MarketsMuse fixed income fix is courtesy of extract from Mischler Financial Group Mar 17 desk notes aka “Quigley’s Corner” and authored by Ron Quigley, Managing Director and Head of Fixed Income Syndicate for this boutique brokerdealer owned and operated by Service-Disabled Veterans and recipient of Wall Street Letter’s 2015 Award for Best Research/Broker Dealer.

Mischler Financial

IG Primary Market Talking Points – M&A Leads The Way re Debt Market Issuance; Deep Dive Into Credit Spreads– An Interesting Read Folks

- M&A represented 7 out of 10 tranches today, and 80.60% of today’s IG new issue volume with the well telegraphed “biggie” being the Merck KGaA deal. The German pharma giant issued a $4 billion five-part thru its EMD Finance LLC. Moody’s “Baa1” rating followed the agency’s one-notch December downgrade of Merck KGaA. Leverage from Merck’s acquisition will increase to 4.5x from 1.8x. Hence, order books closed at a very modest $6.1 billion or 1.52-times oversubscribed. Market participants anticipated much stronger demand for this top pharma-linked name. It was the credit story that saw demand slip and a complete absence of spread compression throughout price discovery.

- APT Pipelines issued a two-part $1.4 billion 10s/20s transaction today, proceeds of which will be used to partly fund the Queensland Curtis LNG Pipeline acquisition. The deal was re-launched and increased to $1.1 billion from $1 billion, but also illustrated another M&A deal that offered no compression at all from IPTs to the launch.

- Campbell’s Soup also issued today following a 32-month absence from the DCM. Today’s deal carried lower Moody’s ratings than their prior transaction due to softer sales in the Company’s soups and beverages units. The agency said ratings could be further pressured in the near future in part due to a more challenging operating environment coupled with potential acquisitions and share repurchases. The final books on Campbell were $375mm or 1.25x bid-to-cover……..for an issuer that hadn’t tapped the DCM in over two and a half years! Again, a credit story as opposed to overall market mechanics.

- The reason for the aforementioned deal color is because investors chimed in today that some deals seemed to be struggling or not quite meeting with the demand that many market participants anticipated. There are indeed definite signs of indigestion given the back-to-back record $50bn weeks of new product we just came out of.

- Furthermore, taking a look at last Friday’s secondary trading performance of last week’s IG and SSA new issuance, of the 79 deals that priced, only 39 (49%) tightened versus new issue pricing while 26 or 33% widened and 14 (18%) were flat.

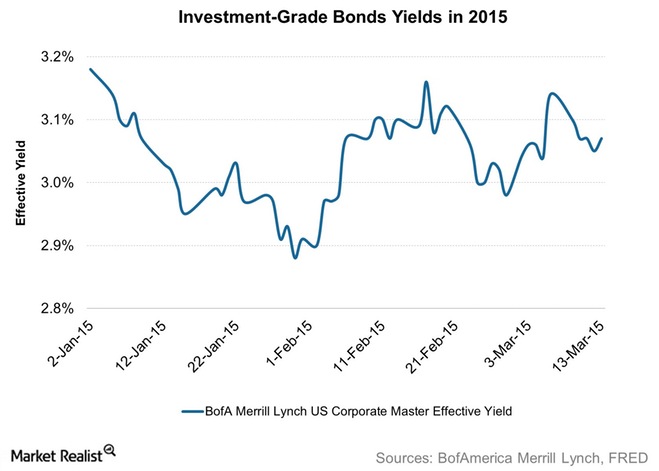

- A word about spreads – S&P Global Fixed Income Research was unchanged. A ha! What gives here readers? Great question and here’s the answer: Despite the widening across all four major IG asset classes and 16 of the 19 major industries, S&P’s method for computing spreads is a composite method as opposed to an index so, each series actually runs independently as opposed to the smaller parts being “components” of the “aggregate.” Therefore with respect to movements in the “AAA”, “AA”, “A” and “BBB” or industry spreads that tend to move in tandem with an investment-grade spread, it doesn’t necessarily have to be the case – it’s all a matter of how the math works out that particular day. So, while many saw IG Corporate spreads push out 1bp, a widely used S&P Index was flat creating the false expectation of a relatively neutral market.

- The average spread compression across today’s 10 IG Corporate-only new issues was 3.90 bps from IPTs to the launch. That’s a 10.23 bps swing from last week’s average 14.13 bps compression across 72 IG Corporate issuers and that’s thanks to the two large M&A related transactions that priced in today’s session.

What’s the net conclusion of all this techno fodder? Is it a question of market indigestion, or is it more the individual credit stories today? I believe despite, some indigestion, it IS the latter.

So, it’s business as usual. This week will be very busy as anticipated and today’s several isolated “story” new issues combined with some technical explanations of spread action should serve to extinguish any concern! This is after all a financial “No Spin Zone!” I know….I know….. It’s much more fun when I write about Vlad-the-Terrible, but I gotta cover my bases readers!

For the entire commentary courtesy of Mischler Financial Group, please click here