With today's announcement from Pfizer (NYSE:PFE) indicating they are that much closer to a Covid-19 vaccine, its time to look forward to who the Biden administration will appoint to prosecute the tens of thousands of SBA PPP loan scammers who reaped tens of billions after the Trump administration made it…Read More

PPP and EIDL Fraud is as rampant as COVID-19. According to the front page story appearing in the New York Times April 26 edition, hundreds of millions of dollars in SBA bailout funds that were intended by the US Treasury to assist small businesses impacted by COVID-19 via the Paycheck…Read More

In a scheme that reads much like the MarketsMuse story published in October profiling so-called digital asset firm Seaquake.io, whose principals Andrew Katz and Matthew Krueger fraudently claimed to be operating a high-frequency trading system for cryptocurrencies, Michael W. Ackerman of Ohio, and a former NYSE floor broker, was charged…Read More

(Source: Law360.com ) Andrew R. Katz, aka Ross Katz, aka Stark Katz an Arvada, Colorado man who is last known to reside in either of New York City or Southern California, and uses California, Colorado, Florida and New York drivers licenses while claiming to be a former FX trader for…Read More

We pay tribute to all WWII Veterans, those who landed on the beaches of Normandy, France to repel Nazi Germany's forces and those who made the ultimate sacrifice on D-Day, June 6, 1944, to defend the values that we hold so dear. MarketsMuse Curators extend a warm salute to Mischler…Read More

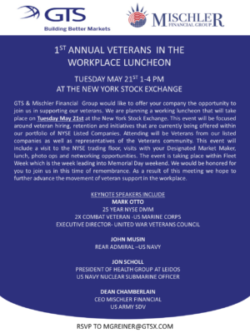

Working Luncheon will celebrate veterans in the workplace with attendees from notable publicly traded companies May 16, 2019 10:00 AM Eastern Daylight Time NEW YORK--(BUSINESS WIRE)--GTS, a leading electronic market maker across global financial instruments and the largest designated market maker at the New York Stock Exchange (“NYSE”), in partnership…Read More

Long Live the Libertad Act! Taking aim at the Cuban Government, US President Donald Trump and his Board of Directors, led by Secretary of Treasury Steve Mnuchin and Secretary of State Mike Pompeo. announced that US shareholders of companies that were seized and nationalized by Fidel Castro when the now-deceased…Read More

Bonds and Billions 3.0...Tradeweb Markets, one of the original electronic bond trading pioneers, which first introduced its dealer consortium platform in 1996, proved that patience is a virtue when it comes to monetizing enterprise value. The company raised $1.1billion via its Nasdaq-listed IPO yesterday (NASDAQ:NW). Illustrating investor attraction to owning…Read More

ETFs $HONR and $VETS advance an intriguing investment thesis: companies that stand up for military veterans outperform their peers. Much like the view that women-led VC firms tend to outperform their male-dominated competitors, the thesis for investing in a culture-centric portfolio of companies is an approach now used by a broad…Read More

For those who missed the MarketsMuse memo from Jan 14, there appears to be yet another exchange coming to the US Equities markets, as if the industry needs one more platform to facilitate trading in publicly-listed stocks. The latest platform, which is still on the whiteboard, is a consortium-based initiative…Read More

MarketsMuse coverage of the exchange-traded fund (ETF) industry began nearly ten years ago, and our senior curators have since been scratching their heads as to why CNBC, the retail investors' most-watched business news network had never created dedicated programming to educate their viewers about ETFs, an asset class that has consistently…Read More

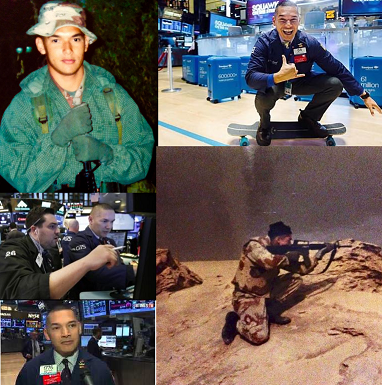

US Marine veteran of Operation Just Cause and Operation Desert Storm and veteran NYSE floor trader enlists with designated market-maker GTS with rank of Global Market Commentator From the USMC to the NYSE, Mark Otto re-defines the phrase 'veteran' when considering his pedigree as a highly-decorated former US Marine and…Read More

[caption id="attachment_5639" align="alignleft" width="150"] NYSE DMM Citadel Securities started as a HFT prop trading firm[/caption] Something funny happened on the way to the floor of the New York Stock Exchange last week; Citadel Securities and Virtu Financial, two of the three biggest NYSE “Designated Market-Makers” aka “DMM”) --also domain experts…Read More

The never ending battle to electronify the secondary market for corporate bonds has yet another new entrant that aims to disintermediate corporate debt dealers that 'control' the trading in what has morphed from a $2trillion market to a $9 trillion marketplace during the last decade alone. As profiled by CNBC…Read More

Trifecta Month for GTS; NYSE DMM, Quant-Trading Powerhouse and Fin-Tech Think-Tank Now Aligned With Investment Bank Specializing in Primary Debt & Equity Capital Markets GTS, the NYSE's Top DMM, and one of the global trading market's leading multi-asset electronic market-makers, is on a strategic deal-making binge. On the heels of…Read More

In Honor of Veterans Day and the USMC 243rd Birthday, MarketsMuse Curators extend our appreciation to all US Military Veterans, Happy 243rd Birthday and Semper Fi to all US Marines, a special salute to the battalion of sell-side broker-dealers owned and operated by Service-Disabled Veterans, and a Special Shout Out to…Read More

Breaking News: GTS Securities, the NYSE's biggest specialist firm aka Designated Market Maker ("DMM") and one of the electronic market-making world's biggest players in the FX and rates markets is now aiming to become the ETF industry's biggest market-maker the old-fashioned way, by buying into the space. After several months…Read More

Broker-Dealer Newport Beach, CA & Stamford, CT – November 1, 2018 — Each year, Mischler Financial Group, Inc. (“Mischler”), the securities industry’s oldest investment bank and institutional brokerage owned and operated by service-disabled veterans, pledges a percentage of the firm’s profits to veteran and service-disabled veteran philanthropies as part of…Read More