Decomposing the Move in Yields...Global Fixed Income Coming Closer to Decoupling from German Bunds MarketsMuse Global Macro and Fixed Income departments merge to provide insight courtesy of "Sight Beyond Sight", the must read published by global macro think tank Rareview Macro LLC. Below is the opening extract from 10 June…Read More

#WhatsNext? wonders the MarketsMuse.com editors and Overstock's Patrick Byrne does not fail to surprise with another announcement that could disrupt the capital markets. As a follow-on to a $500mil stock offering reported here on April 29, now Byrne is pitching an offering that he hopes to be the first issuance…Read More

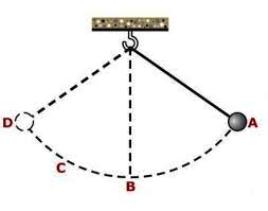

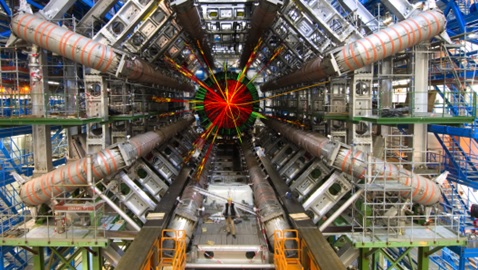

Messing With Data aka When “Art” Smashes into “Science” in Wall Street’s Version of the Hadron Collider MarketsMuse Fixed Income update comes consequent to the Fed's June 5 release of Employment Data, and below is courtesy of extracted comments delivered to institutional clients of Mischler Financial Group under the banner…Read More

MarketsMuse ETF and Fixed Income departments merge to profile trend on part of fixed-income focused hedge funds and institutional fund managers to use ETFs to express their bets on corporate bonds. This MarketsMuse blog update is courtesy of Bloomberg's Lisa Abramowicz and her article, "A $200 Million Hedge-Fund Trade in Your…Read More

MarketsMuse ETF and Fixed Income departments merge and gives credit to Morgan Stanley as they raise their own ETF flag with an innovative idea to package a single corporate bond issuer’s debt into one neat package so that ETF investors can express their bets on the issuer’s outstanding credit… Here’s…Read More

MarketsMuse blog update profiles yet another bond trading system. Bloomberg has introduced new bond trading platform, Bloomberg Bond Cross (BBX), which allows market participants to access European bond market liquidity. Participants now have access to the European bond market liquidity thanks to a new partnership between Bloomberg and State Street. This MarketsMuse…Read More

MarketsMuse update is courtesy of a truly inspiring initiative on the part of Mischler Financial Group, the broker-dealer industry's oldest firm owned and operated by Wall Street vets who are also Service-Disabled Veterans. Mischler Financial Memorial Day Month Pledge: May Profits to Semper Fi Fund For Immediate Release Newport Beach,…Read More

MarketsMuse Global Macro update is courtesy of extract from a.m. edition of "Sight Beyond Sight", the newsletter published by global macro think tank Rareview Macro LLC and authored by Neil Azous. [caption id="attachment_2349" align="alignleft" width="150"] Neil Azous, Rareview Macro[/caption] In last Thursday’s edition of Sight Beyond Sight we argued that…Read More

The US Government Bond Market is set to explode...with more e-trading systems.. MarketsMuse Tech Talk continues its curating of fintech stories from the world of fixed income and today's update is courtesy of WSJ's Katy Burne, who does a superb job (as always) in summarizing the latest assortment of US…Read More

MarketsMuse Global Macro update is courtesy of opening extract from today's a.m. edition of "Sight Beyond Sight", the global macro newsletter published by global-macro think tank Rareview Macro LLC and authored by Neil Azous, Rareview Macro's Founder and Managing Member. [caption id="attachment_2349" align="alignleft" width="150"] Neil Azous, Rareview Macro[/caption] Forgive our…Read More

MarketsMuse Fixed Income update profiles Apple Inc latest bond issuance courtesy of late afternoon desk notes distributed to institutional clients of deal co-manager Mischler Financial Group, the financial industry's oldest and arguably largest boutique Finra member firm that is owned and operated by Service-Disabled Veterans. MarketsMuse Editors are compelled to…Read More

MarketsMuse.com Fixed Income & Trading Tech update is without a rating and instead, takes a long view towards this week's announcement from inter-dealer broker GFI Group launch of an electronic service for "dealers only" to trade odd lots of corporate bonds. For those not in the know, "odd-lot" is generally…Read More

MarketsMuse is known for being both a curator of financial market news as well as a part-time pontificating platform, and yet our altruistic editorial team actually likes to lean towards and forward to our followers select stories that profile the truly compelling "social-sensitive" initiatives spearheaded by Wall Street banks. While…Read More

Just when you thought the world of electronic bond trading had become saturated, MarketsMuse.com Fixed Income and Trading Tech departments continues coverage of the increasingly popular fixation on the part of entrepreneurs and technology firms, who have set up nearly two dozen new markets to trade corporate debt. In the…Read More

TradeWeb's Raazi is out after short stint pitching the merits of electronifying the corporate bond market. MarketsMuse.com has made more than a few mentions about the recent decade’s corporate bond-centric electronic trading platform initiatives and those being spearheaded by the latest generation of altruistic sell-siders, buysiders, and the assortment of…Read More

The senior curator for MarketsMuse.com Tech Talk section was so inspired by a recent article "A Cynic's Guide to Fintech" by Dan Davies, the Senior Research Advisor at Frontline Analysts and published via Medium.com, we wanted to share the opening elements with our audience..For those of you following the various…Read More

MarketsMuse.com Fixed Income Fix update is courtesy of extract from 06 April commentary from Mischler Financial Group's "Quigley's Corner", Wall Street Letter's 2015 winner of "Best Research-BrokerDealer." How Low Will Greece Go? [caption id="attachment_460" align="alignleft" width="125"] Ron QuigleyMischler Financial[/caption] When one broaches the subject of German war reparations, it opens…Read More

MarketMuse blog update profiles the positive market conditions bringing a good cash flow to high yield bonds, some say both are due to the ETF market. MarketMuse blog update is courtesy of Forbes' article "High Yield Bond Funds See $315M Cash Inflow, Thanks To ETFs" with an excerpt below. Retail…Read More