Below excerpt courtesy of Hedge Fund Insight

Nov 17 2014 by Neil Azous Managing Member of Rareview Macro LLC

Most of us hand over dollar bills every day without ever really looking at them very closely. They are too familiar. But if you pause to look closely at the one dollar bill, you will see, right below the one-eyed pyramid, the Latin phrase “Novus Ordo Seclorum”.

The literal English translation of that is “a new order of the ages.” Taken from a book by the Roman poet Virgil, it first appeared on the Seal of the United States, and made its way onto the currency in 1835, where it has stayed ever since. Virgil was not a man to use words carelessly, so when he wrote it, he must have intended to emphasize “new” and, therefore, put it first in the sentence and in front of “ordo.”

A few readers might find that a slightly esoteric digression into Roman and monetary history, of little relevance to the markets today. In fact, they would be wrong. We started with that overlooked phrase because, over the second half of 2014, the professional investment community has come to believe that the US Dollar has indeed established a “new order” and the trend is now here for “the ages”.

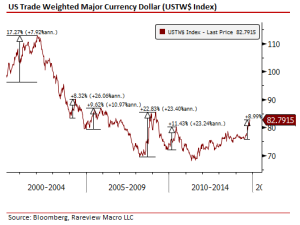

Just take a look at the figures. The US Trade Weighted Major Currency Dollar, an index of global currencies managed by the Federal Reserve, has appreciated by 9% since the start of the third quarter. For anyone who thinks that is the kind of volatility the markets see all the time, bear in mind that during the 21st century so far there have been only five comparable episodes where the US Dollar appreciated by a similar or larger magnitude: 2000, 2004, 2005, 2008, and 2010.

Many of those were, of course, false starts. The dollar rallied a bit, and then it faded away again. But this time around many serious investors, as well as professional forecasters, think the rally can be sustained. Why? There are two reasons.

The first is that the United States is now unique within the global economy in two important ways. It has already been through and survived the Global Financial Crisis, and it now has the only major central bank that has finished with Quantitative Easing……

The full article can be found at Hedge Fund Insight