On the heels of this past week’s near record-breaking investment grade corporate debt issuance courtesy of multiple Fortune companies who are seizing the moment insofar as the current low rate regime, Toyota Motor Credit Corp (TMCC), the financing arm of the world’s largest car maker did something different yesterday in…Read More

(RaiseMoney.com)-French broker-dealer BNP Paribas "gets the joke" when it comes to fintech applications for equity crowdfunding and is embracing blockchain technology to advance their vision. A subsidiary of BNP Paribas Group has announced a partnership that will find it leveraging blockchain technology to enable private companies to issue securities via equity…Read More

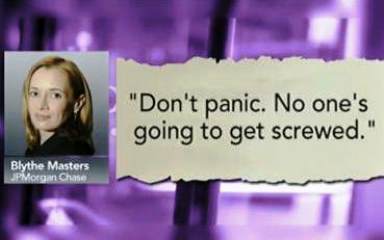

Blythe Masters, the former grand dame of derivatives for investment bank JP Morgan, who after a less-than-glorious exit from her senior role overseeing credit derivatives for House of Morgan and who reinvented herself as a blockchain babe and leads digital ledger startup Digital Asset Holdings, has proven that every cute…Read More

BNY Mellon 'Gets It' and Also Gives It Back. With close-on $29Trillion in deposits and $1.3Trillion in AUM, BNY Mellon (NYSE:BK), the oldest bank in the U.S. is not just the country's biggest, it ranks as one of the world's biggest banks. Hundreds of financial industry professionals now working across…Read More

Within the context of market structure, the ever-evolving rules of the road for those attempting to navigate how and where to secure best pricing when executing equities orders has become so convoluted thanks to pay-to-play rebate schemes, its not only the curators at MarketsMuse who are scratching their heads, even…Read More

Symphony, the Wall Street-backed secure messaging platform first designed to displace Bloomberg LP's most ubiquitous feature and further reduce the Street's dependency and technology costs synonymous with having a Bloomberg terminal, has struck another blow in the bow of Bloomberg's boat thanks to the consortium-owned deal with electronic execution system…Read More

If not as widely-covered as the GOP or DNC primaries, financial industry publication Wall Street Letter ("WSL") held its 5th Annual Institutional Trading Awards ceremony last night at NYC venue 583 Park Avenue and recognized best-in-class broker-dealers across 7 major categories, including Best Broker Dealer (OverAll), Best Broker-Dealer Research, Best…Read More

Announced after the close of trading on Thursday, Goldman Sachs $5.1 billion settlement with the U.S. Department of Justice, AGs from NY and IL and two other federal agencies in connection with the big bank's underwriting and sale of mortgage-backed securities (MBS) sounds whopping, but seemed to have little impact…Read More

(MarketsMuse courtesy of Chicago Tribune)-The notion of a secondary trading market for crowdfund investments is not new--a topic that MarketsMuse has profiled more than once during past several months, but those efforts have been more noticeable outside the US. That's now changing. Chicago-based CFX Markets launched a platform Tuesday allowing crowdfunding…Read More

(Bloomberg LP reporting via TradersMagazine) -- Dan Mathisson, aka "Mr. Algo", the executive who helped build Credit Suisse Group AG into an electronic-trading powerhouse over the past decade, plans to leave the bank at the end of next month, according to people familiar with the matter. Mathisson, who most recently…Read More

To kick off the 2016 debt market outlook, MarketsMuse fixed income curators are looking forward to the next Caribbean boondoggle, and in that spirit, we extend a shout out to Ron Quigley, one of the primary debt capital market's top pulse-takers who also goes by the title Head of Fixed Income Syndicate…Read More

Blythe Masters, once considered the “Babe of Investment Banking” in view of her long tenure and celebrity senior role at JPMorgan—which included her being credited for helping to create those snarkly financial derivative products known as credit default swaps (CDS), has since aspired to become known as either the "Blockchain…Read More

(BrokerDealer.com)- The Financial Industry Regulatory Authority (FINRA) has given a $7.3mil spanking to broker Cantor Fitzgerald consisting of a $6 million fine and an order to pay $1.3 million for commissions, plus interest, it received from selling billions of unregistered microcap shares in violation of federal law in 2011 and…Read More

The Big Short is coming to a theater near you soon, but the hedge fund industry's cool kid of the year David Miller has traded ahead of his peers by exploiting and being short of the popular ETF industry product: leveraged ETFs and “inverse ETFs”; products that are typically powered…Read More

Facebook's Mark Zuckerberg (who needs no further introduction) and his wife Priscilla are celebrating the birth of their first child ( a girl named Max) by announcing that he and his wife will move 99% of their shares in Facebook (NYSE:FB) to a charitable trust. For those without a calculator,…Read More

A pile on approach is impacting hedge fund emulator ETF products (e.g. $GURU, $ALFA), and leading to crowd control issues, according to a recent Bloomberg article re-distributed via TradersMagazine story with title: Hedge Fund-Replicating ETFs Hurt by Crowded Trade Selloff MarketsMuse curators carry the story here.. (Bloomberg) -- Exchange-traded funds…Read More

Institutional Investor Magazine has recently announced the world's top 35 FinTech Bankers, and... As astutely noted by Institutional Investor Magazine’s Senior Editor Jeffrey Kutler, “The origin of the term “fintech” is difficult to pinpoint; only very recently has it become an accepted label for one of the hottest segments of…Read More

Marathon Asset Management CEO Bruce Richards Leads Crowdfund Campaign for "Veterans Education Challenge" Hedge Fund Honcho Will Match $1mm Raised via Crowdfunding Platform CrowdRise (RaiseMoney.com) For those Wall Street sharks and finance industry wonks who haven’t yet received the memo about crowdfunding, you might want to dial in to hedge…Read More