Andrew Katz, aka Ross Katz aka Stark Katz, the CEO of ‘digital asset infrastructure firm “Seaquake.io” presents himself across the internet as a ‘serial entrepreneur’ within the crypto industry. According to civil court and criminal court records in California, Colorado, Florida, and New York, Andrew Katz is a fraud artist, scammer, stalker, and, according to those who know him well, “a sociopath who knows no boundaries.”

The travails of Andrew Katz first became public after records of a federal court action identified Katz, and his partners, Matthew J. Krueger of San Francisco and UK resident Dylan Knight as defendants in a matter in which Katz, Krueger, Knight, and multiple inter-connected shell companies controlled by the defendants, were alleged to have defrauded a family office out of several hundred thousand thousand dollars based on a laundry list of fraudulent misrepresentations pertaining to an investment in so-called digital asset infrastructure firm, Seaquake.io That suit (Florida’s Middle District Court) detailed an elaborate scheme perpetrated by Andrew Katz, Matthew Krueger, and Dylan Knight that included a lengthy and documented list of claims of fraudulent misrepresentation and theft.

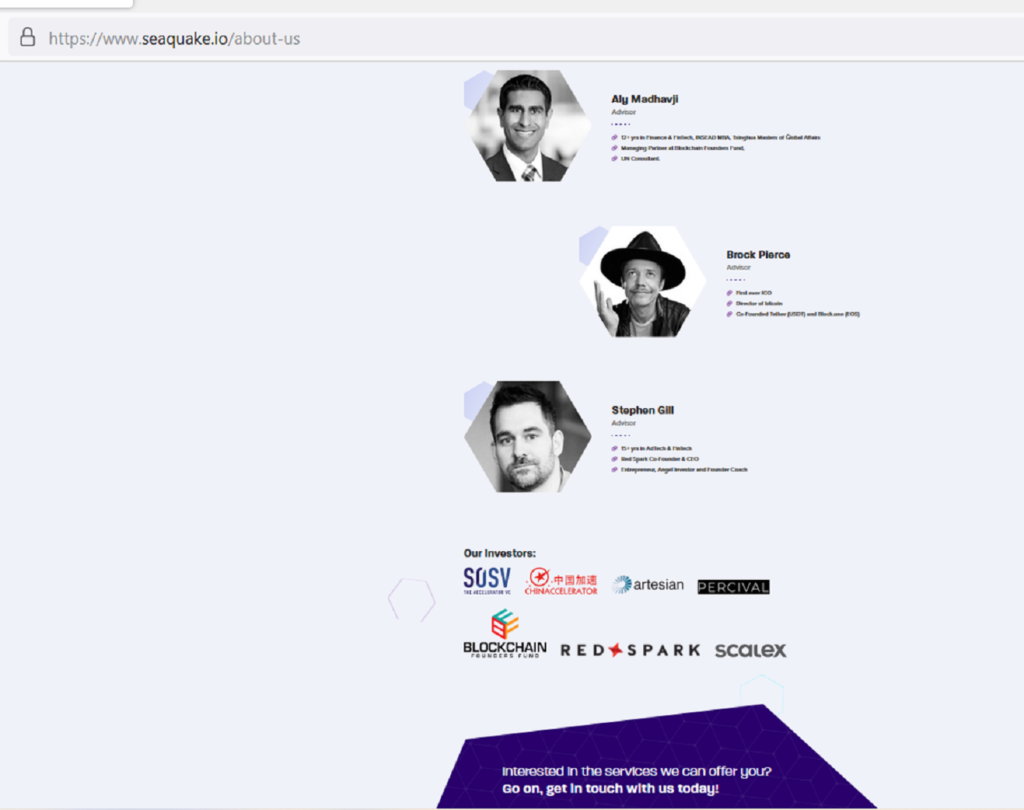

According to court documents, the defendants solicited the investors to purchase an equity stake in one of several ‘Seaquake’ entities. The defendants claimed they had created various software applications for use in crypto currency trading and crypto asset management, and that several industry firms had pledged to license the technology and, better still, Katz and his partners claimed the firm had received investment commitments from a short list of VC firms that specialized in crypto trading investments.

The facts, as documented in the court filing, found that (i), the firm had no commercially-viable software, (ii) references provided by Katz as to other investors proved to be completely false; no one had ever expressed an interest in deploying capital to Seaquake; (iii) the credentials and ‘bona fides’ provided by Katz with regard to his educational background and work history were completely fabricated.

