While high-yield bond followers are seemingly caught between a rock and a hard place as interest rates may be poised to pick up, some expert investors are positing that high yield positioning is precisely the tactical approach to maintain.. The following MarketsMuse.com fixed income fix is courtesy of contributed article “5 Reasons to Hold High Yield” from Philadelphia-based RIA Clark Capital Management Group’s Chief Investment Officer, Sean Clark, CFA.

Editor Note: Before any MarketsMuse followers pooh-pooh the notion that spreads are bound to widen (and in turn, disrupting HY bond exposure), Clark Capital has been successfully navigating fixed income markets since 1986 and currently has $3billion AUM. The firm recently launched Navigator® Tactical Fixed Income Fund.

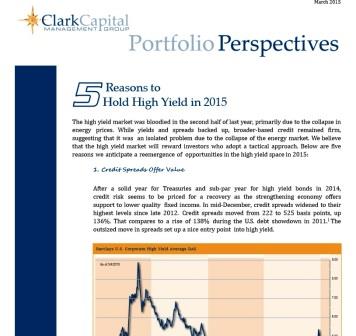

“The high yield market was bloodied in the second half of last year, primarily due to the collapse in energy prices.While yields and spreads backedup,broader-based credit remained firm, suggesting that it was an isolated problem due to the collapse of the energy market.We believe that the high yield market will reward investors who adopt a tactical approach.Below are five reasons we anticipate a reemergence of opportunities in the high yield space in 2015: Continue reading