MarketsMuse.com update profiling iShares MSCI Sweden ETF ($EWD) and a global macro view is courtesy of extract from March 18th coverage by ETFtrends.com’s Todd Shriber

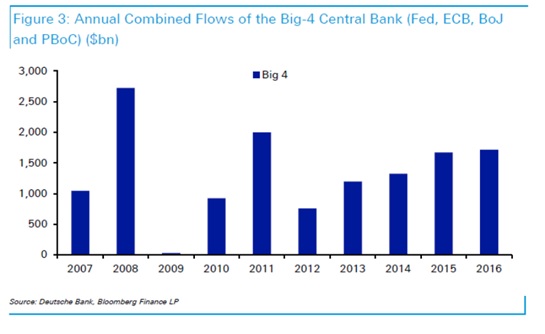

Shares of the iShares MSCI Sweden ETF (NYSEArca: EWD) were modestly higher Wednesday after the Riksbank, the world’s oldest central bank, surprisingly took Sweden’s repo rate deeper into negative territory with a cut of 15 basis points to -0.25% from -0.1%

Some of Sweden’s larger companies are struggling due to weak demand from Europe, the country’s largest export market, as the krona currency appreciated against the euro. However, lower central bank rates has helped stimulate household spending.

Some of Sweden’s larger companies are struggling due to weak demand from Europe, the country’s largest export market, as the krona currency appreciated against the euro. However, lower central bank rates has helped stimulate household spending.

The Swedish central bank recently cut its benchmark rate below zero for the first time and started buying bonds to combat deflationary pressures. However, if the krona continues to strengthen, the Riksbank could be forced to implement more aggressive measures. [Loose Monetary Policy Could Lift Sweden ETF]

In its efforts to stimulate inflation, Riksbank may not be done employing accommodative monetary policy.

“For us, we will pay close attention to the door they opened to launching a scheme to channel monetary support directly to corporations via lending. While no details were provided for the second meeting, we have for some time believed that a funding-for-lending program (FLS), a measure already used by the Bank of England, or a public-private investment program (PPIP), a liquidity tool used by the US Federal Reserve, are transmission mechanisms that have much greater and immediate impacts on the real economy than quantitative easing,” said Rareview Macro founder Neil Azous in a note out Wednesday. Continue reading