MarketMuse blog update profiles the jolt the food and beverage ETFs received on Wednesday when Kraft Foods and the H.J. Heinz Company announced a merge making the new company the world’s fifth-largest food company. This MarketMuse update is courtesy of Benzinga’s 25 March article “Heinz-Kraft News Lifts Food & Beverage ETF“, with an excerpt from the article below.

This week it was announced that Kraft Foods Group Inc KRFT 4.49% would combine with H.J. Heinz Co. in a move engineered by Brazil-based 3G Capital and Berkshire Hathaway Inc (NYSE: BRK-B).

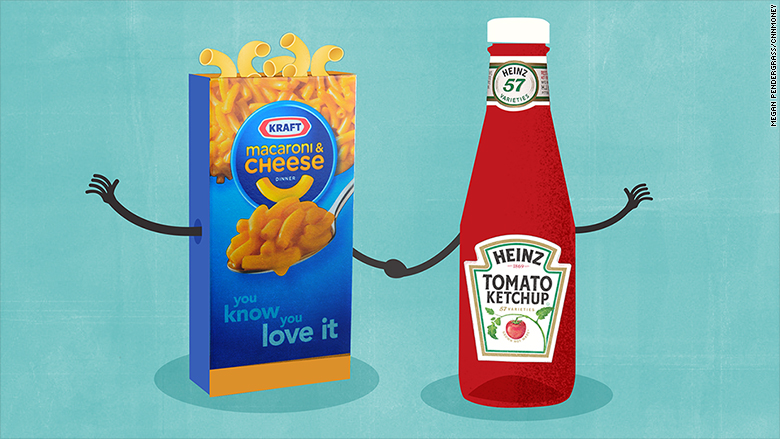

The combination of these two iconic brands will create a powerhouse consumer staples company with far reaching global exposure.

On Thursday, Kraft rose more than 35 percent on news of the deal, which will include a special cash dividend and 49 percent ownership share in the new combined company.

This jump also impacted a specialty ETF designed to capitalize on the strength of food, beverage, and restaurant stocks.

The PowerShares Dynamic Food & Beverage Portfolio PBJ 0.63% invests in a portfolio of 30 U.S. food and beverage companies based on strict selection criteria that includes price and earnings momentum, quality and value.

Kraft is the eighth largest holding in PBJ, with a 4.69 percent allocation, that sent the fund soaring to new 52-week highs on Thursday.

To read the entire article from Benzinga on the boost in food and beverage ETFs, click here.