Courtesy of Andy Nybo and TABB Forum

Courtesy of Andy Nybo and TABB Forum

A proposal to reform the taxation of financial instruments would dramatically change the tax treatment for options strategies, potentially decimating trading volumes by as much as 40%. And it is not the so-called ‘fat cats’ of Wall Street that will be impacted by the proposal; instead, the biggest impact will be felt by asset managers and Mom and Pop investors.

The US listed options market is under attack. And if Washington politicians have their way, it is destined to become a mere shadow of its current form, with far-reaching implications for the financial industry and end users such as retail and institutional investors.

The danger lies in a proposal put forth by Representative David Camp (R-Mich.), Chairman of the House Ways and Means Committee, that contains a number of provisions intended to reform the taxation of financial instruments. Of particular interest to options market participants are proposals that dramatically change the tax treatment for strategies incorporating the use of options that have been a mainstay of the business since its inception in 1973.

The proposal will potentially decimate trading volumes, with total industry volumes seeing a decline of as much as 40% if the proposal is implemented in its current form. And it is not the so-called “fat cats” of Wall Street that will be impacted by the proposal. It is also not targeted at toxic flow that is perceived as having a discernible edge over other investors.

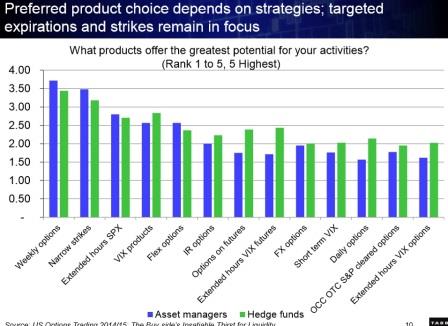

The Camp proposal impacts both retail and institutional demand for options. The biggest impact will be felt by asset managers and Mom and Pop investors that are increasingly using options to earn premium income and manage price risk in their equity holdings. TABB Group estimates that in 2012 retail investors accounted for 14% of total US options volume, with traditional asset managers and hedge funds accounting for an additional 38% of the total. It is volume from these two segments that will be impacted the most by the new tax scheme and, given their critical role in the options market, any tax law changes impacting demand from these two segments needs to be closely analyzed.

Rep. Camp’s proposal may be well-intended, but it is the unintended consequences that will decimate the options market. Surprisingly, it is not exotic options strategies designed to avoid taxes that are the focal point of the reform. Instead, the proposal targets plain vanilla listed options strategies used by main street investors that have begun to embrace options as a way to earn income or to hedge equity ownership. Continue reading →