Well Matilda, as if the universe of corporate bond electronic trading platforms isn’t crowded enough, despite clear signs of consolidation taking place for this still nascent stage industry (e.g. upstart Trumid’s recent acquisition of infant-stage Electronifie) , one more corporate bond e-trading platform has its cr0ss-hairs on the US market. The latest entrant is UK-based Neptune Networks, Ltd., a consortium controlled by sell-side investment banks that has inserted electronic trading veteran Grant Wilson as interim CEO. Neptune’s lead-in value proposition’ is perfecting the IOI approach to capturing liquidity, and also offers a tool kit of connectivity schemes that bridge buyside and sell-side players.

Promoting indication-of-interest orders ( pre-trade real-time AXE indications) as opposed to actionable bid-offer constructs that are ubiquitous to equity trading platforms, is a technique that other US-based corporate bond trading platforms are already advancing. Neptune is also not alone in their positioning an ‘all-to-all’ model as a means to inspire buy-side corporate credit PMs and traders to embrace electronic trading, a seemingly counter-culture technique that enables them to swim in the same pool as sell-side dealers aka market-makers. The distinction that Neptune brings to the table is girth and size, thanks to its sponsors Goldman Sachs, JP Morgan, Credit Suisse, Morgan Stanley, UBS, Citi and Deutsche Bank, each of which maintain board seats. Unlike the other players in the space that are focused on building a “round lot marketplace” (as opposed to retail size orders that MarketAxxess (NASDAQ: MKTX) specializes in, Neptune carries over 14,000 individual ISINs daily, claims that its average order size is 5mm, total daily gross notional in excess of $115bn, and according to Neptune’s marketing material, over 22,000 individual ISINs have been submitted to the platform since January 1st.

Lots of e-bond trading platforms, but none are incorporating bond ETFs, at least not yet.

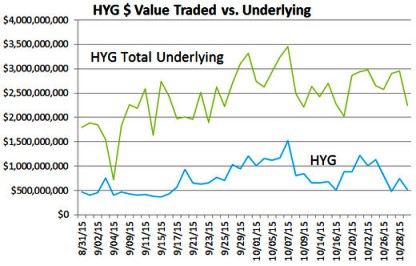

As compelling as Neptune’s value proposition is, some corporate bond e-trading veterans are quietly wondering whether these initiatives are somehow missing the memos being circulated throughout the institutional investor community profiling the rapid adoption of corporate bond ETF products in lieu of their long-held focus on individual corporate credits.

According to one e-bond trading veteran, “Anyone who follows the trends [and follows the money] can’t help but appreciate that a broad assortment of Tier 1 investment managers, RIA’s and even public pensions’ use of bond ETFs is increasing in magnitude by the week, not the quarter. If you’re operating an electronic exchange platform for corporate bonds, and your users are rapidly increasing their use of fixed income exchange-traded funds, having a module for ETFs would seem to be a natural next step.”

Others in the industry have suggested to MarketsMuse reporters that enabling users to trade the underlying constituents against the respective corporate bond cash index along with a module for create/redeem schemes, or even a means by Issuers can distribute new debt directly seems to make “too much sense.” But then again, these same industry experts acknowledge the political landmines that would most assuredly be encountered by those trying to disrupt and innovate within corporate bond land are perhaps too much for those who need to prove their business models before aiming at new frontiers. Continue reading