Failures of SVB, Signature Bank, and (pending failure) First Republic Bank Demonstate US Federal Reserve Bank Regional Divisions Stymied by Conflict, Cronyism, Blind Eye Syndrome

March Madness 2023: The failures of Silicon Valley Bank aka “SVB” (NASDAQ:SIVB), Signature Bank (NASDAQ:SBNY), and on-the-precipice of failing, First Republic Bank (NYSE:FRC) illustrate common denominators, aside from each having upside down balance sheets for months, if not years, each lending to highly-leveraged businesses, and each run by Muppets who should never have been allowed to oversee a Girl Scout cookie sale, no less a banking institution with billions of dollars in deposits and risky loans.

The collapse of SVB and Signature Bank and the looming collapse of First Republic Bank–all inside one week, has inspired independent experts to conclude that Venezuela has a more compliant and better-regulated banking system than the United States of America!

Each of the US Federal Reserve Bank divisions responsible for auditing and ensuring regulatory compliance for the banks in their respective regions is pockmarked with Board Directors who run the same banks that the FRBs are supposed to regulate. Despite what many people have thought, this means that the banking industry is self-regulated, not regulated by real regulators, and is not regulated by independent, objective professionals. Are we shocked? Where is John Oliver?!

- As valiantly reported by the New York Times (and WSJ), the Federal Reserve Bank of San Francisco counted Greg Becker, the now former CEO of Silicon Valley Bank (NASDAQ:SVIB) as a board member since 2019. While Becker sat on the Board, whose President & CEO is one Mary C. Daly, whose bio on the Fed’s website states “Mary champions initiatives to make the San Francisco Fed’s policies and decision-making more transparent.

- SVB bank was subject to MULTIPLE warnings over each of the years that Becker ran SVB. The lack of oversight and lack of control discovered by low-level Federal Reserve Bank examiners was documented multiple times, who reported those findings up the chain of command, and those reports were mysteriously buried. Translation: those warnings were never made public, stakeholders never had a clue there was a problem, ‘trusted’ Greg Becker when he said things were great and ‘trust me’, and Ms. Daly either turned a blind eye (actually two blind eyes), or her view of transparency is skewed towards opacity. Or she is batshit stupid.

- President Biden on Friday said that bank executives who played hide the banana or otherwise failed to control risks in accordance with ‘regulations’ should be punished. What about Ms. Daly? Oh, she and the other FRB presidents are appointed by their respective board of directors—and those boards are populated by executives of the respective banks within those FRB districts. Again-this means that banks are ‘self-regulated’; NOT REGULATED BY A GOVERNMENT ENTITY!

Is it any wonder then, that 3 multi-billion dollar banks in as many days in the same week have suffered a run, and depositors in tens of dozens of banks throughout the country suffering massive outflows before the next bank goes under?

When will George Bailey to come to the rescue? Sadly, George is busy. He and his angel, Clarence Odbody, are having lunch with Warren Buffet—who offered Joe Biden that he would salve the FRC crisis, as he has many other banking catastrophes, but apparently President Biden didn’t like Warren’s term sheet: 12.5% interest on capital infused into FRC and backstopped by the U.S. Treasury. So Warren Buffet said, “If you don’t like my terms, go to Jamie Dimon!”. And that’s what Joe did. And late Friday, Jamie Dimon said, “OK, I’ll bring a few of the boys together and we will be patriotic and save FRC with less egregious terms than Warren.”

FRC stock rallied on the news on late Friday, then cratered on Monday morning when Jamie & Co walked back on the supposed bailout. FRC trading was halted multiple times on Monday, and closed down 47% to $12.15. Shocking that Jamie & Co “re-evaluated” FRC’s value and walked back on his “handshake deal” from Friday?! Don’t Be. Welcome to Wall Street.

