MarketsMuse ETF and Global Macro update takes a look at India for those following the two leading ETFs in the space, the $2.3 billion WisdomTree India Earnings Fund (EPI. C-73) and the $1.9 billion iShares MSCI India ETF (INDA. C-92), and introduces a global macro perspective that adds a different dimension via a brief excerpt from today’s a.m. edition of Sight Beyond Sight and courtesy of Rareview Macro LLC a.m. notes

India: The Darling of EM Faltering

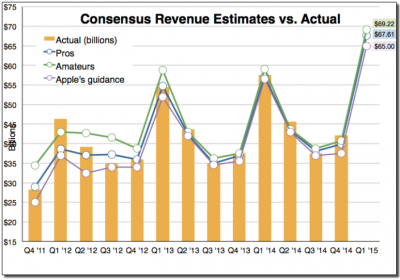

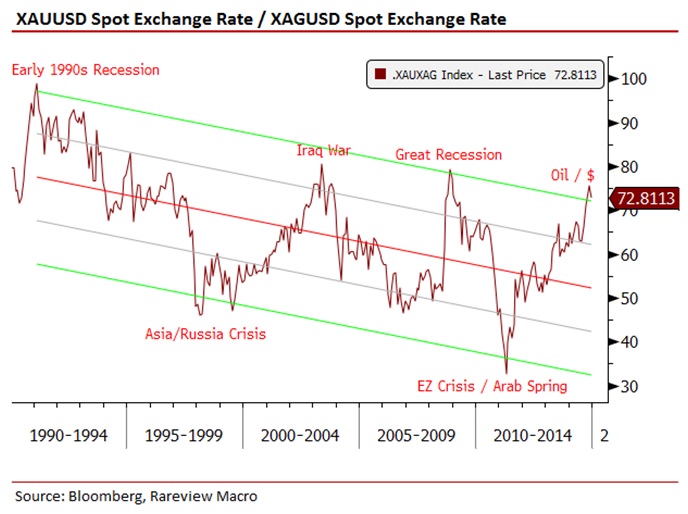

In a very rare occurrence in India, where investors are two-times overweight the equity market benchmark, 49 of the 50 names in the National Stock Exchange CNX Nifty Index (NIFTY Index -2.81%) closed negative. Not only has the ratio of India to Brazil (NIFTY/IBOV) now retraced almost 50% since its mid-2012 ascent higher, but it remains one of the best representations globally of the unwind of the commodity importer vs. exporter strategy that dominated the deflation headlines from July 2014 to February 2015.

Here is an updated version of our favorite representation. This is the Indian SENSEX versus Brazilian Bovespa overlaid with the inverse of WTI crude oil. As you can see, without Brazil even being opened today yet, the Indian leg has taken that ratio down below the 200-day moving average.

For the avoidance of doubt, which is very high in the professional community when it comes to India, after last night’s price action the equity markets are now formally in a technical correction (i.e. -10%) as the NIFTY is -11.36% off its March high. Additionally, the major benchmarks are now negative on the year in both US dollar and local currency (INR) terms. Optically, next to Turkey, India is the only other major emerging market that is negative year-to-date.

Sight Beyond Sight® is a global macro trading newsletter written daily by Neil Azous. With close to two decades of institutional experience across asset classes, Neil interprets the day-to-day economic, policy and strategy developments and provides actionable trading ideas for investors.