An SEC subpoena is not exactly what any Issuer (or stock promoter) puts on the top of their birthday wish list. And, for crypto cool kids who are either already a member of the ICO Issuers Club, or who have applied to become part of the dapper dapp crowd that…Read More

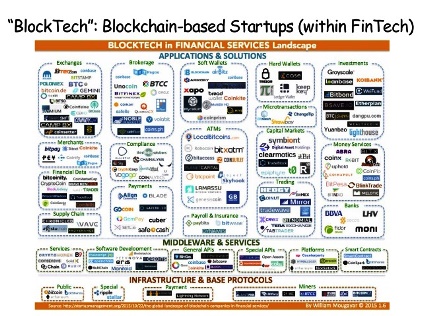

Asset Management Industry is Notorious for Waste: Its About Blockchain, You Blockheads. NOT Bitcoin, Blockchain Dapps Can Mitigate Risk of “Death By Drop Copy” Any asset manager in today's world who has more than $500 of AUM does not need to be fluent in the language of fintech, blocktech or…Read More

(MarketsMuse fintech and blocktech curators extend our thanks to Prospectus.com LLC for the following contribution)-Bloomberg Intelligence reporter Jonathan Tyce wins the Valentine's Day Award for Very Good Framing courtesy of his latest piece "Blockchain is Coming Everywhere, Ready or Not" --one of a series of articles by Tyce that puts…Read More

JERSEY CITY, N.J., Jan. 17, 2018 /PRNewswire/ -- ETF broker WallachBeth Capital, a leading institutional brokerage firm, has announced the Phase I roll out of its internal proprietary Quote Capture platform. The platform further enhances WallachBeth's commitment to providing institutional clients the highest degree of transparency throughout the ETF execution…Read More

What's Next for exchange-traded-fund land? Blockchain ETFs! Duh?! Aside from the efforts by the Winklevoss Boys and a cadre of others to introduce a Bitcoin ETF, Blockchain companies (now known as 'blocktech' firms) fall into the sweet spot for fintech investors and public companies that are pivoting, re-purposing or adding…Read More

Corporate Bond Market Transparency 4.0 MarketsMuse fixed income fintech curators, who have been on the beat for better than 8 years, were keen to cover this week's inaugrual meeting of FIMSAC. e-Bond trading system founders, fixed income fund managers and fintech aficionados who have long lamented the limited degree of US…Read More

When it comes to corporate monikers, MarketsMuse fintech curators are big fans of catchy names and have made it a New Year's resolution to compile and share a weekly list of firms that earn special recognition within the burgeoning world of blockchain, bitcoin and crypto handles. And, the winner for…Read More

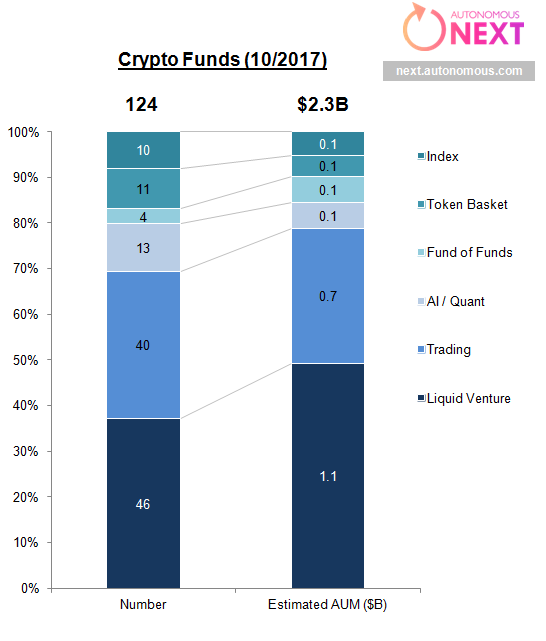

Crypto Hedge Funds Get Their Greenwich On. If the MarketsMuse curators have avoided bidding on and publishing tick-by-tick coverage of "crypto mania" and bitcoin bubblelicious bytes akin to our media industry brethren, its only because we were arguably a pioneer when, starting in 2014, we first started framing the bitcoin and distributed…Read More

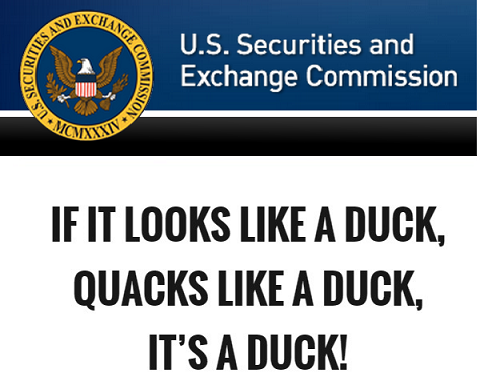

Initial Coin Offerings [Finally] Get SEC Attention; The Duck Test 3.0. For those who believe the US SEC is slow to react when reining in and/or reigning over new-fangled investment products, the evidence indicates you are accurate. After all, recent history regarding sub-prime debt sold to unwary investors, Madoff-style investment…Read More