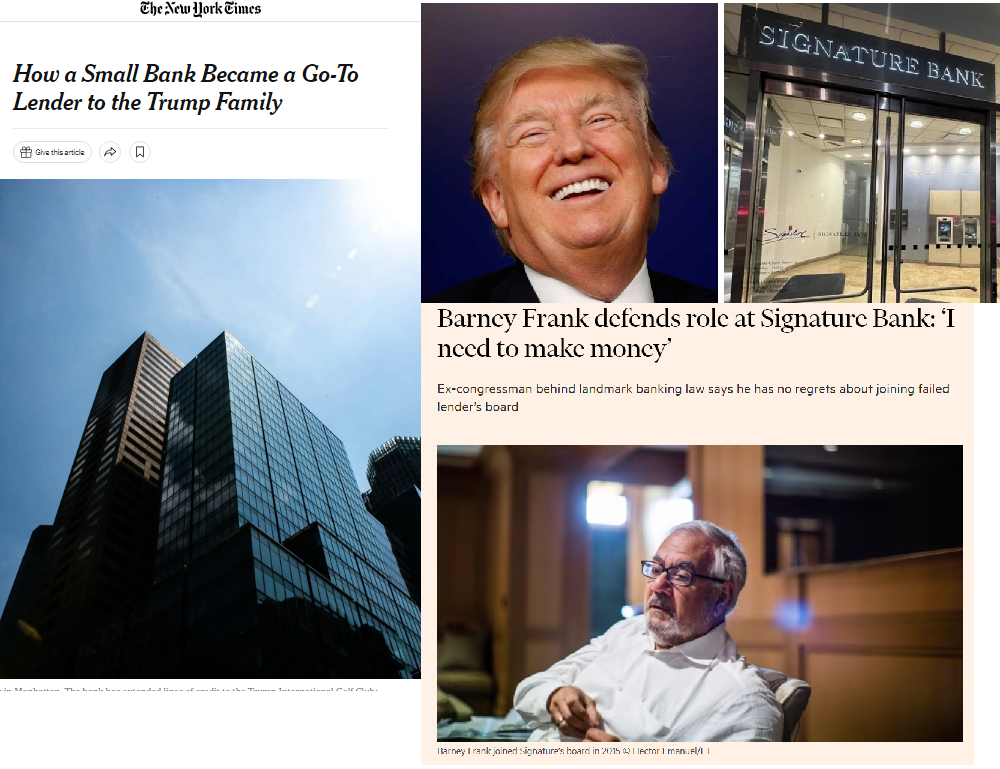

Let’s move on to Signature Bank ($SBNY); the one that former US Congressman Barney Frank sits on their Board of Directors. Remember Barney? He’s the one that credited himself with introducing the Dodd-Frank Bill-which introduced tight regulations on banks after the GFC of 2008. So, Barney’s on the Board—which has been notorious for lax lending standards, which is alleged to have been one of the largest laundering machines for crypto industry crooks—and of course, has long been Donald Trump’s second favorite bank to borrow from after Deutsche Bank; whose reputation for enabling crooks and scoundrels goes back to the days of Adolph Hitler

Now First Republic Bank. 111% Liability to Deposit Ratio. This means if all the depositors want to withdraw their money (if they can) at the same time, this wonderful financial institution would become insolvent. This ratio is not new. The good news is that unlike the bizarre, high-risk loans extended by SVB and Signature, First Republic has a relatively reasonable mix of loans in various sectors. All told, the fair value of First Republic’s financial assets was $26.9 billion less than their balance-sheet value. The financial assets included “other loans” with a fair value of $26.4 billion, or $2.9 billion below their $29.3 billion carrying amount. So-called held-to-maturity securities, consisting mostly of municipal bonds, had a fair value of $23.6 billion, or $4.8 billion less than their $28.3 billion carrying amount.

Thank you, Bank Regulators, Thank You Elected Officials Who Don’t Know How to Balance Their Own Check Books, Thank You to the Greedy, Blind-Eyed, and Conflicted Muppets Who Decided to Hide Their Dirty Laundry Under the Bed. Then they shit the bed; causing stakeholders to wind up with nothing but shit, again.