Courtesy of Kaitlyn Kiernan, Wall Street Journal

Courtesy of Kaitlyn Kiernan, Wall Street Journal

The latest record run for U.S. stocks is sending up caution flags in two corners of the options market that rack investor sentiment.

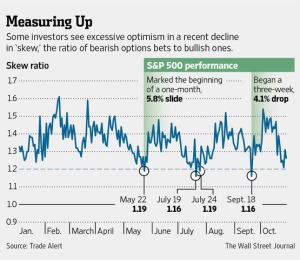

Hefty demand for options that would benefit from a further rise in stock prices recently sent a measure called “skew” to its fifth-lowest reading of 2013. A lower skew ratio shows relatively high prices for calls, options that convey the right to buy shares at a certain price. Some investors say the reading, which reflects the ratio of bearish option prices to bullish ones, points to excessive optimism in the market.

The move put the gauge on the brink of crossing a level that twice this year has preceded stock-market declines of at least 4%, options watchers said.

At the same time, the markets’ so-called fear gauge rose on Tuesday even as the S&P 500-stock index rallied to its third consecutive record close, rising 9.84 to 1771.95. The Chicago Board Options Exchange‘s Volatility Index typically falls when stocks rise, and vice versa. The divergence is unusual and shows that new highs aren’t being met with the typical investor calm, investors said.

At the same time, the markets’ so-called fear gauge rose on Tuesday even as the S&P 500-stock index rallied to its third consecutive record close, rising 9.84 to 1771.95. The Chicago Board Options Exchange‘s Volatility Index typically falls when stocks rise, and vice versa. The divergence is unusual and shows that new highs aren’t being met with the typical investor calm, investors said.

While the options readings alone are hardly enough to provoke worry among stock-market strategists, skeptical investors are picking up on numerous signs of what they term froth in the stock market. On Tuesday, the Dow Jones Industrial Average and the S&P 500 hit record highs on the same day for the first time since Sept. 18, with the Dow advancing 111.42 to 15680.35.

Stocks’ latest record push comes as American corporations are showing softening profit growth and as investors have flooded into technology initial public offerings at a pace last seen during the late 1990s Internet boom. Twitter Inc. this month set plans for an initial public offering that could value the company, which has been losing money, at $11 billion.

Large-company earnings growth has been tepid, pushing the S&P to its highest reading as a multiple of analysts’ expected annual profits in nearly four years. The S&P 500 is trading at 14.78 times its expected earnings for the next 12 months, according to FactSet. Third-quarter corporate profits are on track to rise just 2.7% from the previous year, according to FactSet.

“The market has gone up too quickly, and it’s more than due for a selloff,” said Mark Sebastian, director of trading and investments at Swan Wealth Advisors. The S&P 500 has jumped 7% over the past three weeks through Tuesday.

Added Matt Gohd, senior managing director and market strategist for agency-execution firm WallachBeth Capital, “Irrespective of using a longer-term lens, November could easily be a turkey month; a 5%-7% sell off would not be a surprise.”

“Nothing fundamental justifies this level,” said Uri Landesman, president of Platinum Partners, a hedge fund managing $1.25 billion. “The trend in the long-term continues to be upward, but there are some real short-term risks.

The skew on the SPDR S&P 500 exchange-traded fund, the most actively traded ETF, fell as low as 1.21 last week, according to options data firm Trade Alert. The reading on Tuesday was 1.27. In the past three years, the ratio has averaged 1.43, according to data tracker Trade Alert.

The skew ratio is typically above 1.2 because many investors use put options, which convey the right to sell securities at a certain price within a certain time frame, to hedge stock portfolios against potential declines.

For the entire article from the WSJ, please click here.