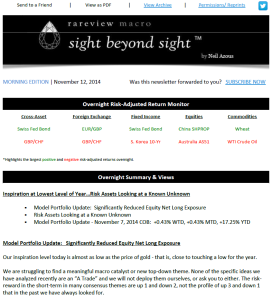

Below is excerpt from opening lines of today’s edition of “Sight Beyond Sight”, the macro-strategy commentary courtesy of Stamford, CT-based think tank Rareview Macro LLC. Our thanks to firm principal Neil Azous for the following observations.

Model Portfolio Update: Significantly Reduced Equity Net Long Exposure

Our inspiration level today is almost as low as the price of gold – that is, close to touching a low for the year.

We are struggling to find a meaningful macro catalyst or new top-down theme. None of the specific ideas we have analyzed recently are an “A Trade” and we will not deploy them ourselves, or ask you to either. The risk-reward in the short-term in many consensus themes are up 1 and down 2, not the profile of up 3 and down 1 that in the past we have always looked for.

In fact, we are finding that the psychology that has driven us all year is dissipating and for the first time we are more concerned about giving back performance in the model portfolio than generating further profits.

In the absence of a new opportunity, and following a period of healthy outperformance, a dilemma has arisen for us – markets/positions by nature mean revert. Now everyone has their own metric they watch for, and their own threshold for the mean reversion in their portfolio to start with. But let us just say that ours has been breached and it has served us well in the past to pay attention to that.

Now that may not be the case for many of you, and if we were in your position there is little question we would be pursuing the same ideas/themes in order to catch up with our benchmark. For today, we have little to offer you. However, like the Homebuilder seasonality and beta observation made yesterday (reminder BZH reported this morning and is in small cap basket we presented), we will continue to highlight ideas as and when they arise.

So in that spirit, we significantly reduced our net long equity exposure.

As a reminder, we caught ~10% the stock market downside in October via being short of the Euro Stoxx 50 and then captured 10% of the index move higher via being long on the S&P 500. It is not that we are bullish or bearish at these index levels and this is not a market call. We simply are respecting the rules of mean reversion in a portfolio and have no desire to play for another 1-2% upside following a 10% linear move if the risk is of a 2-4% downside move first.

Specifically, we sold out our S&P 500 and US financial call options and reduced our long delta exposure in Asia ex-Japan.

- Sold 5250 SPY 12/20/14 C205 at $2.22 to close (vs. $0.17 cost basis on 10/15/14).

- Sold 5000 XLF 12/20/14 C24 at $0.52 to close (vs. $0.24 cost basis on 10/29/14).

- Sold 307,900 AAXJ at $62.25 to close (vs. $64.96 cost basis on 7/23/14).

This reduced our net option premium exposure by 1/3rd down to ~2.2% from 3.3% of the model portfolio NAV.

Our upside salvation now lies within two market proxies:

- Long Apple Inc. (AAPL 12/20/14 105-115 1×2 call spread)

- Long iShares China Large-Cap ETF (FXI 1/17/15 C42)

If these two themes work going into the end of the year that should be more than enough to generate 2-4% of additional performance given the large amount of optionality we own in the model portfolio.

Despite selling out of our index/regional/sector positions, our faith was renewed by the fact AAPL quietly closed at a new high yesterday.

What remains is our long US Dollar and short Gold positions.

Our original long US Dollar purchase (DXU4) was on July 3rd for a price of 80.28.

When the December futures contract (DXZ4) that we are long traded yesterday at 88.15 we were humbled by capturing ~10% in the greatest theme of 2014 and this was another reason that gave us pause.

The two differences between the 10% move we caught in the Dollar versus the S&P 500 was that the former took over four months and the latter took less than one, and the Dollar for the majority of this period was 100% of the NAV and the SPY was largely a free option because we originally sold a put to pay for it after a 10% correction.

For some unknown psychological reason, these 10% round numbers have left us uninspired and asking what we to do now. Put another way, in the short-term how much water is left in the well to drink and how do we manage the existing positions?

This quote from technician Peter Brandt comes to mind:

“Open trades with a profit are the hardest trades to manage. A losing trade is easy to manage – just cut the loss. A profitable trade that is close to a price target is easy to manage – take profits or jam stops. But, trades that are profitable yet well shy of price targets are the most difficult trades to manage. I do not have the answers.”

To continue reading this edition, or any other prior edition of Sight Beyond Sight, a free trial subscription is available to ‘newbies’; no credit card is required. For access, click here.