MarketsMuse.com profile of ETFs intended to provide global-macro-focused investors with a hedge against a continuing strong dollar and currency swings is courtesy of below extract from Mar 20 WSJ column by reporter Carolyn Cui.

Exchange-traded funds that protect against currency swings are attracting U.S. investors concerned that the strong dollar will erode their gains.

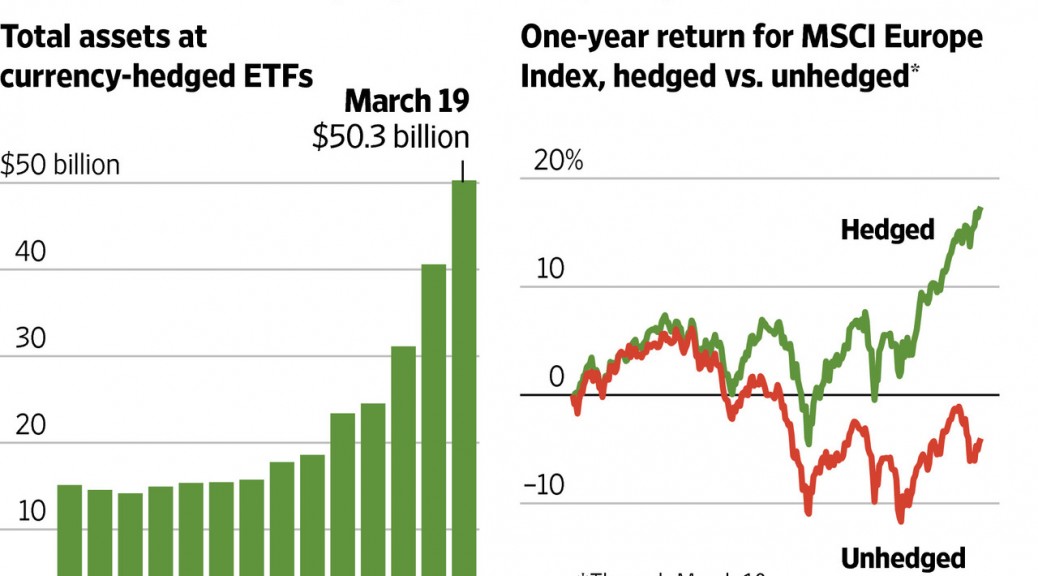

Currency-hedged ETFs have more than doubled their assets this year to $50.3 billion, largely thanks to strong inflows of $21.6 billion, according to data tracker ETF.com. Firms that offer the funds—including WisdomTree Investments and Deutsche Bank—use derivatives to offset the effects of currency swings, which they say could cause unintended volatility for investors and even hurt their returns in periods of dollar strength.

Yet investors could be giving up potential gains and diversification benefits, industry experts say. What’s more, the products are relatively new—the first one appeared in 2009—so it is uncertain how they would react in times of financial stress.

Yet investors could be giving up potential gains and diversification benefits, industry experts say. What’s more, the products are relatively new—the first one appeared in 2009—so it is uncertain how they would react in times of financial stress.

For years, currency risk was an afterthought for U.S. investors. Foreign-exchange markets were generally calm, and prolonged weakness in the greenback boosted returns on international investments as gains in other currencies like the euro or yen translated into more dollars.

But recently, diverging economic conditions and central-bank policies have jolted the markets and caused outsize currency moves, overshadowing the ups and downs in stocks and bonds.

The volatile and unpredictable nature of currencies suggests that “fundamental analysis can be easily thrown out of the window during periods of uncertain policies,” says Christopher Gannatti, associate director of research at WisdomTree. By removing the currency impact, investors can “put aside that source of risk and invest as though you’re living in Europe,” he says.

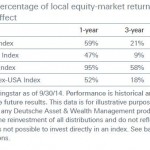

Investors have plowed $9.1 billion into the WisdomTree Europe Hedged Equity Fund this year, making the $16.2 billion ETF the biggest by assets in the category. The fund has returned 18.3% this year as of Wednesday, while the MSCI Europe Monetary Union index was up 3.6% in dollar terms

Other currency-hedged ETFs also have received significant inflows, including Deutsche Bank’s $6.4 billion X-trackers MSCI EAFE Hedged Equity ETF and BlackRock’s $1.9 billion iShares Currency Hedged MSCI EAFE ETF, which track the same MSCI developed-markets index. The funds charge annual fees of 0.35% and 0.39%, respectively.

Despite the trend, most international investments still are unhedged. Among all ETFs invested in European stocks, only $19.1 billion is in currency-hedged products, while $120.7 billion remains in unhedged funds, according to J.P. Morgan Securities.

Only a few mutual funds hedge their currency exposure, and even those that do hedge typically don’t carry “currency hedged” in their names, says Gregg Wolper, a senior fund analyst at investment-research firm Morningstar. Shareholders in unhedged mutual funds often seek currency exposure to diversify away from their dollar investments, he says.

To continue reading Carolyn Cui’s article in the WSJ, please click here