A pile on approach is impacting hedge fund emulator ETF products (e.g. $GURU, $ALFA), and leading to crowd control issues, according to a recent Bloomberg article re-distributed via TradersMagazine story with title: Hedge Fund-Replicating ETFs Hurt by Crowded Trade Selloff MarketsMuse curators carry the story here.. (Bloomberg) -- Exchange-traded funds…Read More

MarketsMuse followers have been reminded more than a few times that conventional wisdom requires investors to keep their eyes on corporate bond spreads so as to have a clear lens when considering the outlook for equity prices on a medium-to-longer time frame. The relationship between high-yield debt,most-often measured by HYG…Read More

Unless you are Rip Van Winkle, you don't need to be a MarketsMuse to know that the primary value proposition put forth by the ETF industry has always been: “Lower Fees Vs. Mutual Funds!” Yes, the secondary ‘advantage’ is “liquidity,” given that investors can move in and out of exchange-traded-funds…Read More

9 November (BrokerDealer.com)--Broker-Dealer Mischler Financial Group (“Mischler”) , the securities industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans announced that in connection with the firm’s annual recognition of Veteran’s Day, Mischler has pledged a portion of the firm’s entire November 2015 profits to The…Read More

The NYSE, a division of Intercontinental Exchange (ICE) has encountered a slippery slope in the exchange's effort to secure a bigger role in the ETF marketplace through a scheme that would expedite the creation of so-called actively-traded ETFs, which some MarketsMuse followers have dubbed 'exchange-traded funds on testosterone.' WSJ-The New…Read More

Sayonara City As Japan Getting Crash Course in Leveraged Returns With Nikkei ETF MarketsMuse ETF update courtesy of Bloomberg LP Oct 15--Nomura Asset Management Co. said it would suspend on Friday the creation of new shares in a large leveraged exchange-traded fund, as well as two others, citing liquidity concerns.…Read More

MarketsMuse Strike Price curators are always looking for smart perspectives on how to bring more asset managers and institutional investors to better understand and embrace the use of options in a responsible manner. According to Todd Hawthorne, lead portfolio manager of Boston Partners, volatility [which some immediately and sometimes, misguidedly…Read More

The battle between business news pontificaters across the 4th estate is in full season, as evidenced by a smart article yesterday by Bloomberg LP's Eric Balchunas and suggests that MarketsMuse curators are apparently not the only topic experts who noticed and took aim at a recent WSJ article that proclaimed…Read More

For followers of the global equity crowdfund movement and fintech aficionados who are fluent in 'what's next?', this is a big news week from the crowdfund world. Yesterday, MarketsMuse curators spotlighted a just-launched trading exchange that brings billions of dollars worth of private shares into the wacky world of secondary…Read More

MarketsMuse ETF Curators debated on the title to this story, and first suggested the headline "Has BATS Gone Bats?!" While market structure experts continue to debate the topic of pay-to-play, i.e. payment for order flow schemes, BATS Global Markets, the youngest and arguably, now one of the largest electronic exchanges…Read More

While equities markets have zig-zagged since late summer with lots of volatility, leading to pretty much no change in major indices since late August, news media outlets have put their cross hairs on the ETF industry, which has been battered with criticism consequent to out-0f-context pricing that has riddled opening…Read More

Hold the pickles, and hold the lettuce...Just when MarketsMuse curators and an assortment of ETF market enthusiasts thought there might already be enough themes, toppings and twists to the growing number of exchange-traded funds, ProShares is taking a page straight out of Burger King's 1970's branding campaign via a newly-launched…Read More

For Wall Street bankers and brokers who have been in the business since at least the early 2000's and are still working on the Street, and who think you've already been pilloried plenty for the work you do, watch out, former Lehman broker-turned best-selling author Michael Lewis ("Liar's Poker", "Money…Read More

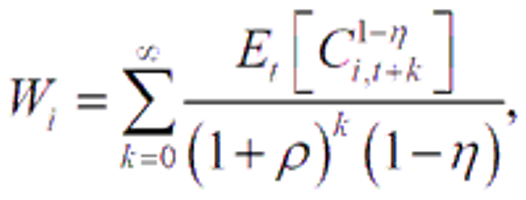

MarketsMuse Global Macro merges with Strike Price seers with sage excerpt from 18 Sept edition of "Sight Beyond Sight", the daily newsletter published by global macro think tank Rareview Macro and authored by Managing Member Neil Azous and rising star Michael Sedacca...For fans of the film Draft Day, this excerpt…Read More

MarketsMuse curators note that "there is always a better way, until its not better. .."But that isn't stopping Betterment LLC, the startup robo-adviser that claims to offer a solution for investors who seek an automated approach to stuff ETFs into their401k portfolios. Betterment, a leading robo-adviser, announced last week that…Read More

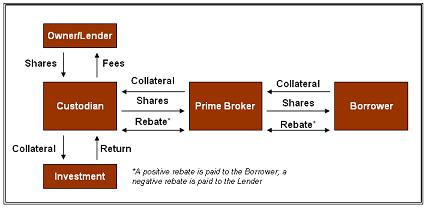

Sec Lending is a big business for Wall Street and through the big banks, institutional investors are lending out more bonds and accepting increasing amounts of non-cash securities — including exchange traded funds — as collateral, according to a recent report spotlighted by MarketsMuse editors courtesy of a.m. story from…Read More

In the wake of recent weeks' volatility and pricing dislocations across the exchanged-traded product space, news media and Mutual Fund marketers are having a field day putting the feet to the fire--and those toes being torched are connected to the universe of juiced-up and levered ETF and ETN products, as…Read More

For RIAs who want to be smarter (and at the same time, earn CFP and CE credits, MarketsMuse points you to the Sept 17, Forbes Advisor Playbook iConference. Why? Well for one, Shark Tank shark extraordinaire Kevin O'Reilly a newbie ETF Issuer of exchanged-traded funds firm "O'Shares" (whose first product…Read More