The investors, after signing a “SAFE Note” (to document the equity stake was executed by Katz on behalf of Seaquake), discovered the above information just a few days after they sent their funds to one of the Seaquake entities. Within less than a week after making this discovery and demanding the funds be returned, Katz and Krueger engaged in an elaborate scheme to move the investor money to newly-created accounts at a different bank, then to a series of accounts at crypto firm Coinbase, then over to an off-shore account administered by crypto firm Binance.

Within weeks after the lawsuit became a matter of public record, multiple individuals (including those who had also invested in Seaquake) contacted the plaintiff’s attorney to share information as to how they were victimized by Katz & Co. In addition to investors who were duped, at least four individuals came forth with experiences in which Katz had stolen funds or victimized them in other ways, and in retaliation, Katz embarked on sordid campaigns to harass them via social media platforms and via bombardments of threatening txt messages sent from burner phones and “untraceable” email accounts. *

Editor’s note: forensic investigators have concluded that upwards of four dozen harassing and/or threatening messages received by at least three individuals who had lodged complaints against Katz came from devices belonging to Katz and sent from locations in New York and more recently, Florida.

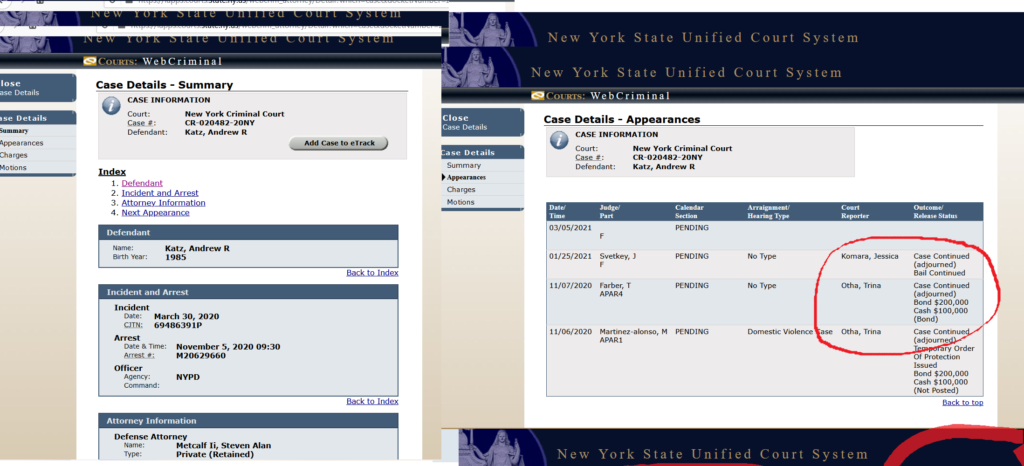

One of those victims was his estranged wife, who, according to criminal arrest records in California and New York, was assaulted by Katz on multiple occasions. In point of fact, Katz was convicted by New York’s Manhattan Criminal Court in February 2022 for assaulting his now ex-wife 18 months earlier.

Apparently, Katz failed to appear for sentencing and then fled the jurisdiction to Florida, where a few months later, he was arrested yet again, this time by Miami Police. Katz was charged with 11 felony counts, including assaulting a police officer. When reviewing court records relating to prior arrests, Katz has perfected the art of getting continuances and delays in court proceedings, and his next appearance for the 11 felony charges is Dec 1 in Miami Dade County Court

In the interim, Katz has been accused of defrauding a spectrum of crypto industry investors, including industry pioneer Brock Pierce. Yet Katz still remains at large. Even more bizarre, throughout a period that now extends more than 4 years, Katz has not been incarcerated and he has been self-publishing fake interviews of himself via a series of blog outlets that offer self-promotion and branding services. One nearly has to do a Google search to discover the assortment of phony interviews on websites whose operators use pseudonyms and non-verifiable identities.

Andrew Katz displays a number of quixotic items on his LinkedIn profile (he has since removed his bio and that of his partners from the Seaquake.io website), and in the assortment of self-published puff pieces on PR blogs. Here are some Quick Facts:

- Financial Industry Background. Securities Industry regulator FINRA has NO record of Katz ever being employed in the industry. He claims to have worked for EFG Bank as a trader, yet a senior HR executive for EFG Bank stated “we have no record of his employment.” UBS, the other financial industry firm that Katz claims to have worked for stated “we cannot confirm (or deny) having employed him.

