A brief, but intriguing blog post over at SeekingAlpha–written a a self-proclaimed gear-head backed by compelling research suggests that returns using straight-forward indexing has trumped fast-money hedge fund investing for each of the past five years.![]()

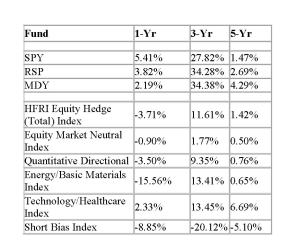

As illustrated by the table below (the full article can be accessed by clicking the image), blogger/private investor Jeff Gonion reached a pretty foregone conclusion when stating, “Overall, investors in equity-based hedge funds fared worse than investors that simply invested in index funds. Looking across the entire universe of hedge funds, the results are similar for non-equity focused hedge funds. The bottom-line is that most hedge funds don’t beat the market, especially after fees.”

We happily encourage any/all hedge fund managers to come forward (in full frontal or without fanfare i.e. anonymously, to rebut or to simply qualify the take-away. We could insert lots of caveats, but we’ll defer to an HF to defend itself.