Broker Rebates From Exchanges and HFT Firms May Be Securities Fraud, Says Federal Judge

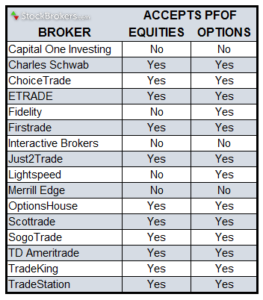

Broker Rebates, Payment-for-Order-Flow (“PFOF”) and “Pay-to-Play” have become synonymous with new world order in which exchanges, dark-pool operators and high-frequency trading (“HFT”) firms, (the so-called “flashboys”) dominate the world of stock trading. While many Wall Street geniuses will argue “the genie is out of the bottle”, it doesn’t mean this practice is right-minded, no less legal-and it hasn’t stopped naysayers from arguing that customers’ best interests are clearly not part of the equation. A Federal judge in Nebraska seems to agree, based on his ruling last week that allows a class action lawsuit aimed at TD Ameritrade in connection with their receiving payment-for-order-flow rebates from high-frequency trading (“HFT”) (and not even sharing those rebates with customers!) to proceed. The plaintiff argument is that TD has violated best execution guidelines. Should anyone be shocked?! After all, the topic of payment-for-order-flow and barely-disclosed rebates paid to brokerages by exchanges and electronic market-making firms in consideration for routing orders to them has been a topic of spirited debate for more than several years.

Here’s the excerpt from WSJ reporting by Cezary Podkul:

Here’s the excerpt from WSJ reporting by Cezary Podkul:

Mom-and-pop investors who think their brokers are prioritizing high-frequency traders over them may soon have a chance to try to prove their case in court.

A federal judge in Nebraska this month ruled a class-action lawsuit could proceed against TD Ameritrade Holding Corp. AMTD -1.09% , one of the nation’s largest discount brokerages. In his ruling, the judge cited “serious and credible allegations of securities fraud” stemming from the company’s order routing practices.

Plaintiffs allege the discount brokerage prioritized its profits over their best interest on stock transactions

The TD Ameritrade customers who brought the suit alleged the company, which provides investing and trading services for 11 million client accounts, prioritized its profits over their best interests. They claim it did so by accepting incentives from stock exchanges and large electronic trading firms to route customer orders to them without ensuring the customers would get the best prices available – an obligation that along with related factors is known as “best execution.”

A spokeswoman for TD Ameritrade said the company disagrees with the judge and will appeal his ruling.

Judge Joseph Bataillon’s ruling, delivered Sept. 14 in federal court in Omaha, Neb., marks the first time a court has allowed customers to pursue a class-action lawsuit on the grounds a retail brokerage breached its duty to provide best execution, according to the ruling and the plaintiffs’ attorneys.

The decision comes at a time of growing focus on how brokerages handle customer orders. In its Oct. 2017 blueprint for streamlining financial regulations, the U.S. Treasury Department said it is concerned payments to brokerages “may create misaligned incentives” for brokers and their customers. It urged the Securities and Exchange Commission to boost regulation of such payments and require more disclosure.

In March, the SEC proposed a study that would impose temporary restrictions on stock exchanges’ fee and rebate payments and measure the impact on order routing behavior and trade execution quality. On Wednesday, an SEC commissioner called on the agency to move ahead with the study and faulted it for not doing more to ensure transparency and fairness in the stock market.

Keep reading, the story is only going to get better, but not necessarily for brokers. Then again, the current SEC leadership is likely to put their own dog in the game, given their views toward re-defining the concept of fiduciary within the context of broker-dealer guidelines.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com.

Here’s the link to the WSJ coverage