JERSEY CITY, N.J., Jan. 17, 2018 /PRNewswire/ — ETF broker WallachBeth Capital, a leading institutional brokerage firm, has announced the Phase I roll out of its internal proprietary Quote Capture platform. The platform further enhances WallachBeth’s commitment to providing institutional clients the highest degree of transparency throughout the ETF execution process.

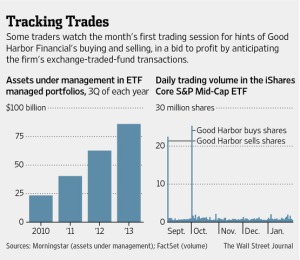

WallachBeth has always leveraged the advantages of a competitive quote model to source liquidity for outsized ETF block trades, providing price improvement and increased liquidity in often hard-to-trade and/or illiquid products. In light of clients’ interest in the transparency provided by RFQ (“Request for Quote”) platforms, WallachBeth’s Quote Capture tool allows clients to quantify and validate their price discovery process and satisfy compliance obligations.

The foundation of WallachBeth’s ETF execution business is providing institutional clients high touch access to a full suite of execution strategies, coupled with agnostic advice throughout the trade lifecycle. WallachBeth continues to be increasingly relevant to the broadening number of institutions using ETF products and strategies to achieve their investment mandates. Andrew Mcormond, Managing Director, ETF Trading Solutions, at WallachBeth Capital states, “We always emphasize that best price often goes beyond a block trade. True best execution requires a comprehensive plan that includes experienced consultation, pre- and post- trade analysis and the invaluable expertise of seasoned ETF traders.”

About WallachBeth Capital LLC

WallachBeth Capital is a leading provider of institutional execution services, offering clients a full spectrum of solutions to help them navigate increasingly complex markets. The firm’s expertise includes ETF and equity trading, derivatives, and capital markets. Operating on a fully disclosed, agency-only basis, the firm is committed to facilitating all client needs with transparency and integrity. The firm’s website is located at www.wallachbeth.com.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor or email: cmo@marketsmuse.com.