MarketsMuse followers have been reminded more than a few times that conventional wisdom requires investors to keep their eyes on corporate bond spreads so as to have a clear lens when considering the outlook for equity prices on a medium-to-longer time frame. The relationship between high-yield debt,most-often measured by HYG…Read More

Former Lehman Bros capo Richard Fuld likes acronyms, and somewhat out of character for the Big Dick many on Wall Street remember him to be, he also apparently likes the idea of inserting himself into a consortium that has created yet another new exchange platform--that eschews the notion of maker-taker…Read More

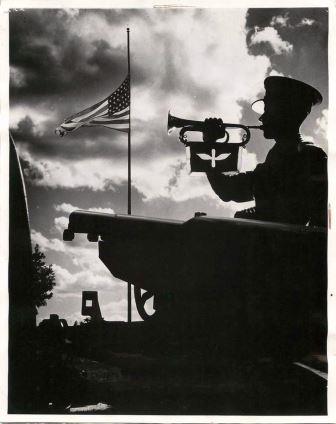

9 November (BrokerDealer.com)--Broker-Dealer Mischler Financial Group (“Mischler”) , the securities industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans announced that in connection with the firm’s annual recognition of Veteran’s Day, Mischler has pledged a portion of the firm’s entire November 2015 profits to The…Read More

MarketsMuse Strike Price curators are always looking for smart perspectives on how to bring more asset managers and institutional investors to better understand and embrace the use of options in a responsible manner. According to Todd Hawthorne, lead portfolio manager of Boston Partners, volatility [which some immediately and sometimes, misguidedly…Read More

While 99% of market pundits have been busy for the past months laying odds and making bets as to precisely when and how much the Fed will raise interest rates, a small universe of Fed Watchers have picked up on a surprising nuance that few seasoned market experts have even…Read More

(Bloomberg) via (TradersMagazine) MarketsMuse Fintech team notes that Deutsche Bank AG’s Stephen McGoldrick, who was leading a consortium of banks and asset managers in developing a new European dark pool for stocks, has decided to leave the project. McGoldrick will return to his role as director of market structure at Deutsche…Read More

The battle between business news pontificaters across the 4th estate is in full season, as evidenced by a smart article yesterday by Bloomberg LP's Eric Balchunas and suggests that MarketsMuse curators are apparently not the only topic experts who noticed and took aim at a recent WSJ article that proclaimed…Read More

MarketsMuse extends a warm salute to the nation's oldest and largest minority brokerdealer owned and operated by service-disabled military veterans in connection with the following news announcement.. Oct 5 2015–Stamford, CT and Newport Beach CA–Mischler Financial Group, Inc., the financial industry’s oldest and largest institutional brokerage and investment bank owned…Read More

Professional Investment Community Cries Out in Agony and They Don’t Yet Know Exactly Why MarketsMuse Strike Price and Global Macro curators voted the Oct 5 edition of global macro advisory firm Rareview Macro's Sight Beyond Sight the best read of the week. Yes, its only Monday, but those who follow…Read More

MarketsMuse Fixed Income Update "Corporate Bond Market- Balancing on a Knife Edge" is courtesy of extract from the 10.02.15 weekend edition of "Quigley's Corner", a daily synopsis of the investment grade corporate bond market and rates trading space authored by Ron Quigley, Managing Director of investment bank and institutional brokerage…Read More

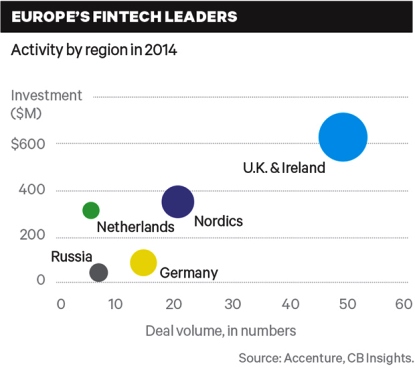

The FinTech aka financial technology revolution continues to advance across the financial industry landscape, as dozens of startups from block chain to bond trading initiatives work towards securing a presence within the institutional financial services ecosystem. And, as profiled in a brilliant column this week from Institutional Investor spotlighted by…Read More

Hold the pickles, and hold the lettuce...Just when MarketsMuse curators and an assortment of ETF market enthusiasts thought there might already be enough themes, toppings and twists to the growing number of exchange-traded funds, ProShares is taking a page straight out of Burger King's 1970's branding campaign via a newly-launched…Read More

For Wall Street bankers and brokers who have been in the business since at least the early 2000's and are still working on the Street, and who think you've already been pilloried plenty for the work you do, watch out, former Lehman broker-turned best-selling author Michael Lewis ("Liar's Poker", "Money…Read More

MarketsMuse curators note that "there is always a better way, until its not better. .."But that isn't stopping Betterment LLC, the startup robo-adviser that claims to offer a solution for investors who seek an automated approach to stuff ETFs into their401k portfolios. Betterment, a leading robo-adviser, announced last week that…Read More

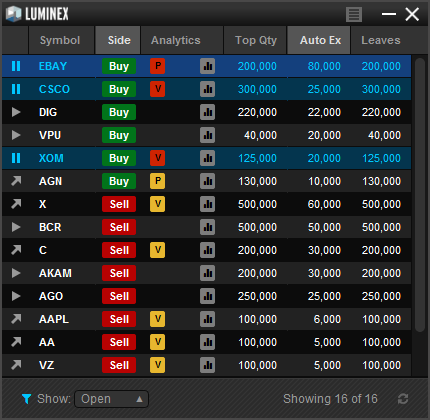

As if there were not enough electronic trading platforms, the buyside remains determined to have their own equities trading platform open only to buy-side block trading peers. MarketsMuse Tech Talk Editors tip our hats to FierceFinanceIT.com for the following update re Luminex Trading & Analytics, the ATS block trading venue…Read More

One needs to have 'been there and seen that' for at least twenty years in order to have been "loaded for bear" in advance of this morning's equities market rout. At least one of the folks who MarketsMuse has profiled during the past many months meets that profile; and those…Read More

MarketsMuse fintech update is a "bid on" to prior Wall Street bitcoin initiative coverage, and following is courtesy of excerpt from 4 Aug story by Bloomberg LP reporter Andrew Leising, " Wall Street, Meet Block 368396, the Future of Finance." [caption id="attachment_3847" align="alignleft" width="180"] Justin Brownhill, SenaHill[/caption] When Justin Brownhill…Read More

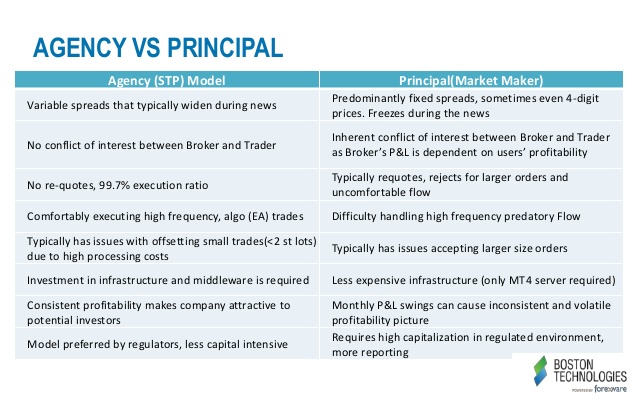

MarketsMuse dip and dash department frequently prefers spotlighting altruists and do-gooders, including Agency-only execution firms in the brokerdealer sphere who, unlike “principal trading desks”, do not take the contra side to institutional customer orders as a means of making a profit; agency-only firms merely execute those client orders via the…Read More