MarketsMuse update profiles last week’s launch of the SPDR S&P Buyback ETF, an exchange-traded fund focused on tracking the stock price performance of companies that are in midst of corporate share repurchase (10b-18) programs. Excerpt courtesy of ETF Daily News.

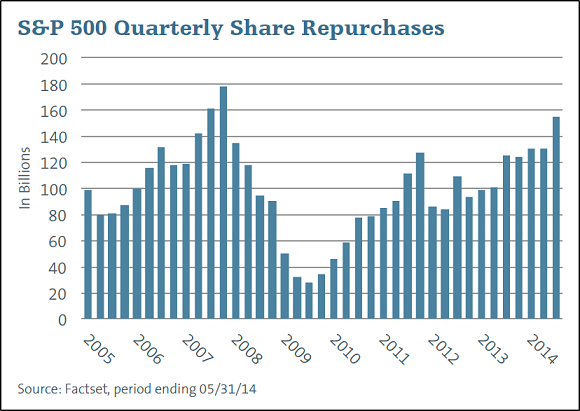

Buybacks and dividends have been among the primary contributors to the stock market Bull Run. In fact, share buybacks in the third quarter amounted to $143.4 billion – the fourth highest quarter for spending on buybacks by S&P 500 companies since 2005.

This massive surge in spending by U.S. companies on share buybacks has prompted issuers for launching new products targeting this space. State Street has recently launched a product that would tap companies having a high buyback ratio.

The product – SPDR S&P 500 Buyback ETF – was launched on February 4 and trades under the ticker SPYB. Below we have highlighted some of the details about the newly launched fund.

SPYB in Focus

The ETF looks to track the performance of the S&P 500 Buyback Index, which provides exposure to 101 companies in the S&P 500 with the highest buyback ratio in the last 12 months. The index follows an equal weighted strategy and is rebalanced quarterly. The equal weighted strategy ensures that the index’s assets are quite well diversified with none of the individual holdings having more than 1.2% exposure in the fund.

Tesoro Corporation, Kohl’s Corporation and MeadWestvaco Corporation are the top three holdings of the fund. Sector-wise, Consumer Discretionary takes the top spot with a little less than one-fourth of fund assets, followed by Technology and Industrials with 18.2% and 16.3% exposure each..

The index currently has a dividend yield of 1.47%, while the fund charges 35 basis points as fees.

How does it fit in a portfolio?

Though most investors prefer dividends to buybacks as they allow investors to get the cash immediately, a buyback has its own set of advantages. Buybacks reduce the outstanding share count and thus increase earnings per share. Further, they are more tax efficient than a special dividend.

Per Fact Sheet, U.S. share buyback increased 16% year over year and 6.6% quarter over quarter during the third quarter of 2014. Moreover, U.S. companies are currently sitting on a record amount of cash, which might encourage the companies to continue to be active on the share buyback front.

For the entire story from ETF Daily News, please click here