With today's announcement from Pfizer (NYSE:PFE) indicating they are that much closer to a Covid-19 vaccine, its time to look forward to who the Biden administration will appoint to prosecute the tens of thousands of SBA PPP loan scammers who reaped tens of billions after the Trump administration made it…Read More

PPP and EIDL Fraud is as rampant as COVID-19. According to the front page story appearing in the New York Times April 26 edition, hundreds of millions of dollars in SBA bailout funds that were intended by the US Treasury to assist small businesses impacted by COVID-19 via the Paycheck…Read More

In a scheme that reads much like the MarketsMuse story published in October profiling so-called digital asset firm Seaquake.io, whose principals Andrew Katz and Matthew Krueger fraudently claimed to be operating a high-frequency trading system for cryptocurrencies, Michael W. Ackerman of Ohio, and a former NYSE floor broker, was charged…Read More

(Source: Law360.com ) Andrew R. Katz, aka Ross Katz, aka Stark Katz an Arvada, Colorado man who is last known to reside in either of New York City or Southern California, and uses California, Colorado, Florida and New York drivers licenses while claiming to be a former FX trader for…Read More

Bonds and Billions 3.0...Tradeweb Markets, one of the original electronic bond trading pioneers, which first introduced its dealer consortium platform in 1996, proved that patience is a virtue when it comes to monetizing enterprise value. The company raised $1.1billion via its Nasdaq-listed IPO yesterday (NASDAQ:NW). Illustrating investor attraction to owning…Read More

For those who missed the MarketsMuse memo from Jan 14, there appears to be yet another exchange coming to the US Equities markets, as if the industry needs one more platform to facilitate trading in publicly-listed stocks. The latest platform, which is still on the whiteboard, is a consortium-based initiative…Read More

[caption id="attachment_5639" align="alignleft" width="150"] NYSE DMM Citadel Securities started as a HFT prop trading firm[/caption] Something funny happened on the way to the floor of the New York Stock Exchange last week; Citadel Securities and Virtu Financial, two of the three biggest NYSE “Designated Market-Makers” aka “DMM”) --also domain experts…Read More

Stock Price Implosion Leads Some to Challenge Current Market Structure; HFT Firms Are Under Attack, Again… Heads Up to High-Frequency Firms: Time to Hire a PR Crisis Manager Again, Call Your Lobbyists, Book Your Plane Tickets to Washington DC. Before “bidding on” to the anti-HFT and anti-ETF remarks circulated by…Read More

The never ending battle to electronify the secondary market for corporate bonds has yet another new entrant that aims to disintermediate corporate debt dealers that 'control' the trading in what has morphed from a $2trillion market to a $9 trillion marketplace during the last decade alone. As profiled by CNBC…Read More

Trifecta Month for GTS; NYSE DMM, Quant-Trading Powerhouse and Fin-Tech Think-Tank Now Aligned With Investment Bank Specializing in Primary Debt & Equity Capital Markets GTS, the NYSE's Top DMM, and one of the global trading market's leading multi-asset electronic market-makers, is on a strategic deal-making binge. On the heels of…Read More

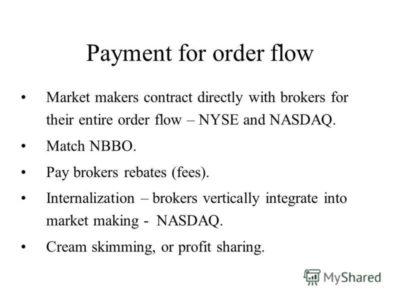

Broker Rebates From Exchanges and HFT Firms May Be Securities Fraud, Says Federal Judge Broker Rebates, Payment-for-Order-Flow ("PFOF") and "Pay-to-Play" have become synonymous with new world order in which exchanges, dark-pool operators and high-frequency trading ("HFT") firms, (the so-called "flashboys") dominate the world of stock trading. While many Wall Street…Read More

Digital Token Offerings & Securities Regulation: Are you an ICO or STO? (the following is courtesy of Prospectus.com LLC) A question that is harder to ask than whether asked if your product is butter or margarine. Blockchain token sales (aka initial coin offerings or “ICOs”) reportedly topped $5 billion in…Read More

Morgan Stanley Raises Its Hand and Appoints e-Trading Veteran to lead investment bank's scheme for the Electronification of Fixed Income Markets. Electronic bond trading has long been a holy grail for certain folks in and around Wall Street. On the one hand, reducing head count and mitigating dependence on high-paid sales…Read More

Tom Farley, the former top gun at the NYSE, has long advocated the benefits of raising capital via the construct of Special Purpose Acquisition Company aka "SPAC", aka "Blank Check company." Now he's become the CEO poster boy for SPACs with the formal IPO and NYSE listing of Fintech SPAC…Read More

Securities Token Offering to Displace Initial Token Offering Fad; BOX in JV with digital broker-dealer tZero to Create Securities Token Exchange platform (Redistributed with permission; story from Traders Magazine)-Well, Matilda, the Boston Options Exchange (BOX) is plotting to create the first regulated exchange to list and traffic in securities tokens…Read More

What's Next? CryptoCurrency Bank License; Crypto Cool Kids New Goal: Stay Inside Regulatory Goal Posts Coinbase Inc. and another cryptocurrency firm talked to U.S. regulators about the possibility of obtaining banking licenses, a move that would allow the startups to broaden the types of products they offer. Coinbase, which operates…Read More

Goldman Sachs, the venerable investment bank and trading house, has been called lots of things, including "Squid." But nobody on Wall Street can dispute the fact that $GS is uniquely innovative and perhaps, a firm that can smell the trail of money better than its peers and explains why Goldman is…Read More

Alpha Trading Labs, the Chicagoland fintech "crowd sourcing startup" has thrown the gauntlet down and threatens to democratize the sacred world of HFT wonks, those hoodie-wearing quant jocks who occupy $1mil per yr cubicles at high-frequency trading firms like Virtu, Citadel, Jones Trading, Hudson Trading, and Two Sigma (among others).…Read More