When ETFs were first launched in 1993, the 'framers' might not have fully appreciated what would happen to the respective ETF cash index in the event of a lopsided market opening when the underlying constituents had not yet opened for trading, despite the easy recall of October 1987.. Since that…Read More

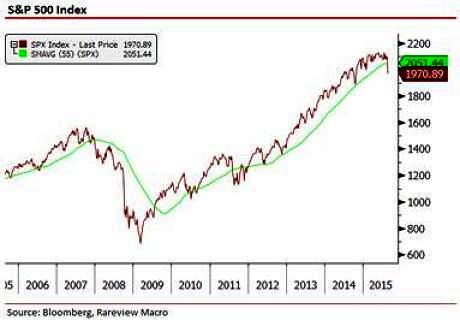

If the second shoe is actually falling as US (and all other) equities markets appear to indicate this morning, MarketsMuse ETF and Global Macro editors were stimulated by having Sight Beyond Sight with this morning's coffee, courtesy of Rareview Macro's Neil Azous. Of particular interest, Azous points to Mebane Faber’s…Read More

As reported earlier this week by MarketsMuse, a "computer glitch" suffered by market data vendor Sungard Systems has left custodian BNY Mellon still scrambling to price Net Asset Value (NAV) for nearly 10% of exchange-traded funds held by customers. Late Wednesday, BNY said 20 mutual fund companies and 26 ETF…Read More

When it rains it pours. While many ETF investors have been sucker-punched while trying to execute orders during the past several highly volatile days, MarketsMuse finds that a second shoe dropped Monday on the heads of thousands of BNY Mellon customers thanks to a software snafu attributed to market data…Read More

One needs to have 'been there and seen that' for at least twenty years in order to have been "loaded for bear" in advance of this morning's equities market rout. At least one of the folks who MarketsMuse has profiled during the past many months meets that profile; and those…Read More

MarketsMuse blog update is courtesy of BrokerDealer.com and initial reporting by InvestmentNews.com and profiles the deal between RIA titan Envestnet and mutual fund king Eaton Vance, which is now approved to promote its novel, actively-managed ETF product “NextShares.” NextShares are exchange-traded funds that are both actively managed and unlike any…Read More

When investors think about ETFs, most are focused on the nearly 2000 products that trade within US markets and leading countries in the EU; few realize that Africa is no longer just a ‘Frontier Market’, and some go as far to argue that Africa (once again?) represents a burgeoning investment…Read More

Bond giant Pacific Investment Management Co. aka Pimco said Monday that it received a Wells Notice from the SEC and the firm could be sued by the country’s top securities regulator over how it valued assets in ETF $BOND, one of its most popular exchange-traded bond funds aimed at small…Read More

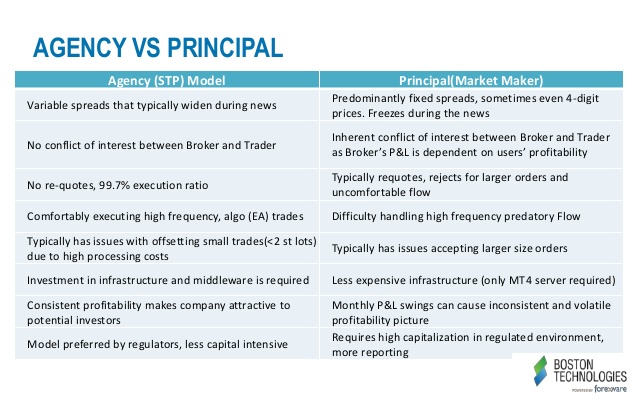

MarketsMuse dip and dash department frequently prefers spotlighting altruists and do-gooders, including Agency-only execution firms in the brokerdealer sphere who, unlike “principal trading desks”, do not take the contra side to institutional customer orders as a means of making a profit; agency-only firms merely execute those client orders via the…Read More

As reported previously by MarketsMuse, actively-managed ETFs, aka AMETFs (or as Eaton Vance has dubbed their product: "NextShares ETMFs") are the next holy grail for Issuers of exchange-traded funds simply because these new-fangled products offer a refreshing new batch of flavors to a product category that has nearly 2000 issues…Read More

How big are ETFs these days? Even Kevin O'Leary, aka "Mr. Wonderful" of ABC's "Shark Tank" is getting into the game. On Tuesday, O'Leary was on the NYSE floor to launch the O'Shares FTSE US Quality Dividend ETF, (ARCA NYSE:OUSA): a basket of high-dividend stocks. But he's not doing this just…Read More

Marketsmuse updates that fund giant John Hancock Investments will partner with Dimensional Fund Advisors on six “smart-beta” exchange-traded funds, according to paperwork filed with regulators early on Monday. Dimensional, based in Austin, Texas, is one of the earliest proponents of factor investing. They blend elements of index-based investing and active…Read More

Now that InteractiveBrokers is turning up the heat and joining the "unbundling movement" by offering independent research via its world-class trading platform, MarketsMuse editors spotlighted the following comments courtesy of global macro sage Neil Azous, Founder/Managing Member of Rareview Macro LLC from today's IB feed..If you're a hedge fund-type, you…Read More

Do you hear that? That stampeding sound you hear is coming from fund managers scurrying to get into the currency-hedging trade. Currency hedging ETFs have been in vogue this year given the ultra-lose monetary policy across the globe and a strong U.S. dollar against a basket of other currencies. The…Read More

First Trust Advisors L.P. expects to launch a new etf, the First Trust NASDAQ CEA Cybersecurity. The fund seeks investment results that correspond generally to the price and yield (before the fund’s fees and expenses) of an equity index called the Nasdaq CEA Cybersecurity IndexSM. Cybersecurity is gaining global attention…Read More

Hull Tactical Asset Allocation, LLC (“HTAA”), announces the launch of the Hull Tactical US ETF (“HTUS”), an actively managed exchange traded fund designed by industry veteran Blair Hull. The ETF is designed to deliver hedge fund-type management and trading tactics to a broad investor audience. Working in partnership with Exchange…Read More

Pot has been generating lots of buzz both in the public and private sectors. Twenty-three states and the District of Columbia have legalized marijuana, either for medicinal or personal use, while an additional 13 have planned votes by 2016. If the trend toward legalization continues, there's big profit potential, considering $2.5 billion in legal sales…Read More

This post was written by Pete Hoegler, Washington DC-based Social Media Savant for The JLC Group. Three years after the JOBS Act was passed, it seems that Washington is back for more--a curtain call if you will--making it easier for small ventures to raise capital. The House Financial Services Committee in…Read More