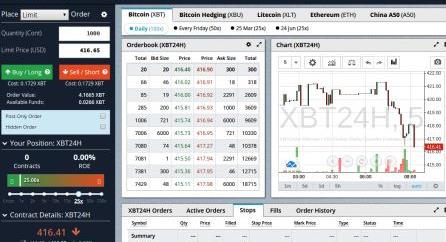

CME Aims to Legitimize Bitcoin Marketplace via..What Else? A Bitcoin Futures Mart!! Any and every credible financial market veteran will argue that any credible financial instrument can only be credible when there is a legitimate marketplace in which buyers and sellers can express their view as to the value of…Read More

If you've been a professional trader for 'more than 15 minutes' (i.e. years, if not decades), you know the equities markets will move lower when (a) complacency prevails, a sense of calm is seemingly endless and equity market indices quietly creep higher and higher or (b), business news front page…Read More

What's Next for Option Markets? A CFTC regulated platform for bitcoin options; NY-based firm gets approval to trade puts and calls on cryptocurrency. For bitcoin aficionados, the road to legitimacy has been pockmarked with obstacles and detractors, including those who have insisted that bitcoins are the currency of money launders,…Read More

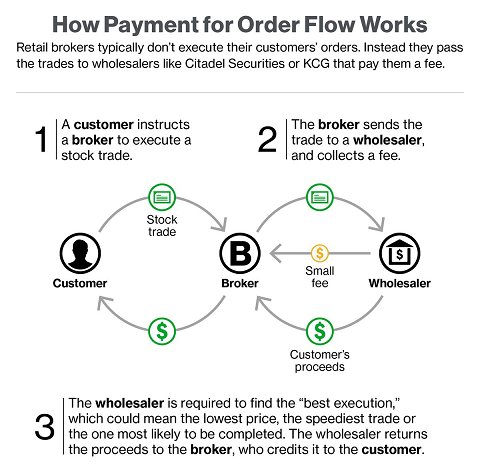

In a July 18 NYT op-ed piece "Wall Street Profits by Putting Investors in the Slow Lane" submitted by Jonathan Macey, a professor at Yale Law School and David Swensen, the chief investment officer of Yale University, the spirit debate topic of payment-for-order-flow schemes, aka rebates paid by the various stock exchanges to…Read More

Well Matilda, as if the universe of corporate bond electronic trading platforms isn't crowded enough, despite clear signs of consolidation taking place for this still nascent stage industry (e.g. upstart Trumid's recent acquisition of infant-stage Electronifie) , one more corporate bond e-trading platform has its cr0ss-hairs on the US market.…Read More

High-Touch or High-Tech? That is The Question.. Virtually any industry professional will acknowledge the now two-decade evolution of financial markets whereby the electronification of equity, options, currency and even fixed income markets has been the primary catapult for business models wrapped in high-tech trading services, trading software applications and niche offerings…Read More

The notoriously fragmented universe of upstart electronic bond trading platforms that aim to address "the lack of liquidity" concerns voiced by institutional fund managers and deliver e-bond trading tools that enhance transparency and make trading fixed income products easier for buysiders is starting to consolidate. This week Trumid, founded in 2014 and…Read More

And The Winner Is….Institutional Investor Presents 2017 Top 40 Trading Tech Top Guns Who says trading technology wonks are under-appreciated within the context of recognition by industry followers? Certainly not MarketsMuse fintech curators, and definitely not Institutional Investor Magazine, which brings us their annual ranking of the top trading technologists…Read More

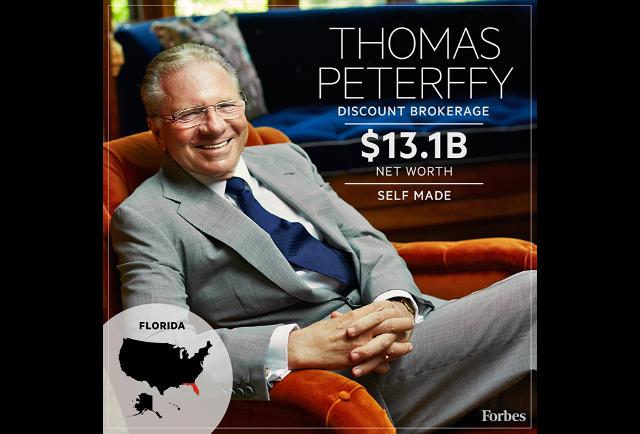

(FinanceMagnate)--Electronic trading firm Interactive Brokers Group, Inc. (NASDAQ:IBKR) aka “IB”has announced its plans to put an end to its options market making activities globally. The operations, which are conducted through the Timber Hill companies, are expected to be phased out over the coming months. The broker will continue carrying out…Read More