Nobody can accuse veteran government bond market broker and fintech poster boy David Rutter of being single-minded. The former Prebon Yamane exec, who later migrated to inter-dealer broker ICAP where he became of head of electronic trading, then did a stint as CEO of fixed income and FX platform BrokerTec,…Read More

MarketsMuse inhouse political pundits are headed to Hempstead, NY, home of Hofstra University where the Circus Comes to Town disguised as the first tranche of 2016 US Presidential debates. While our inhouse politicos battle the LIE rush hour traffic in effort to get a ring-side seat for the Ringling Bros…Read More

If History is Any Guide....more than one "markets muse" should be running for cover, faster than if they found themselves strolling the streets of NYC's Chelsea neighborhood this past Saturday evening. And, one global macro muse is extending that warning.. Stock market technicians, i.e. those who hang their hats on…Read More

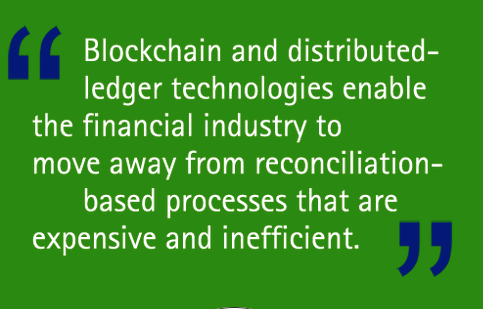

"What's Next? Well, for those familiar with Patrick Byrne, the controversial and innovative founder of Overstock.com, one of the first online retailers to embrace the use of bitcoins, it should not be a surprise that Overstock's chief honcho would 'get the joke' and realize its all about the underlying technology…Read More

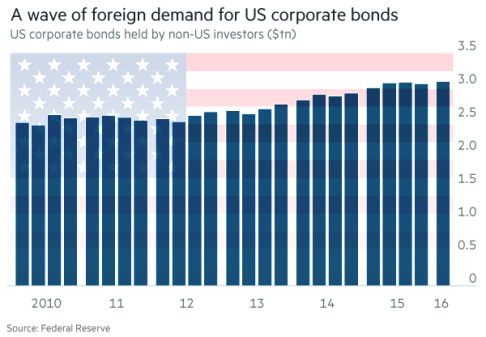

MarketsMuse Fixed Income Curators have been keeping tabs on the seemingly insatiable and outsize demand for yield and in particular, the demand for IG Corporate Bonds aka investment grade corporate debt. With that, we roll to opening excerpt of Aug 9 notes from "Quigley's Corner", the financial industry award-winning commentary…Read More

TRUMP CAMPAIGN SPECIAL REPORT: GOP NOMINEE VOWS TO SHUT US DEPT OF STATE AND REPLACE WITH US DEPT OF SEX; FIRST LADY MELANIA TO GIVE HEAD AND "LEND A HAND" DONALD TRUMP TWEETS "MY NEW US DEPARTMENT WILL BE PROFITABLE STARTING DAY ONE!" (MarketsMuse Exclusive)- Donald Trump, the GOP Presidential…Read More

The summer interns at MarketsMuse had already voted "Shark Tank" as their favorite TV show, so it was no surprise that our senior curators took their cue to advance the latest news from Kevin O'Leary, the celeb entrepreneur and more recently, an ETF aficionado who has extended his brand to…Read More

BREXIT or BREMAIN the NEVERENDUMS Will Continue in Europe "Should I Stay or Should I Go? That Answer Is Self Evident..." A Global Macro perspective from Debt Market Veteran..Music by Clash, Comments by Quigley Below excerpt courtesy of 22 June edition of "Quigley's Corner", the industry award-winning debt capital market…Read More

(RaiseMoney.com)-Minneapolis-based Stratifund, which models itself as a modern day version of a traditional Wall Street "independent equity research firm" has become the first such firm to plant its flag on the crowdfunding beachhead and bring objective analysis to crowdfund deals. Led by a cadre of Wall Street-trained wonks and crowdfund…Read More

MarketsMuse sends out a shout out to SubstantiveResearch.com for profiling Global Macro guru Neil Azous from Rareview Macro, who "always looks to challenge the consensus and the sometimes lazy view of the prevailing market set up." In yesterday’s note he focused on China, and the consensus view that the cyclical…Read More

(RaiseMoney.com) May 16 2016 marks the beginning of what could be an avalanche of private equity offerings promoted via the web. Thanks to the JOBS Act and SEC Regulation Crowdfund, which now totals 685 pages of rules to live by for those in the U.S. Equity Crowdfunding space, including brokers…Read More

May 12-Stamford, CT--Mischler Financial Group (“MFG”), the financial industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans, announced today that in recognition of the upcoming Memorial Day celebration, the firm has pledged a percentage of its entire May profits to Veterans Education Challenge, (VetEdChallenge) a donation-based…Read More

NEW YORK (Reuters) - Federal authorities investigating the market-making arms of the $25bil hedge fund Citadel LLC and broker KCG Holdings Inc, are looking into the possibility that the two giants of electronic trading are giving small investors a poor deal when executing stock transactions on their behalf. The Justice…Read More

Bloomberg LP's agency broker Bloomberg Tradebook is continuing to grab market share in the ETF execution space thanks to introducing a blockbuster approach that has proven to work across a universe of hard-to-trade financial instruments: RFQ ("Request For Quote"). The "Bloomberg ETF RFQ" tool, which, according to a statement issued by Bloomberg…Read More

(FinanceMagnates.com) Supporters of Tom Hayes, the former UBS rates trader and the first person to be convicted for the manipulation of the London Interbank Offered Rate (LIBOR), have launched a crowdfunding appeal via UK platform Fundrazr to raise £150,000 ($217,403) to underwrite a further appeal against his conviction. The former…Read More

Cheryl Cargie, head trader at buy-side fund manager Ariel Investments in Chicago, said that while the buy side is looking for more from its sales trader coverage, it depends on whether a buy side trader is representing a passive or active strategy. For a veteran with over 20 years in…Read More

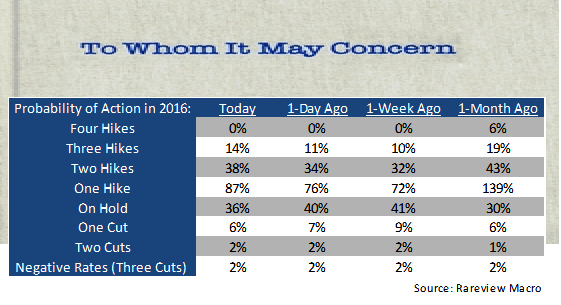

Memo: To Whom It May Concern: Inflation Risk is Back In Play Below is a special edition of global macro commentary courtesy of Stamford-based think tank Rareview Macro LLC, the publisher of "Sight Beyond Sight." The following has been excerpted by the curators at MarketsMuse and republished with permission from…Read More

Call it a Rat's Nest, a Rabbit Hole, or a Rubik's Cube, but no certified marketsmuse can dispute the fact the ETF industry has become a Spider's Web of complexity when it comes to the assortment of products being promoted. And, who more qualified to advocate on behalf of a…Read More