Corporate Bonds and exchange-traded funds is a combination that first seemed counter-intuitive to the select universe of traders who are actually fluent in both corporate bond trading and equity trading; two practice areas that are distinctively different. “Stocks are bought and bonds are sold” as they used to say, and the nuances of trading these distinctive asset classes in the secondary marketplace have long been at odds with each other.

This explains why fixed income traders from both the buy-side and sell-side rarely even knew their equity-trading counterparts, no less engaged in cross-asset trading. But thanks to shrinking trading profit margins, Wall Street trading desks now ‘get the joke’, and per story below, are bolstering their business models.

(REUTERS) Feb 18 Wall Street banks are ramping up businesses that trade exchange-traded funds full of bonds, a bright spot of growth at an otherwise bleak time for trading but one that may carry unappreciated risk.

Barclays PLC, Credit Suisse Group AG and Goldman Sachs Group Inc have all created special teams to make markets in bond ETFs. The teams include staff across stock and bond markets, since the ETFs trade like stocks on stock exchanges, but their underlying securities are bonds.

All told, 12 to 15 banks now have a presence in the business, whereas a few years ago almost none did, said Anthony Perrotta, global head of research and consulting at TABB Group.

“There are a lot of institutions that, even though they might be retrenching in fixed-income trading, are looking at ETFs as a way to galvanize their business,” said Martin Small, who oversees U.S. operations for BlackRock Inc’s iShares unit, which is the largest ETF issuer.

Although these businesses are sprouting up across Wall Street, they are unlikely to make up for huge profits banks earned during the glory days of bond trading, at least not anytime soon.

Investors pay banks 0.01 percent to 0.03 percent to trade a bond ETF, according to TABB Group, compared with 1.03 percent for an individual bond. Traders say they are hoping to make up for piddling margins by selling more of the product, since the ETF business is a bulk-volume one that is rapidly growing.

The sales push comes after years of pressure from leading ETF creators like BlackRock and State Street Corp to make markets for the bond ETFs. Those firms rake in billions of dollars’ worth of revenue from ETFs each year, and view bond ETFs as a way to grow their own businesses.

Firms that create ETFs need banks to act as intermediaries for sales, and also to ensure that prices are in sync with underlying securities. Before banks entered the market, trades were handled by market-makers like KCG Holdings Inc, Cantor Fitzgerald and Susquehanna Capital Group, who have been in the business for years.

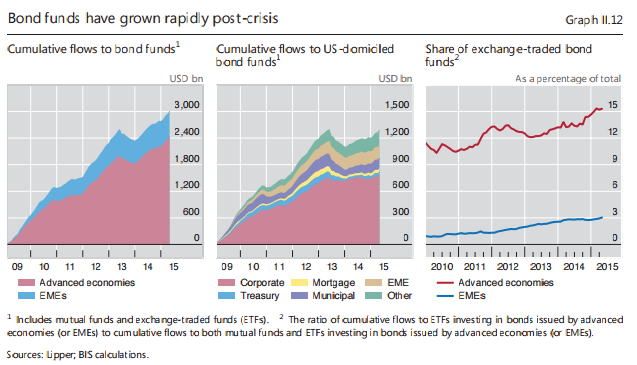

As Wall Street has warmed to bond ETFs, the market has quickly grown. Assets under management in the U.S. rose 44 percent to $372 billion at the end of January from $258 billion a year earlier, according to fund research service Lipper. That represents about 19 percent of the broader $2 trillion U.S. ETF market.

While the bond-ETF boom may be good for Wall Street, it is not without risk.

It comes at a time when liquidity in the corporate bond market has shriveled due to new rules that require banks to hold a lot of capital against those securities. As a result, banks avoid buying bonds from investors unless they can resell them quickly, and do not maintain much inventory for interested buyers.

Despite their holdings, bond ETFs trade more like stocks, on stock exchanges, so they are not facing the same type of liquidity issue. But it is unclear how they will perform if investors rush for the exit all at once, or if markets come under serious stress. During the Aug. 24 “flash crash,” for instance, some ETFs failed to trade properly.

The full story from Reuters is here