CME Aims to Legitimize Bitcoin Marketplace via..What Else? A Bitcoin Futures Mart!!

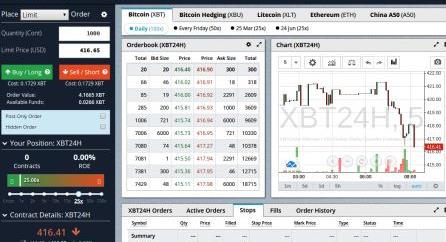

Any and every credible financial market veteran will argue that any credible financial instrument can only be credible when there is a legitimate marketplace in which buyers and sellers can express their view as to the value of that instrument. Bitcoin enthusiasts have long advocated that digital currencies aka cryptocurrencies-those that are presented as ‘coins’ or ‘tokens’ represent a revolutionary form of currency and deserve to be represented as such within the context of yet another instrument within the global financial market ecosystem. To date, those enthusiasts have flocked to unregulated ‘exchanges’ that make it easy to purchase these instruments, but only a very few of those people can actually implement hedging techniques that enable ‘shorting’ bitcoins.

For those not aware what ‘shorting’ means, you’re better off going to a different blog site–but before you leave, shorting allows a speculator to bet against an upward movement in the value of the instrument by borrowing the asset from an existing holder, paying that holder a ‘borrow cost’ and agreeing to return that asset at a later date.

ICO’s aka Initial Coin Offerings are all the rage, right? Thought leaders at Prospectus.com offer sober guidance and insight via this link

The thesis of shorting is therefore to borrow the instrument, wait until the bubble bursts and purchase the instrument at a lower price and profit from the difference between the original short sale price and the ‘cover the short price’. But the vast majority of bitcoin enthusiasts can’t ‘short; there is no borrow mechanism for most market players without having to put up nearly 10x margin on the underlying value, which means posting $50,000 in collateral for a single coin that is priced at $5000, whereas any other financial instrument ‘margin requirement’ to sell short ranges from as little as 10% of the value to perhaps 50%, not 500 %. The vast majority of speculators therefore can only ‘go long’ and hope the price goes higher, at which point they can sell and make a profit. The CME Group, one of the world’s leading futures markets, wants to change that and provide a legitimate platform in which optimists and pessimists can meet in a regulated marketplace and transact–in turn creating a true market that reflects a realistic current market value. CME’s announcement below tells the latest story:

CHICAGO, Oct. 31, 2017 /PRNewswire/ — CME Group, the world’s leading and most diverse derivatives marketplace, today announced it intends to launch bitcoin futures in the fourth quarter of 2017, pending all relevant regulatory review periods.

The new contract will be cash-settled, based on the CME CF Bitcoin Reference Rate (BRR) which serves as a once-a-day reference rate of the U.S. dollar price of bitcoin. Bitcoin futures will be listed on and subject to the rules of CME.

“Given increasing client interest in the evolving cryptocurrency markets, we have decided to introduce a bitcoin futures contract,” said Terry Duffy, CME Group Chairman and Chief Executive Officer. “As the world’s largest regulated FX marketplace, CME Group is the natural home for this new vehicle that will provide investors with transparency, price discovery and risk transfer capabilities.”

Since November 2016, CME Group and Crypto Facilities Ltd. have calculated and published the BRR, which aggregates the trade flow of major bitcoin spot exchanges during a calculation window into the U.S. Dollar price of one bitcoin as of 4:00 p.m. London time. The BRR is designed around the IOSCO Principles for Financial Benchmarks. Bitstamp, GDAX, itBit and Kraken are the constituent exchanges that currently contribute the pricing data for calculating the BRR.

“We are excited to work with CME Group on this product and see the BRR used as the settlement mechanism of this important product,” said Dr.Timo Schlaefer, CEO of Crypto Facilities. “The BRR has proven to reliably and transparently reflect global bitcoin-dollar trading and has become the price reference of choice for financial institutions, trading firms and data providers worldwide.”

CME Group and Crypto Facilities Ltd. also publish the CME CF Bitcoin Real Time Index (BRTI) to provide price transparency to the spot bitcoin market. The BRTI combines global demand to buy and sell bitcoin into a consolidated order book and reflects the fair, instantaneous U.S. dollar price of bitcoin in a spot price. The BRTI is published in real time and is suitable for marking portfolios, executing intra-day bitcoin transactions and risk management.

Cryptocurrency market capitalization has grown in recent years to $172 billion, with bitcoin representing more than 54 percent of that total, or $94 billion. The bitcoin spot market has also grown to trade roughly $1.5 billion in notional value each day.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com.

For more information on this product, please visit cmegroup.com/bitcoinfutures. Continue reading