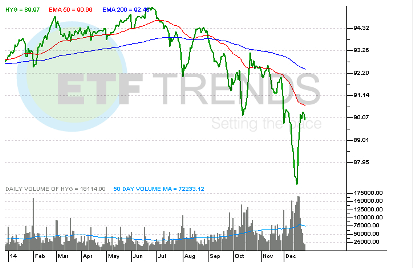

MarketsMuse ETF and Fixed Income curators have frequently spotlighted the ongoing debates as to whether corporate bond ETFs, and in particular, junk bond-specific exchange-traded-funds pose special risks. Some argue that a liquidity crisis could unravel the high yield bond sector if/when institutional investors decide that risk of recession continues to ratchet higher, leading all of those investors to run for the exit at the same time, and in turn, causing a reverberation across the ETF market. The counter side to that thesis is that corporate bond ETFs (NYSE:HYG among them) are insulated from the risk of a catastrophe that might envelope the underlying components (the actual bonds themselves). One thing that is certain is that the US SEC is not certain, and they’ve raised the volume on this topic.

Adding light to this topic is WSJ columnist Ari Weinberg, someone who is arguably one of the best educated members of the 4th Estate when it comes to ETFs, and Monday night column deserves our kudos and sharing select extracts…Roll the tape..

Most investors in mutual funds and exchange-traded funds probably don’t worry much about liquidity. After all, fund shares can be bought and sold easily anytime online, and trades are completed in one to three business days.

Most investors in mutual funds and exchange-traded funds probably don’t worry much about liquidity. After all, fund shares can be bought and sold easily anytime online, and trades are completed in one to three business days.

But there is another layer of trading—the trading the funds themselves do when a wave of selling by investors requires the funds to sell some of their assets—that has the Securities and Exchange Commission worried about liquidity. And the commission wants investors to be more aware of the risks it sees.

The issue is particularly pertinent for the fixed-income fund market, because assets that some of those funds hold are very thinly traded. Here’s a look at what’s involved.

Deciding between the two isn’t always straightforward. Here’s help clarifying the differences and similarities.

The SEC’s concern is that some mutual funds and ETFs might hold too many securities that aren’t easy to sell quickly. As a result, the funds might not always be able to adjust their holdings without “materially affecting” the funds’ net asset value per share, the commission said in its September announcement of proposed new liquidity-risk management rules. In other words, selling a substantial amount of illiquid securities quickly could drive down their price, resulting in a big loss for a fund, lowering its value.

Among other things, the proposed rules would require funds to categorize the liquidity risk of their holdings according to how many days it would take to sell the assets without greatly affecting their market price, and disclose those risk assessments to investors. The SEC also proposed to strengthen and clarify an existing guideline that no more than 15% of a fund’s assets should be held in securities that would take more than seven days to convert to cash.

Several ETF issuers, as well as the Investment Company Institute, a fund industry trade group, have said in comment letters that the SEC’s proposals aren’t relevant to most ETFs, because the funds are structured differently from mutual funds.

Mutual-fund investors buy and sell their shares directly from or to the fund. So mutual funds regularly need to sell assets on the open market to pay investors who are redeeming their shares. But ETF shares are traded among investors, not between investors and the fund. So most ETFs usually don’t have to sell assets when investors sell their shares, because the shares are being bought by other investors, not being redeemed by the fund.

ETF shares are only created or redeemed, and the underlying assets bought or sold, when doing so is necessary to keep the market price in line with the net asset value of the fund’s holdings. Those transactions are done between the funds and financial institutions called authorized participants, or APs, which often also serve as market makers in the ETFs and other securities.

Here is how it works in most cases: If heavy selling is driving an ETF’s market price below the fund’s net asset value, a market maker, acting through an AP or acting as an AP itself, will buy up shares and deliver them to the fund in the form of a so-called creation unit—taking them off the market—in return for an equal value of the underlying assets held by the fund. It’s then up to the trading firm to decide if it wants to hold those assets or sell them.

The argument ETF issuers are making to the SEC is essentially that this process insulates ETF investors from the dangers of a fund having to sell illiquid securities on the open market.

The opposing argument, made by the SEC and those who favor the proposed new rules, is that there is a risk that the AP might not be willing to take on assets that are very hard to sell quickly, throwing a wrench into the whole process of keeping the fund’s net asset value in line with its share price. That would be reflected in a widening of the bid-ask spread for the ETF—the difference between the price investors can get for selling shares and the higher price they would have to pay to buy the shares.

The concern that this could happen to a fixed-income ETF is based in part on changes in recent years in the fixed-income markets. Financial institutions in general are more averse to the liquidity risk that some debt securities pose, in part because of increased regulation governing the institutions’ risk exposure. Investment banks, for instance, hold 80% less corporate bond inventory than a decade ago.

Ultimately, according to many traders and market participants, concerns around ETFs and fixed-income holdings will only be mitigated when there is more transparency in the market, as more securities are quoted and traded electronically. Currently, only about 10% to 25% of the secondary trading in corporate bonds—depending on the amount of each bond in the market and the issuer’s credit quality—is electronic. The rest is done via online messaging and phone calls.

Continue reading Ari Weinberg’s dissertation directly via the WSJ