Courtesy of Kaitlyn Kiernan, Wall Street Journal

Courtesy of Kaitlyn Kiernan, Wall Street Journal

The latest record run for U.S. stocks is sending up caution flags in two corners of the options market that rack investor sentiment.

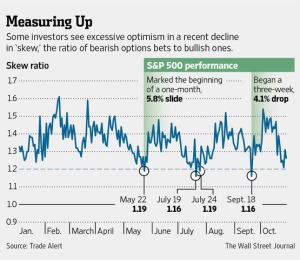

Hefty demand for options that would benefit from a further rise in stock prices recently sent a measure called “skew” to its fifth-lowest reading of 2013. A lower skew ratio shows relatively high prices for calls, options that convey the right to buy shares at a certain price. Some investors say the reading, which reflects the ratio of bearish option prices to bullish ones, points to excessive optimism in the market.

The move put the gauge on the brink of crossing a level that twice this year has preceded stock-market declines of at least 4%, options watchers said.

At the same time, the markets’ so-called fear gauge rose on Tuesday even as the S&P 500-stock index rallied to its third consecutive record close, rising 9.84 to 1771.95. The Chicago Board Options Exchange‘s Volatility Index typically falls when stocks rise, and vice versa. The divergence is unusual and shows that new highs aren’t being met with the typical investor calm, investors said.

At the same time, the markets’ so-called fear gauge rose on Tuesday even as the S&P 500-stock index rallied to its third consecutive record close, rising 9.84 to 1771.95. The Chicago Board Options Exchange‘s Volatility Index typically falls when stocks rise, and vice versa. The divergence is unusual and shows that new highs aren’t being met with the typical investor calm, investors said.

While the options readings alone are hardly enough to provoke worry among stock-market strategists, skeptical investors are picking up on numerous signs of what they term froth in the stock market. On Tuesday, the Dow Jones Industrial Average and the S&P 500 hit record highs on the same day for the first time since Sept. 18, with the Dow advancing 111.42 to 15680.35. Continue reading