Long Live the Libertad Act! Taking aim at the Cuban Government, US President Donald Trump and his Board of Directors, led by Secretary of Treasury Steve Mnuchin and Secretary of State Mike Pompeo. announced that US shareholders of companies that were seized and nationalized by Fidel Castro when the now-deceased Cuban ruler first took control of Cuba in 1959 can now sue the Cuban government for losses they sustained. Of the several dozen US companies nationalized by Castro in 1959, shareholders of Vicana Sugar Co., also known as Compania Azucarera Vicana, lost the entirety of their investments and can now seek recourse.

Secretary of State Mike Pompeo announced that the US will enforce a controversial provision of the decades-old trade embargo on Cuba that will allow US citizens to file lawsuits in US federal court against businesses that operate on property seized by the Cuban government during the revolution — the first administration to do so since the law’s creation in 1996. Pompeo said Title III of the Helms-Burton Act, also known as the Libertad Act, would be implemented in full effective May 2.

According to at least two White House sources speaking off the record, Treasury Secretary Mnuchin was influential in guiding President Trump to implement this new tactic after Mnuchin’s wife had purportedly acquired a large cache of stock certificates from an estate that owned the shares and were issued by Vicana Sugar Company months before Fidel Castro nationalized that company in November 1959. The extent of Mnuchin’s holdings is not known, but include many 1000 share certificates with an original ‘par value’ of $3.00 per share.

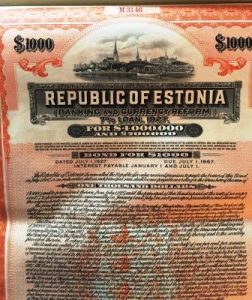

A small number of Vicana Sugar Co share certificates, in both 100 share and 1000 share denominations are listed on eBay and offered at upwards of $700 for each certificate. As evidenced by stamp on share certificate in amount of 1000 shares and par value $3.00 each share (see photo).

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com