2. “Academic Pedigree” “Harvard Masters in Finance”. Harvard University records indicate Katz did attend an online course for 1 year and earned a Master of Arts, (not Finance); comparable to degrees offered by the online University of Phoenix. As to other academic credentials, during his youth, Katz did briefly attend “World Wide Association of Specialty Programs”. This ‘school’ has billed itself as “in the business of serving desperate parents of troubled youths and specializes in improving the students’ aberrant social behavior..” Katz’s parents, Ken and Alyson Katz of Arvada, CO, who shipped their son off to this ‘special school’ joined a class action lawsuit against the institution. It is unclear if the parents were dissatisfied with the ‘treatment’ received by their son. Based on the many allegations of aberrant behavior since, perhaps they should have put him in a mental institution.

3. “Business Success“. The business he claims to be “generating profits since shortly after we were formed..”?

Katz disputes this himself in documents obtained from the civil lawsuit in Florida. Katz submitted an affidavit stating “investors were told the business is a start-up, does not generate revenue [no fewer profits] and is not expected to until first raising several million dollars in development capital.”

4. “Industry Entrepreneur.” Katz and Co also maintain personal and company Twitter accounts; each of which falls into the realm that Elon Musk has used to walk back his bid to acquire Twitter; the percentage of phony Twitter accounts is exponentially greater than what Twitter has stated in corporate filings. In this case, Katz’s personal Twitter account, @AndrewKCrypto (https://twitter.com/AndrewKCrypto) indicates his having 5346 followers. A simple interrogation discovered that all but ten of those followers are legitimate Twitter accounts. The rest are “bots” and all of those accounts are less than several months old, and none have more than 5-10 followers; a classic ‘tell’ for those familiar with Twitter Inc.s failure to remove phony accounts. The same seems to be true for the Seaquake company Twitter account (@_Seaquake_); the account boasts nearly 5000 “followers”, yet 98% of which Elon Musk would say are “Phony Followers! All Bots!”

Matthew J. Krueger, who until October 2022 had displayed himself on both LinkedIn and the Seaquake.io website as the Chief Financial Officer for Seaquake, has apparently made efforts to ‘erase’ his role, as his bio on Seaquake, as well as that of Katz and CTO Dylan Knight were removed.

Krueger’s updated bio on LinkedIn suggests that he is a finance consultant and ‘venture builder’ under the auspices of “Krugs Consulting“. His LinkedIn bio suggests that he has operated this entity since 2018, although prior to the LinkedIn update, he made no mention of this entity, which is not registered to do business in California, or any other jurisdiction.

In his bullet-pointed prior roles and responsibilities, Krueger advertises that he is an expert in financial models, cash settlement, and managing investor expectations and that he “built the financial model for a startup’s crypto mining operations for SOSV Chinaaccellerator.” He also says he was a former Head of Finance for Venmo.

Causing those who are familiar with the Seaquake Scoundrels to smirk, the Krugs Consulting website indicates having offices in San Francisco, Wyoming, and Estonia. No great surprise as to San Francisco, as this is where he lives. Wyoming? He’s created a number of shell companies on behalf of Seaquake that are registered in Wyoming, yet there is no Krugs Consulting registered with the State of Wyoming. Estonia? Perhaps that is a favored place to domicile a crypto account these days?

Again, he makes NO reference to his 4-year tenure as CFO of Seaquake (or “Seaquack”), yet the SOSV reference is a tell, as that China-based ‘venture firm’ went to get great lengths to prhttps://krugsconsulting.com/contact-us#462bb376-2e6b-43c9-821c-c7c48cae65dbomote the fact it had invested in Seaquake in 2020 (well after news of Seaquake scamming other investors became a matter of public record.)

Regarding Krueger’s Venmo role a seasoned background check expert will tell you that Venmo HR records indicate he was terminated for cause.

So, in view of Krueger’s role at Seaquake, those seeking an expert in money laundering via off-shore crypto accounts, or how to open a bank account using other people’s identities, or those hoping for a playbook on how to craft fraudulent financial statements who can help perpetuate investor fraud schemes would find Mr. Krueger to be just the kind of co-conspirator for your next initiative.