One needs to have ‘been there and seen that’ for at least twenty years in order to have been “loaded for bear” in advance of this morning’s equities market rout. At least one of the folks who MarketsMuse has profiled during the past many months meets that profile; and those who have a true global macro perspective such as Rareview Macro’s Neil Azous have pointed to the credit spread widening during the past number of months as a prime harbinger of things to come. And so they have…

Last night, Neil Azous published one of his finer commentaries in advance of this morning’s global equities market rout and incorporated a great phrase:

“Man looks in the abyss, there’s nothing staring back at him. At that moment, man finds his character. And that is what keeps him out of the abyss.” – Lou Mannheim, Wall Street, 1987

The highlights of last night’s edition of “Sight Beyond Sight” are below…

- Big Picture View

- S&P 500 View

- Asset allocation Requires Swimming Against the Tide – Low-to-Negative Downside Capture

- Long German versus Short US Equities (Currency Hedge)

- US Fixed Income – Short 2016 Eurodollars

- Long European & Japanese Equities (FX hedged), US Biotech and US 10-Yr Treasuries

- Long US Energy Sector

- Volatility – Sell Apple Inc.; Not the S&P 500 or VIX

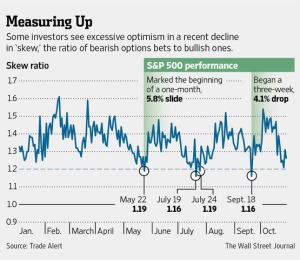

- Harvesting S&P 500 Index Option Skew

- Long Agricultural Call Options

- Long US Housing (Hedged)

- Technical Mean Reversion – Short EUR/BRL

- Long Euro Stoxx 50 Index Dividend Futures (symbol: DEDA Index)

To read the full edition of the Sight Beyond Sight special Sunday (Aug 23 2015) commentary, please click here*

*Subscription is required; a free, 10-day trial is available

Neil Azous is the founder and managing member of Rareview Macro, an advisory firm to some of the world’s most influential investors and the publisher of the daily newsletter Sight Beyond Sight.