Working Luncheon will celebrate veterans in the workplace with attendees from notable publicly traded companies

May 16, 2019 10:00 AM Eastern Daylight Time

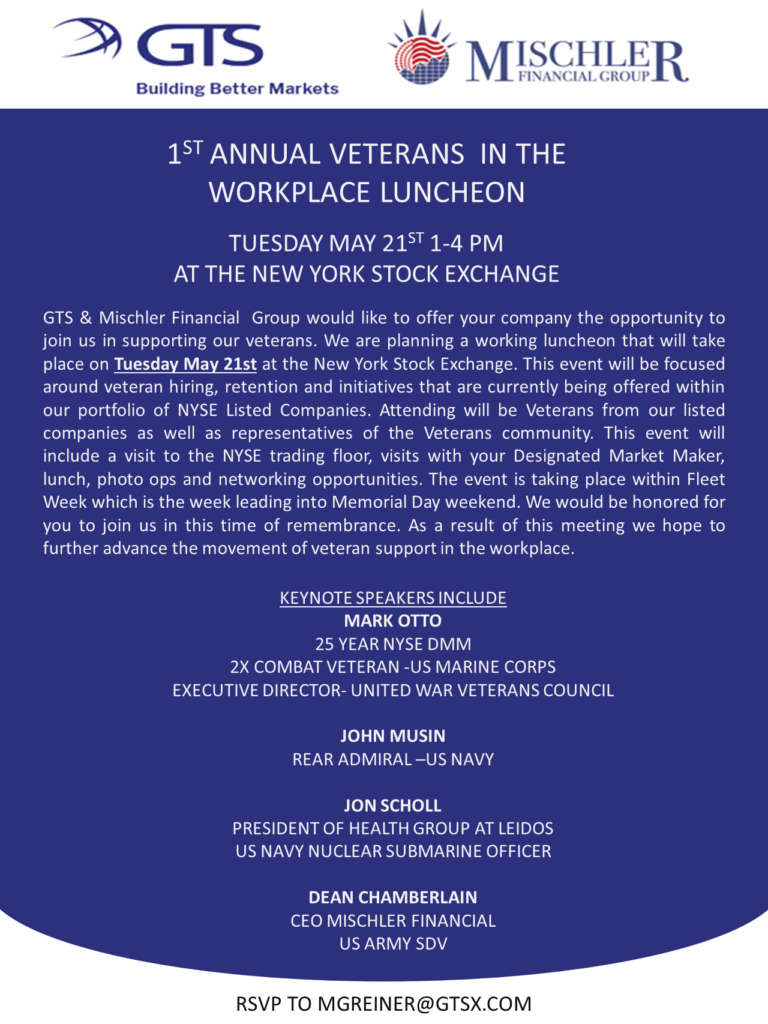

NEW YORK–(BUSINESS WIRE)–GTS, a leading electronic market maker across global financial instruments and the largest designated market maker at the New York Stock Exchange (“NYSE”), in partnership with veteran-owned broker dealer Mischler Financial Group, will hold the first annual ‘Veterans in the Workplace’ luncheon at the NYSE on May 21, 2019.

The luncheon will kick off the 31st annual Fleet Week New York, which will take place from May 22-28. Attendees will include veteran C-level executives and employees of publicly listed companies, high-ranking military officials, and student veterans from local New York colleges.

The event is being organized by Mark Otto, Global Markets Commentator for GTS and U.S. Marine Corps combat veteran. Otto also serves as Executive Director of the United War Veterans Council (“UWVC”), which is the organization that produces the New York City Veterans Day Parade.

“I am thrilled to organize the first-ever ‘Veterans in the Workplace’ luncheon at the NYSE to kick off Fleet Week in New York,” Otto said. “This event will be a great opportunity to honor both those who are actively serving as well as veterans who, after serving our country, have rejoined the workforce to serve our capital markets.”

The event will feature three keynote speakers:

- Dean Chamberlain, CEO of Mischler Financial, West Point graduate and former U.S. Army Officer;

- Rear Admiral John Mustin, Deputy Commander of the U.S. Second Fleet and Naval Surface Force Atlantic;

- Jon Scholl, President of the Health Group at Leidos, U.S. Naval Academy graduate and 5-year U.S. Navy veteran; and

- Diego Rubio, U.S. Army Veteran and Co-founder of Women Veterans on Wall Street (“wVOWS”)

“It is an honor to deliver a keynote address for a unique program that includes fellow military veterans in the workforce,” Chamberlain said. “As the CEO of the industry’s oldest service-disabled veteran-owned business, it is always inspiring to work alongside corporations that provide veterans with opportunities to leverage the skills acquired in the course of their service and provide focused programs to help them successfully transition to new careers.”

In addition to the keynote speakers, the luncheon will provide attendees with a networking opportunity, and will highlight topics including veteran-hiring retention and the different initiatives companies are taking to help veterans.

Approximately forty C-level executives and employees from publicly listed companies such as Wabash National (NSYE: WNC), DHI Group (NYSE: DHX), Leidos (NYSE: LDOS) and Samsung will be in attendance.

Fleet Week is a weeklong celebration of the U.S. military’s sea services and gives the citizens of New York the opportunity to meet and interact with members of the U.S. Navy, U.S. Marine Corps and U.S. Coast Guard. This year, the U.S. Navy expects about 2,600 Sailors, Marines and Coast Guardsmen will be on hand.

About GTS

GTS is a global electronic market maker, powered by combining market expertise with innovative, proprietary technology. As a quantitative trading firm continually building for the future, GTS leverages the latest in artificial intelligence systems and sophisticated pricing models to bring consistency, efficiency, and transparency to today’s financial markets. GTS accounts for 3-6% of daily cash equities volume in the U.S. and trades over 10,000 different instruments globally. GTS is the largest Designated Market Maker (DMM) at the New York Stock Exchange, responsible for nearly $12.5 trillion of market capitalization.

For more information on GTS, please visit www.gtsx.com.

About Mischler Financial Group

Established in 1994, Mischler Financial Group (“Mischler”) is the financial industry’s oldest diversity-certified investment bank and institutional brokerage owned and operated by service-disabled veterans, the firm was the first FINRA member to be designated as a Service-Disabled-Veteran-Business Enterprise (SDVBE). Mischler is recognized for its role as a leading capital markets boutique operating across the primary and secondary financial market ecosystem. The firm serves Fortune corporate treasurers in the course of their issuing new debt and equity offerings and administering their respective corporate share repurchase aka 10b-18 programs. In many initiatives, Mischler is viewed as a pure complement to the role played by issuers’ lead underwriters and also assists state and local governments in selling tax-exempt and taxable municipal securities. Investment management clients of the firm’s secondary market execution platform include a broad spectrum of public plan sponsors and investment fund managers. Mischler also provides cash management for government entities and corporations, and asset management programs for liquid and alternative investment strategies. Mischler maintains offices in 8 major cities and is staffed by more than 50 securities industry veterans.

Visit https://www.mischlerfinancial.com for more information.