Below fast market update courtesy of Rareview Macro LLC a.m. edition of global macro strategy commentary “Sight Beyond Sight”; MarketsMuse is re-publishing this extract no more than 10 minutes of current subscribers receipt..Our thanks to the folks at Rareview!

• New Position: Long Canadian Dollar versus Short Swiss Franc (CAD/CHF)

• Existing Position: iShares China Large-Cap ETF (FXI) Now Above Strike Price

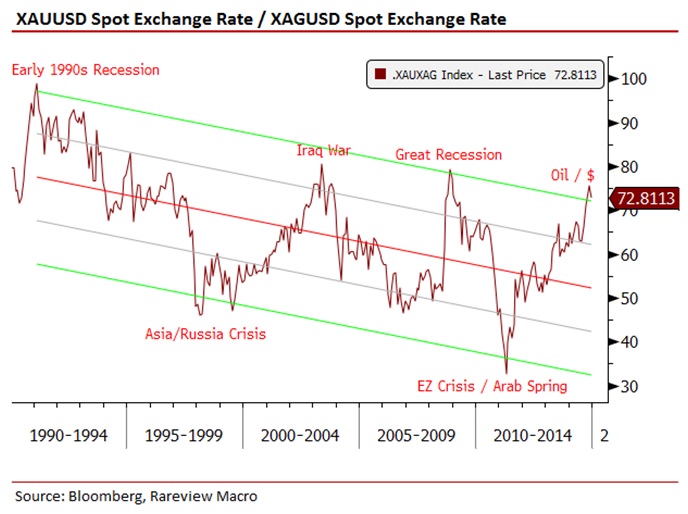

Something very illuminating appeared on our risk-adjusted return monitor today.

After reading the tea leaves, the conclusion we have drawn from it points to a trend that will have meaningful global repercussions – and will also provide the basis for an investment and hedging opportunity.

Additionally, while everyone else is focused on the weakness in the Euro exchange rate (i.e. the ECB EUR/USD fix on January 4, 1999 was 1.1789 vs. last price 1.1782 ECB Statistical Data Warehouse), or else trying to figure out whether the S&P 500 is half-way through a V-shaped recovery and the bounce is actually tradable, this is genuinely a “Rareview” – one that has not been widely observed in the market yet.

See the below illustration. In yesterday’s edition of Sight Beyond Sight, we highlighted that the release of the latest data on Switzerland’s Foreign Currency Reserves showed thelargest rise since mid-2012 when ECB President Mario Draghi famously said “we will do whatever it takes” to save the euro. Specifically, FX reserves were 495.1 bln vs. 472.0 bln estimated vs. 462.7 bln previously. Put another way, they ended up rising by 32.4 bln versus the expected 9.3 bln. A forecast missing by 23.1 bln is, to put it mildly, a significant event and one that highlights the degree of flight to quality away from Russia in mid-December.