Fintech Fixed Income Trading & Fragmentation-What’s Next? A Venue for Private Placement Bonds & MTNs

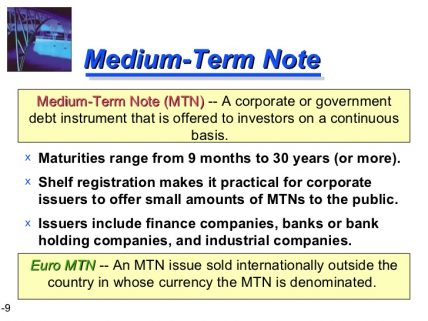

Despite the seeming oversupply of electronic bond trading initiatives, the convergence of fintech and fixed income trading continues to spawn new electronic trading start-ups, bringing the total industry count to 128 venues. The latest player, dubbed “Origin Markets”, aims at filling a void in the $1.5 trillion Medium-Term Note space aka private placement bond market. The “still-in-beta mode” initiative is based in the UK and backed by a consortium of global banks led by BNP Paribas, Bank of America Merrill Lynch, Societe Generale and Credit Suisse.

Origin’s founder and quarterback is Raja Palaniappan, a former Credit Suisse flow trader and MIT wonk who cut his teeth trading MTNs at various firms during the past 9 years and was most recently a VP responsible for making markets in investment grade and crossover corporate bonds and CDS at Credit Suisse.

A spokesperson for UK-based Origin said its platform “simplifies issuance in the medium-term note private placement market by acting as a central information source.” The business model allows dealers to receive targeted funding levels from issuers on a single platform and allows users to foster new relationships through cloud-based technology and bank-grade security.

“[Issuers] can optimise their funding using the built-in cross-currency pricer, comparing their funding levels to their own and their peers’ levels in the secondary markets,” Origin said.

Joakim Holmstrom, head of funding at Municipality Finance, explained the platform makes the medium term note process more efficient and provides access to a broader pool of dealers. Ben Powell, head of funding for IFC, added that Origin’s platform “simplifies what was once a manual process prone to inefficiency. It allows us to manage our dealer communication in one central place.”

The platform’s full launch is expected later this year and brings the total number of electronic fixed income platforms to 128, according to a recent compilation of platforms by front office trading consultant John Greenan.

Bob Mahdavi, the CTO for private placement bond documentation firm Prospectus.com stated “The MTN market is indisputably one of the largest sectors in terms of number of issues, yet it is populated by thousands of private issues that don’t typically lend themselves to being traded in an electronic venue.” Added Mahdavi, whose firm works with tens of dozens of Issuers, as well as attorneys and boutique investment banks throughout Europe and Asia in preparing debt offering documents, “You can build it, but will they come?”

According to fintech merchant bankers at SenaHill Partners “When considering the still nascent stage impact of electronic venues focused public company investment grade corporate bonds, including the likes of startup Electronifie among others, a platform that can prove truly effective and liquid for MTNs can prove to be a big challenge, albeit the backing of big banks does provide some wind in the sail.”

If you’ve got fintech fever, or just a hot tip, a bright story idea profiling global macro, fintech, ETFs, options, or fixed income markets, or if you’d like to get visibility for your firm through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, etc., please reach out to MarketsMuse Corporate Communication Conciege via this link

As noted in a 11 Jan story in TheTradeNews and citing the work of Greenan, between November 2016 and January this year alone, 14 new fixed income trading platforms joined the market.

“…The asset class is overcrowded with trading venues as regulation forces the structure of fixed income across instruments away from a centralised model – mostly due to bank balance sheet constraints – towards a decentralised model….Market participants have said the explosion of venues is causing fragmentation and a ‘liquidity drought’ in global bond markets.”

Large buy-side firms and asset managers have the opportunity to act as price makers rather than price takers, according to a quarterly report published by the International Capital Market Association (ICMA) this week.

The report said the bond market has seen a decrease in ratio turnover, despite an increase in market size and overall turnover against a backdrop of bond issuance, as issuers take advantage of low interest rates globally.

Joanna Cound, head of public policy EMEA at Blackrock and a member of the ICMA board, explained this has led to liquidity in fixed income markets suffering, something regulators have taken a greater interest in over the last year.

Fixed income participants are wary the bond market has not improved significantly since the financial crisis, as future stress events could have far-reaching consequences.

To continue reading TheTradeNews story click here

Venture capitalists and angel investors can provide

Venture capitalists and angel investors can provide