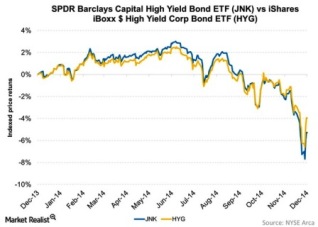

But relationships between prices and asset values have been volatile. Shares in the iShares iBoxx high-yield bond ETF recently traded at a discount of almost 1 per cent to net asset value before surging to a premium of 1.3 per cent last week.

The Market Vectors Russia ETF saw its discount to net asset value jump to 5.8 per cent earlier this month, before moving to a premium of 9.5 per cent last week. The SPDR S&P Russia ETF this month reported both the biggest discount and largest premium since the fund was started about four years ago.

ETF market-makers cautioned that discrepancies might occur because the asset values were calculated at specific times, whereas the shares traded continuously.

To continue reading, please visit FT.com