(RaiseMoney.com) The Equity Crowdfund Industry continues to go mainstream, as evidenced by this week’s market data and index intel pact signed between business news platform CNBC and DealIndex, a self-described “global deal and data aggregator for the best crowdfunding opportunities.” The deal will have the two firms launching four equity crowdfunding indices that provide metrics on top equity crowdfund deals from around the globe. Last month Bloomberg LP announced it had formed a pact with Orchard Partners to distribute Orchard US Consumer Marketplace Lending Index, a direct lending (aka peer-to-peer lending) index of marketplace loans.

Equity crowdfunding, which has been a sweet spot for MarketsMuse curators is expected to create more than $4bil in funded deals for startups and fast-growth companies. Booming investments in real estate are leading the way among equity-crowdfunded projects, which rose to $662 million in the first quarter of 2015, a big jump from the $483 million recorded in the final quarter of 2014.

“Equity crowdfunding is going to double every year as more and more investors get to know about it,” said Eric Smith, director of data analytics at Crowdnetic, an online platform that tracks equity investments in real-time and just published the equity-crowdfunding data in its new quarterly report.

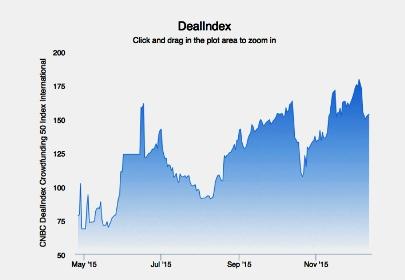

In partnership with CNBC, DealIndex announced the launch of four crowdfunding indices: International 50 Index, UK 50 Index, Technology Index, and the International Aggregate Index. The indices take transparency in the crowdfunding industry to a new level by aggregating information on the private fundraising sector into usable and easy-to-understand benchmarks. The indices track the pulse of the alternative finance market, providing a real-time indicator of market activity.

According to one highly-reliable MarketsMuse source, “The race for crowdfund industry data and metrics is only beginning. The fact that CNBC, which most financial industry professionals view as the ‘Cartoon Channel’ when compared to the likes of Bloomberg LP, could certainly add a new silo for the CNBC programming lineup, as the crowdfund industry is expected to soon surpass the grey beard venture capital industry in terms of money raised for innovative startups.

For the entire story, please click here