(Traders Magazine)-CME Group, the US derivatives exchange, has launched an online tool to allow investors to compare the costs of futures against exchange-traded funds, as some ETF issuers have claimed the funds are now cheaper to use.

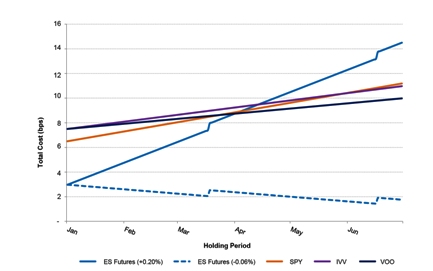

Last month the CME launched the Total Cost Analysis tool to allow investors to compare the all-in costs of replicating the S&P 500 by trading equity index futures versus ETFs, and intends to expand the tool to other indexes.

Tim McCourt, global head of equity products at CME Group, told Markets Media: “The online tool gives customers the flexibility to compare costs for specific variables such as commissions, trade size and time period.”

The tool focuses on three different components of the total cost of trading – transaction costs, implementation costs and holding costs. McCourt claimed that for an active trader on a short time horizon, futures are overwhelmingly cheaper on a total cost of trading basis, which includes both fees and market impact but in certain circumstances, over different time periods, this could change.

Source, the European ETF issuer, had issued a paper in April, “ETFs vs Futures”, which said futures have become more expensive due to bank regulation while ETFs have become cheaper due to increased competition. The paper said that futures costs have been cheaper recently, this is expected to change. “We expect that, as volatility reduces, the usual imbalance between buyers and sellers in the futures markets will resume and futures costs will return to the levels we saw between 2013 and 2015,” said the report.

In addition Source said futures are particularly expensive relative to ETFs at the December roll as banks have less risk appetite at the financial year-end. “For investors planning to hold an exposure over the December-March period, it may make sense to buy ETFs instead of futures,” added Source.

To continue reading, please click here